BUSINESS

ECONOMICS - ANTONIO GINÉS -

PART 1.- THE PRODUCTION AREA.-

PRODUCTIVE PROCESS, EFFICIENCY AND PRODUCTIVITY.-

Definition of production.- Production is a process of combining various material inputs (things) and immaterial inputs (plans, knowledge) to make something for consumption (output).

Classification of productive activities.-

According to the segment where the product is directed.-

Production by order.- The product has been manufactured because the client has ordered it

Production for the market.- The product has been manufactured for the market in general.

According to the degree of differentiation of the product.-

Series production.- All products are the same

Individualized production.- Each product is different

According to the continuity of the production process.-

Continuous process.- The activity doesn’t stop

Discontinuous process.- The activity ends with the manufacture of the product and begins again when we make another product (eg the construction of an industrial unit)

Allocation of productive resources.-

Production factors. Evolution of the concept.-

Classical economists.- They use the three factors that Adam Smith defined, each factor takes part in the result of production through a reward set by the market:

Land (which is rewarded by rent)

Work (which is rewarded by wage)

Capital (which is rewarded by interest)

Neoclassical economists.- They use only capital and labor

Current economy.-

Earth.- (More and more changed by human intervention). Today the land is considered a component of capital or a component of a broader natural factor (natural resources or natural capital)

4th factor of production.- In the economy of knowledge and business development produced since the end of the 20th century, people consider that technology and science (what has been called R + D - Research and Development - or even R + D + i –Research, Development and Innovation-) is a 4th factor of production that characterizes more and more production in industrialized countries. At the same time, to the concept of physical capital or financial capital is added the concept of human capital or intellectual capital, even social capital, as a way of explaining the improvement in productivity that isn’t due to the other factors.

New factors of production.-

Natural capital

Physical capital

Material work

Intangible capital (knowledge, organization, non-physical but computable assets, intangible work, knowledge economy)

Training.- Investment allows the volume of production factors to increase. Training can be considered a form of investment, because it increases the capacities of workers and production

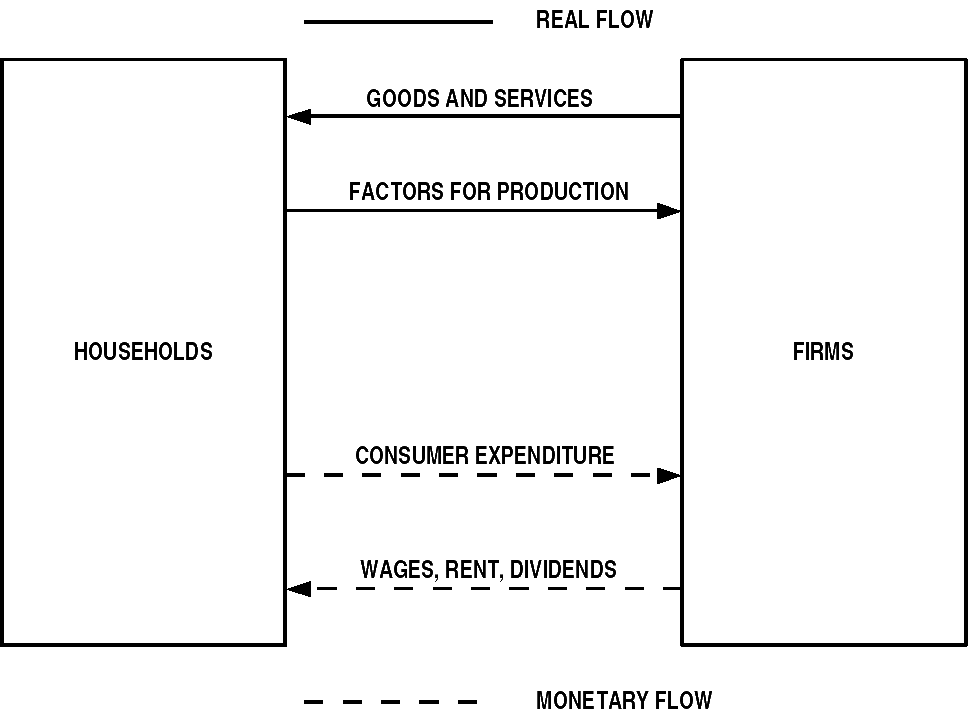

Relationship between families and companies.-

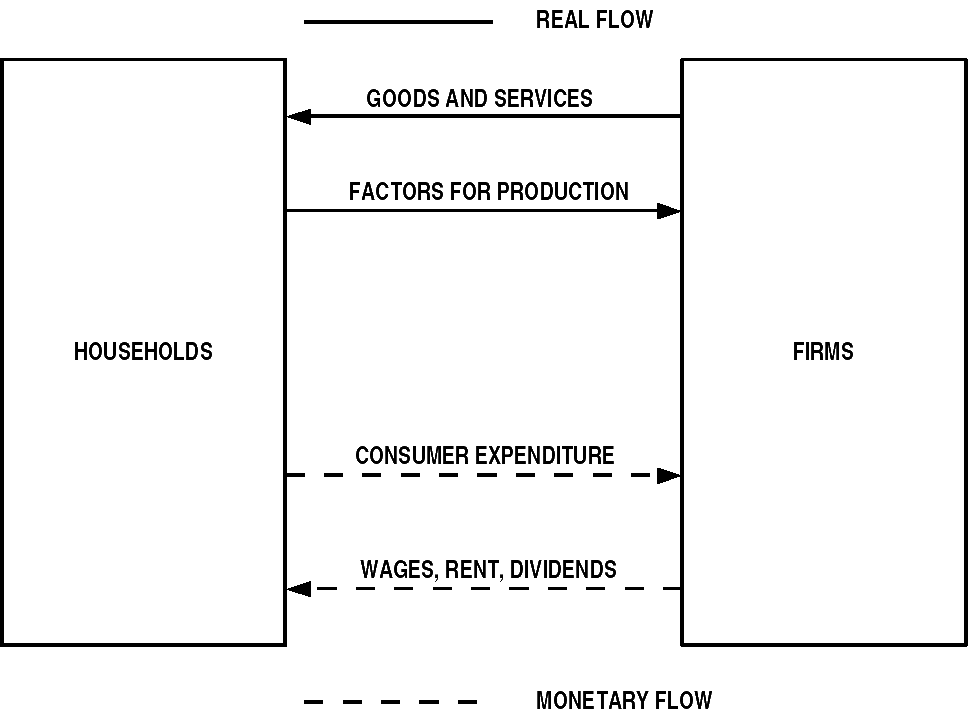

Relationship between families and companies and the public sector.-

Productivity of a factor.- Productivity of a factor = Quantity produced of a product : Incoming quantity of a factor

Example.- Calculate labor productivity if the company needs 20 man/hours to produce 100 chairs

![]()

Global productivity.-

Restrictions.-

As we refer to all production, where different types of products can exist, and to all factors, we can’t work only with quantities, but we must mix them, in monetary terms, through their prices.

Normally, we compare the productivities of different years so we must use constant prices (the prices of the base year) to avoid inflation.

Example.-

|

2009 |

2010 |

||

Outputs |

Quantity |

Price |

Quantity |

Price |

Chairs |

100 |

24 |

120 |

25 |

Tables |

twenty |

36 |

fifteen |

38 |

Inputs |

Quantity |

Price |

Quantity |

Price |

Work |

100 |

18 |

90 |

19 |

Wood |

700 |

0.9 |

650 |

1 |

Overall productivity for the base period.-

![]()

![]()

Global productivity for the next period.-

![]()

![]()

Global productivity index.-

![]()

![]()

Global productivity rate.-

![]()

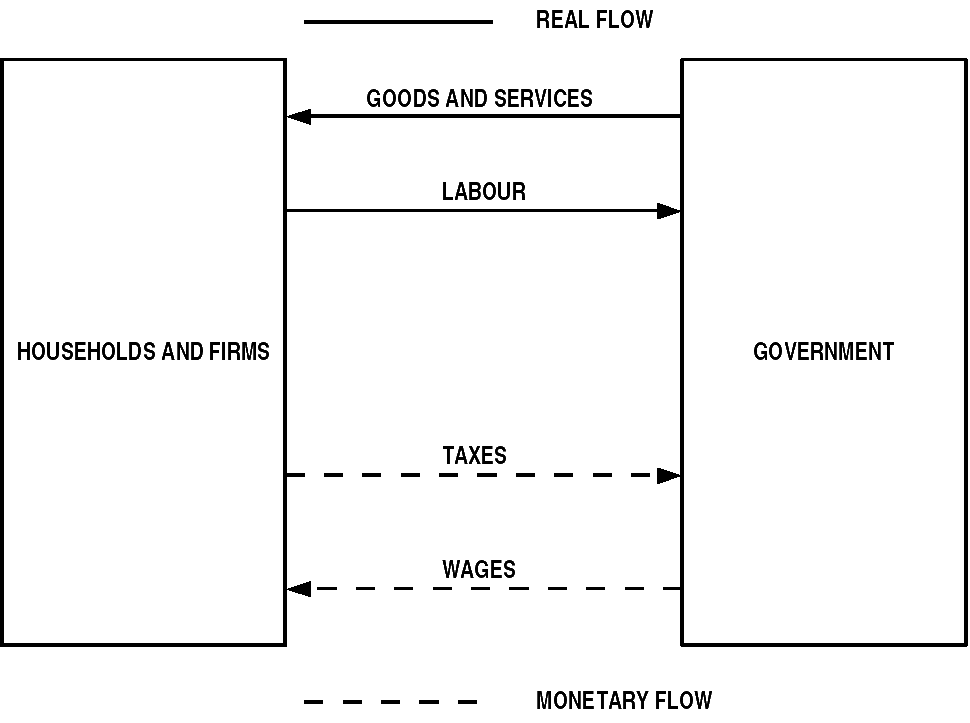

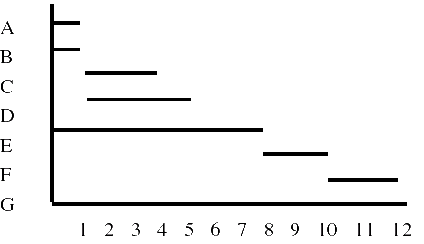

Project management model; PERT.-

PERT model.-(click here to learn more about PERT)

Functioning.-

Critical path.- The PERT describes the critical path. It’s the path that takes the longest time to complete. In this path we can’t admit delays.

Several.- It’s possible to have several critical paths

ACTIVITIES |

DESCRIPTION |

MINUTES |

PLACES |

- |

- |

- |

1. Start |

A |

Wash the lettuces |

1 |

2. Sink 1 |

B |

Wash the tomatoes |

1 |

3. Sink 2 |

C |

Chop the lettuces |

3 |

5. Countertop |

D |

Chop the tomatoes |

4 |

5. Countertop |

E |

Boil the eggs |

8 |

4. Vitroceramic |

F |

Chop the eggs |

2 |

5. Countertop |

G |

Dress |

2 |

6. Salad bowl |

Graph.-

Explanation.- In this example, activities A and C admit a delay of six minutes ((8 + 2) - (1 + 3)), because we need the lettuces after cooking and chopping the eggs (which lasts ten minutes). Activities B and D allow a delay of five minutes. Activities E, F and G don’t admit any delay because they’re on the critical path.

Critical path.- The critical path is EFG.

Duration.- We finish the salad in twelve minutes.

Gantt chart.-

Precedent.- It’s a precedent of the PERT method.

Salad.- The Gantt chart of the salad would be:

Problem.- Activities C and D follow activities A and B but we don’t know if activity C follows activity A or activity B.

Six minutes.- This method allows you to know how the process is. So if we want to know how the process is when the time is six minutes:

Completed activities: A, B, C and D totally and E (75%)

Activities that haven’t started yet: E (25%) and F and G fully

Competitiveness and quality.-

How can we achieve competitiveness? .- We must achieve the costs that allow us to have good prices, but there’re two problems:

The market sets the prices, not the company

We can’t reduce costs by reducing quality

The quality.-

How can we measure it? .- Through the degree of adjustment to the production program and seeing if we have the attribute or attributes that satisfy the needs of consumers in the best way

Total quality.- All the departments of the company have the responsibility of achieving quality

How can we achieve quality? .- We must establish a standard and we must establish controls

THE IMPORTANCE OF TECHNOLOGICAL INNOVATION: R + D + i.-

4th factor of production.- In the economy of knowledge and business development produced since the end of the 20th century, people consider that technology and science (what has been called R + D -Research and Development- or even R + D + i –Research, Development and Innovation-) is a 4th factor of production that characterizes more and more production in industrialized countries. At the same time, the concept of physical capital or financial capital is added to the concept of human capital or intellectual capital, even social capital, as a way of explaining the improvement in productivity that isn’t due to other factors.

Ways to obtain technology.-

We can buy it from other companies or countries.- In this way we depend technologically on others and we can’t develop freely

We can discover new technologies.- We need R + D + i departments. These departments are expensive and only large companies can have them

The technological matrix.- The technological matrix helps us decide the best technology for our company and also indicates us whether we should buy it or invest in an R + D + i department.

Technological innovation, intellectual property and consumer protection.- States create norms that defend technological innovation, that is why states create norms that defend intellectual property

Main forms of intellectual property.-

Patents.- A patent is a set of exclusive rights granted by the state (the national government) to an inventor or their assignment for a limited period of time (in Spain 20 years) in exchange for a public disclosure of an invention.

Utility model.- A utility model is very similar to a patent, but usually has a shorter time (in Spain 10 years) and less strict patentability requirements

Trademarks.-

Definition.- A trademark is a distinctive sign or indicator used by an individual, a business organization, or other legal entities to identify that the products or services for consumers with which the trademark appears originate from a single source, and to distinguish your products or services from those of other entities.

Maintenance.- Trademark rights must be maintained through the current and legitimate use of the trademark. These rights will cease if a trademark isn’t actively used for a period of time, normally 5 years in most jurisdictions (in Spain 10 years).

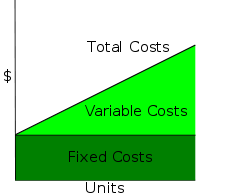

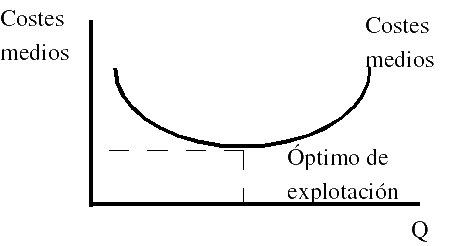

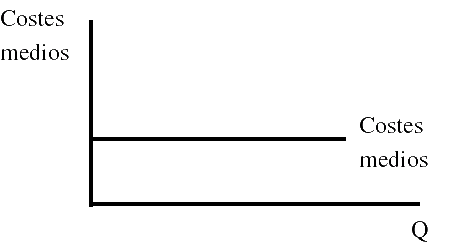

BUSINESS COSTS: CLASSIFICATION AND CALCULATION.-

Definition of costs.- It’s the value of the production factors that we have been spending to produce something

Types of costs.-

According to the way in which they are loaded to the project or the product.-

Direct costs.-

Definition.- They’re those for activities or services that benefit specific projects, eg. salaries for project personnel and materials required for a particular project. Because these activities are easily mapped to projects, their costs are usually charged to projects on an individual basis.

Costs usually charged directly.- Project staff, consultants, project supplies, publications, travel, training, etc.

Indirect costs.-

Definition.- They’re those for activities or services that benefit more than one project. Its precise benefits to a specific project are often difficult or impossible to locate. For example, it can be difficult to determine precisely how the activities of an organization's director benefit a specific project.

Costs usually assigned indirectly.- Utilities, rent, audit and legal, administrative staff, rental equipment, etc.

Costs either charged directly or assigned indirectly.- Price of phone, computer use, project office staff, postage and printing, assorted office supplies, etc.

Direct/Indirect.- It’s possible to justify the treatment of almost any type of cost as direct or indirect. Labor costs, for example, can be indirect, as in the case of maintenance personnel and official executives; or they can be direct, as in the case of project staff members. Similarly, materials such as miscellaneous supplies purchased in bulk - pencils, pens, paper - are typically treated as indirect costs, while materials required for specific projects are charged as direct costs.

According to its dependence on the volume of activities.-

Fixed costs.- These are business expenses that aren’t dependent on business activities. They tend to be related to time, such as wages or rent paid by the month.

Variable costs.- They’re related to volume (and are paid by quantity)

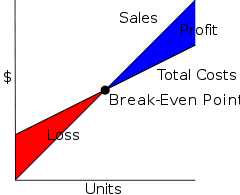

BREAK EVEN POINT.-

Overview.- In economics and business, specifically cost accounting, the break even point is the point where costs or expenses and income are equal: there is no net loss or profit. A profit or loss hasn’t been made, although the opportunity costs have been paid, and the capital has received a risk-adjusted return.

Example.- If a business sells less than 200 tables each month, it will make a loss, if it sells more, it will make a profit. With this information, the manager will then need to see if they expect to be able to make and sell 200 tables per month.

Graph.-

Implementation.- If they think they can’t sell that much, to ensure viability they could:

Fixed costs.- Try to reduce fixed costs (renegotiating the rent for example, or maintaining better control of telephone bills or other costs)

Variable costs.- Try to reduce variable costs (the price you pay for tables by finding a new supplier)

Price.- Increase the sale price of your tables.

Either.- Any of these would reduce the break even point. In other words, the business wouldn’t need to make as many tables to ensure that it could pay its fixed costs.

Calculation.- In the linear model of cost, volume and profit analysis, the break even point in terms of units sold (Q) can be directly calculated in terms of total revenue (I) and total costs (TC) as:

![]()

![]()

![]()

![]()

![]()

where:

CF are the fixed costs

P is the price of the unit sold, and

CVu is the unit variable cost

The amount (P - CVu) is of interest in its own right, and is called the Unit Contribution Margin: it is the marginal benefit per unit

INVENTORIES AND ITS MANAGEMENT.-

Inventory costs.-

Acquisition and production costs.-

Fixed costs of entry into the warehouse.- Transportation costs, order costs, processing, etc.

Storage costs.- Warehouse rental, internal movement of goods, control and maintenance

Technical costs.-

Obsolescence.- Technical obsolescence can occur when a new product or technology replaces the old one, and it becomes preferred to use the new technology instead of the old one. Historical example of replacement technologies causing obsolescence include CD-ROM on floppy disk which allowed for greater storage capacity and speed.

Opportunity cost.- It’s the best choice available to someone who has chosen between several mutually exclusive choices

Financial cost.- It’s the interest that I have to pay for the loan that I have requested to pay the warehouse

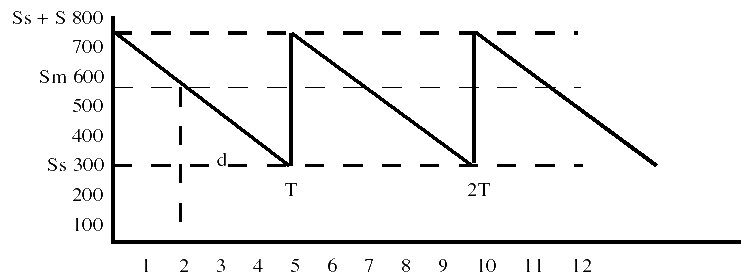

The cycle of renovation of the warehouse and the safety stock.-

Out of stock.- When we don’t have merchandise

S = Order volume

T = Replenishment time (time between two orders)

S/T = Average depletion of stock (number of units sold per day)

Sm= Stock level to place a new order

d = Delivery period, in days, used by suppliers = (Sm- Ss): S/T

Ss= Safety Stock (allows you to continue working when there’re delays in delivery days)

Average warehouse stock = Ss + ½ S

Example.- Knowing that the order volume is 500 chairs, the replacement time is five days, the safety stock is 300 chairs and the delivery time used by the suppliers is three days. Calculate: the average stock depletion, the stock level to place a new order and the average stock in the warehouse

Solution.-

Average depletion of stock = S/T = 500/5 = 100 chairs per day

If we sell 100 chairs per day, the delivery time used by the suppliers is three days and the safety stock is 300 chairs; the stock level to place a new order will be: (100 x 3) + 300 = 600 chairs

Average warehouse stock = Ss + ½ S = 300 + ½ 500 = 550 chairs

Wilson Model.- (click here to learn more about the Wilson Model)

Economic order quantity.- It’s the inventory level that minimizes total inventory maintenance costs and order costs.

Variables.-

Q = order quantity

Q * = optimal order quantity

D = quantity of annual demand for the product

P = purchase cost per unit

S = fixed cost per order (not per unit, in addition to unit cost)

H = annual cost of ownership per unit (also known as cost of ownership or cost of storage) (warehouse space, refrigeration, insurance, etc. usually not related to unit cost)

Formula.-

![]()

EXTERNALITIES.-

Definition of externality.- An externality (or surplus transaction) is a cost or benefit, not transmitted through prices, incurred by a party that doesn’t agree with the action causing the cost or benefit. A benefit in this case is called a positive externality or external benefit, while a cost is called a negative externality or external cost.

Prices don’t reflect the total costs/benefits.- In these cases in a competitive market, prices don’t reflect the total costs or benefits of producing or consuming a product or service, producers and consumers may or may not bear all the costs or not collect all the benefits of economic activity, and too much or too little of the merchandise will be produced or consumed in terms of overall costs and benefits for society. For example, manufacturing that causes air pollution imposes costs on the whole of society, while fire prevention at home improves the fire safety of neighbors.

Overproduction/underproduction.- If there are external costs such as contamination, the merchandise will be overproduced by a competitive market, since the producers won’t take into account the external costs when they produce the merchandise. If there are external benefits, such as in areas of education or public safety, too little of the merchandise would be produced by private markets as producers and buyers don’t take into account external benefits for others. Here, the total cost and benefit to society is defined as the sum of the benefits and the economic costs for all parties involved.

Types of externalities.-

Negative externality.- A negative externality is an action of a product on consumers that imposes a negative secondary effect on a third party. Many negative externalities (also called "external costs" or "external diseconomies") are related to the environmental consequences of production and use.

Positive externalities.- An example could be a beekeeper raising bees for his honey. A secondary effect or externality associated with its activity is the pollination of surrounding crops by bees. The value generated by pollination may be more important than the value of the honey collected.

Positive externalities.-

Position externalities.- Position externalities refer to a special type of externality that depends on the relative ranks of the actors in a situation. Because each actor is trying to "be better" than the other actors, the consequences are unforeseen and financially inefficient.

Example.- An example is the phenomenon of “over-education” (referring to post-secondary education) in the North American labor market. In the 1960s, many young middle-class Americans prepared for their careers by completing a bachelor's degree. However, in the 1990s, many people from the same social background were completing master's degrees hoping to “be better” than other competitors in the job market, pointing to their highest quality as potential employees. By 2000, some jobs that had previously only required bachelor's degrees, such as political analyst positions, were requiring master's degrees. Some economists argue that this increase in educational requirements was above what was efficient,

Solution.- A solution to such externalities is the regulation imposed by an external authority. The government could pass a law against companies requiring master's degrees unless the job actually required these advanced skills.

Possible solutions.-

Criminalization.-As with prostitution, addictive drugs, business fraud, and many types of environmental and public health laws.

Civil tort law.- For example, a class action lawsuit against smokers, multi-product liability lawsuits.

Government provision.- As with lighthouses, education and national defense.

Taxes and subsidies.- Impose taxes or give subsidies that are equal in value to the negative externality.

Agreement.- However, the most common type of solution is tacit agreement through the political process. The agreement is mutually beneficial.

PART 2.- COMMERCIAL (MARKETING)

CONCEPT AND TYPES OF MARKETS.-

Market concept.- The market concept is any structure that allows buyers and sellers to exchange any type of merchandise, services and information. Market participants consist of all buyers and sellers of a commodity who influence its price. The market facilitates trade and enables the distribution and allocation of resources in a society. Marketplaces allow any tradable item to be evaluated and priced.

Types of markets.-

According to the type of goods.-

Market of goods and services.-

Factor market.- A factor market refers to a market where the production factors are bought and sold.

Labor market

Capital market

According to government intervention.-

Free market.- A free market is a market without intervention and economic regulation by the government except to respect property "property rights" and contracts.

Controlled market.- In a controlled market the government regulates how the means of production, goods and services are used, priced or distributed

According to the number of buyers and sellers.-

BUYERS |

SELLERS |

||

MANY |

FEW |

ONE |

|

MANY |

Perfect competition (homogeneous, tomatoes) Monopoly competition (different, restaurants) Low prices |

Oligopoly (oil) High prices |

Monopoly (Seville-Aracena buses) High prices (if not regulated) |

FEW |

Oligopsony (companies that sell to hypermarkets - assuming there were only hypermarkets) High prices |

Bilateral oligopoly (fencing equipment) |

Limited monopoly (a company that produces a very expensive machine that only a few hospitals can afford) |

ONE |

Monopsony (companies that produce hubcaps for the sole automobile company) Low prices |

Limited monopsony (companies that sell, to the sole aerospace company, components for their space shuttles) |

Bilateral monopoly (a company that produces a new good that only the single aerospace company needs) |

According to the knowledge of the conditions of purchase and sale.-

Transparent market.- A market is transparent if a lot is known by many about: what products, services or fixed assets are available, at what price, where, etc.

Market not transparent.-

According to the product.-

Perfect market.- Products are homogeneous

Imperfect market.- Products are different

According to the participants.-

Open market.- An open market refers to a market that is accessible to all economic actors. In an open market, as defined, all economic actors have the same opportunity to enter that market.

Protected market.- In a protected market, entry is conditional on certain financial and legal requirements or is subject to tariff barriers, taxes, or state subsidies that effectively prevent some economic actors from participating in them

According to the degree of elaboration of the product.-

Unprocessed product market

Manufactured products market

According to the buyer's links with the distribution channels.-

Wholesale markets

Retail markets

According to the number of buyers and sellers and the product.-

Perfect competition.- Many buyers and sellers and homogeneous products

Imperfect competition.-

Monopoly Competition - Many different sellers and products

Oligopoly.- Few sellers and few differences in products

Monopoly.- A seller and there is no substitute for the product

According to the type and applications of the product.-

B2C Markets (Consumer Markets) .-

B2B Markets (Industrial Markets) .-

The main characteristics of the B2B sales process are:

One to one.- Marketing is, in itself, one to one. It’s relatively easy for the seller to identify a potential customer and build a face-to-face relationship.

Several decision makers.- Highly professional and trained people in purchasing processes are involved. In many cases two or three decision makers have to be considered in purchasing industrial products.

Value.- High value considered purchase

Buying team.- The buying decision is typically made by a group of people (“buying team”) not by one person.

Complex.- The buying/selling process is often complex and includes many stages (for example, request for expression of interest, request for supply, selection process, award of supply, contract negotiations and signing of the final contract).

Long processes.- Sales activities involve a long process of prospecting, qualifying, attracting, making representations, preparing supplies, developing strategies and contract negotiations.

The main characteristics of the B2C sales process are:

From one to many.- Marketing is, in itself, one to many. It’s not feasible for sellers to individually identify potential customers or meet them face-to-face.

Value.- Lower purchase value.

Impulsive decision.- The purchase decision is often, in itself, impulsive (stimulated for the moment).

Confidence.- Greater confidence in the distribution (buying in places of sale to the public).

Mass marketing.- More effort put into mass marketing (one to many).

Brands.- More confidence in brand techniques.

Media.- Increased use of major media (television, radio, print media) advertising to build the brand and achieve brand awareness

The behavior of organizations.-

How is the purchase decision of the organizations? .- Normally it’s the result of a long process

How is the demand of the organizations? .- The demand of the organizations depends on the demand of other minor buyers (derived demand)

How do price fluctuations influence organizations? .- They have little influence on the demand of these companies (they have inelastic demand)

Is it easy for other organizations to enter the market?.- In closed markets, demand is highly concentrated, making it difficult for other organizations to enter

How is the volume of purchases of the organizations? .- It’s very high and involves a formula for customer selection

How is the final purchase decision made in organizations?.- The final purchase decision is usually collegiate, that is, it isn’t the responsibility of a single person

Perfect competition.-

Definition.- In neoclassical economics and in microeconomics, perfect competition describes the perfect being of a market in which there are many small companies, all producing homogeneous goods

Features.-

Many buyers/many sellers.- Many consumers with the will and the ability to buy the product at a certain price. Many producers with the will and the ability to offer the product at a certain price.

Low entry and exit barriers.- It’s relatively easy for a company to enter or exit in a perfectly competitive market.

Perfect information. For both consumers and producers.

The objective of companies is to maximize profits.- The objective of companies is to sell where marginal costs meet marginal revenue, where they generate the greatest profit.

Homogeneous products.- The characteristics of any given market good or service don’t vary across suppliers.

MARKET RESEARCH TECHNIQUES.-

Objective of market research.- Market research is any organized effort to gather information about markets or customers

Steps that a company could take to analyze the market.-

Provide secondary and/or primary data.- If necessary

Analyze the economic Micro and Macro data.- Supply and demand, price change, economic growth, sector/industry sales, interest rates, Consumer Price Index, social analysis, etc.

Put into practice the concept of the marketing mix.- Which consists of: place, price, product, promotion, people, process, physical evidence and also political and social situation to analyze the global situation of the market

Analyze market trends, growth, size, share and competition.- Drivers of customer loyalty and satisfaction, brand perception, satisfaction levels, current analysis of the competitor-channel relationship, etc.

Determine the market segment, the target market, market projections and market positioning.-

Formulation of market strategy and also investigate the possibility of association/collaboration.-

Combine those analyzes with the business plan/business model analysis.- Business description, business process, business strategy, revenue model, business expansion, return on investment, financial analysis (History of the company, financial assumption, cost/profit analysis, projected profit and loss, cash flows, balance sheet and company ratios, etc.)

Types of data for market research.-

Primary data.- Primary data are collected by the researcher conducting the research.

Secondary data.- Secondary data is data collected by someone other than the user. Common sources of secondary data for the social sciences include censuses, studies, organizational records, and data collected through qualitative methodologies or qualitative research.

Ways to obtain primary data.- (click here to learn more about how primary data is obtained)

Surveys.-

Telephone.-

Mail.-

Online surveys.-

Personal survey at home.-

Personal surveys intercepting in a shopping center.-

Observation.- Observation is an activity consisting of receiving knowledge of the outside world through the senses, or the recording of data using scientific instruments. The term can also refer to any data collected during this activity.

Experimentation.- The results are observed in a laboratory environment.

Consumer panels.- (click here to learn more about consumer panels)

Definition.- Consumer Panels are a research technique to measure markets that uses the same sample of people who respond on an ongoing basis.

CONSUMER ANALYSIS AND MARKET SEGMENTATION.-

Commercial (marketing).- Design the product, assign prices and choose the most appropriate distribution channels and communication techniques to launch a product that will truly meet the needs of customers. These techniques are also called Grundy's four pess: product, price, distribution or location, and advertising or promotion.

Marketing plan.- A marketing plan is a written document that details the necessary actions to achieve one or more marketing objectives. It can be for a product or for a service, a brand or a product line. Marketing plans cover one to five years. A marketing plan can be part of an overall business plan. A solid marketing strategy is the foundation of a well-written marketing plan. While a marketing plan contains a list of actions, a marketing plan without a firm strategic foundation is of little use.

Types of utilities.-

Shape utility.- It’s to give the product a more practical presentation. For example, a packaged product might be more useful than one that isn’t.

Time and space utility.- It’s to sell the product at the right time and place. For example, it’s selling snow chains at a gas station located just before a mountain pass.

Possession utility.- It’s to facilitate the customer's possession of the product now. For example, through deferred payment

Prestige utility.- It’s having a product that could be dispensed with outside of a certain social group. For example, owning a luxury car

What should companies do in the face of the external environment?.-

Faced with technological innovations.- The firm must be informed about the innovations and must invest in them to be competitive.

Faced with the intervention of the government and associations.- The company must face political interference from the government and pressure from consumers and other associations

Given the evolution of the population.- The company must have information on this issue so that it can better adapt to changes in ages, ways of thinking, etc.

Given the economic situation of the population.- The company must adapt to each type of consumer by offering them the product they need. This can be achieved through market segmentation.

Given the position of the competition.- The company must have information about the competition to know what others offer

Main role of the market.- Allow buyers and sellers to exchange any type of goods, services and information

Competitor Analysis.- A common technique is to create detailed profiles of each of your main competitors. These profiles give an in-depth overview of the competitor's fund, finances, products, markets, facilities, staff, and strategies.

Market Segmentation.-

Definition.- Market segmentation is a concept in economics and marketing. A market segment is a subset of a market made up of people or organizations that share one or more characteristics that cause them to demand a similar product and/or service based on the qualities of those products such as price or function.

Characteristics.- A true market segment meets the following characteristics: 1) is different from other segments (different segments have different needs), 2) is homogeneous within the segment (sample needs common); 3) it responds similarly to a market stimulus, and 4) it can be reached by a market intervention.

Quantities.- The term is also used when consumers with the same product and/or service need to be divided into groups so that different amounts can be charged. These can be widely seen as positive or negative applications of the same idea, dividing the market into smaller groups.

Segmentation criteria.-

Geographical.- The same boats are not used in the Mediterranean as in the Cantabrian

Demographic.- Attending to sex, age, religion, race, etc.

Psychographic.- It depends on the personality of each consumer.

Socioeconomic.- It depends on social class, income, etc.

Behavioral.- Day and time when you usually make the purchase, loyalty to your brand, etc.

Business advantage.- While there may be theoretically ideal market segments, in reality each organization committed to a market will develop different ways of imagining market segments, and create product differentiation strategies to exploit these segments. Market segmentation and the corresponding product differentiation strategy can give a temporary business advantage to the company.

Segmentation of industrial markets versus segmentation of consumer markets.- Industrial market segmentation is quite different from consumer market segmentation but both have similar objectives

Profits.-

Opportunities.- Sellers are in a better position to locate and compare marketing opportunities

Programs.- Sellers can easily and effectively formulate and implement marketing programs

Adjustments.- Sellers can make better adjustments to their products and marketing communications

Evaluation.- Competitive strengths and weaknesses can be effectively evaluated

Utilization.- Segmentation leads to a more effective use of marketing resources

MARKETING-MIX AND STRATEGIES.-

Elements of the marketing mix.- The elements of the marketing mix are often referred to as the “four pes”: product, price, place and promotion.

The product.-

Components of the total product.-

The basic product.- It is the natural essence of the product

Formal and tangible aspects.-It’s the added value that the product has thanks to the brand, quality, style, design, packaging, etc.

Increased aspects.- Each additional service that the company gives to the client: after-sales service, financing, guarantee, etc.

The brand.-

Definition.- A brand is the identification of a specific product or service. A brand can take many forms, including a name, a sign, a symbol, a color combination, or a slogan. The word brand started out simply as a way of naming one person's cattle from another's by means of a hot iron stamp. A legally protected brand is called a trademark. The word brand has continued to evolve to encompass identity - it affects the personality of a product, company or service.

Types of brand names.-

Acronym.- A name made from initials such as UPS or IBM

Descriptive.- Names that describe a benefit of the product or a function such as Airbus

Alliteration and rhythm - Names that are fun to say and hit the mind like Reese's Pieces or Dunkin 'Donuts

Evocative.- Names that evoke a relevant and vivid image such as Amazon or Crest

Neologisms.- Completely invented words like Wii or Kodak

Foreign words.- Adoption of a word from another language such as Volvo or Samsung

Founder's names.- Using real people's names like Hewlett-Packard or Disney

Geographical.- Many brands are named for regions and well-known places such as Cisco and Fuji Film

Personification.- Many brands take their names from myths like Nike or from the minds of advertising executives like Betty Crocker

Approaches to branding techniques.-

Company name.-In this case a very strong brand name (or company name) is made the vehicle for a range of products (for example, Mercedes-Benz or Black & Decker) or even a range of subsidiary brands (such as Cadbury Dairy Milk, Cadbury Flake or Cadbury Fingers in the United States).

Individual branding technique.- Each brand has a separate name (such as Seven-up or Nivea Sun (Beiersdorf)), which can even compete against other brands of the same company (for example, Persil, Omo, Surf and Lynx are all owned by Unilever).

Derivative brands.- In this case the supplier of a key component, used by a number of suppliers of the final product, may wish to secure its own position by promoting that component as a brand in its own right. The most frequently given example is Intel, which secures its position in the personal computer market with the slogan "Intel Inside".

Brand extension.- The existing strong brand name can be used as a vehicle for new or modified products; for example, many fashion and design companies extend brands in fragrances, shoes and accessories, home textiles, home decor, luggage, sunglasses, furniture, hotels, etc.

Multi-brands.- Alternatively, in a market that is fragmented among a number of brands, a supplier may deliberately choose to launch entirely new brands in apparent competition with their own existing strong brand (and often with identical product characteristics); simply to absorb some of the market share that goes to minority brands anyway. The rationale is that having 3 out of 12 brands in such a market will have a greater total share than having 1 out of 10 (even if much of the share of that new brand is taken from the existing one). In its most extreme manifestation, a pioneer supplier in a new market that believes it will be particularly attractive may immediately choose to launch a second brand in competition with its first, to get ahead of others entering the market.

Own marks.- With the emergence of strong retailers, private labels, also called private labels or warehouse brands, also appeared as a main factor in the market. Where the retailer has a particularly strong identity (such as Marks & Spencer in the UK apparel sector) this 'own brand' must be able to compete against even the strongest leading brands, and can outperform those products that otherwise, they have strong marks

The label.-

Definition.- A label is a piece of paper, polymer, cloth, metal or other material attached to a container or item, on which a legend, information regarding the product, addresses, etc. is printed. A label can also be printed directly on the container or article.

Uses.- Labels have many uses: product identification, name tags, advertising, warnings, and other communications.

Types.- Special types of labels or labels called digital labels (printed through a digital printer) can also have special structures such as radio frequency identification and security printing.

Phases in the life of a product.-

Introduction.- People begin to know the product and it doesn’t give benefits yet

Growth.- The product is slowly having more market share

Maturity.- The market share of the product stabilizes

Decline.- The product is losing market share

Physical distribution.-

Definition.- It’s an organization or group of organizations (intermediaries) involved in the process of making a product or service available for use or consumption by the client or user.

The distribution channel.-

Definition.- Chain of intermediaries, each passing the product further down the chain to the next organization, before it finally reaches the consumer or end user .... This process is known as the "distribution chain" or the " channel". Each of the elements in these chains will have their own specific needs, which the producer must take into account, in addition to those of the all-important end user.

Available channels.-

Long channel (for consumer markets) .- The manufacturer, the agent, the wholesaler, the retailer and the final consumer

Short channel (mainly for industrial markets) .- The manufacturer, the wholesaler or the industrial agent and the industrial consumer intervene in the industrial markets; in consumer markets the manufacturer, the retailer and the final consumer are involved (multiple choice questions refer to consumer markets)

Direct sale.- The manufacturer, the seller and the final consumer

Hotels.- Distribution channels may not be restricted only to physical products. They can be just as important in moving a service from producer to consumer in certain sectors, since both channels, direct and indirect, can be used. Hotels, for example, can sell their services (typically rooms) directly or through travel agents, tour operators, airlines, tourism councils, centralized reservation systems, etc.

Innovations in service distribution.- For example, there has been an increase in franchising and rental services - the latter offering anything from televisions to tools. There has also been some evidence of service integration, with services linked together, particularly in the travel and tourism sectors. For example, links now exist between airlines, hotels, and car rental services. There has also been a significant increase in retail outlets for the service sector. Retail outlets such as real estate agencies are driving traditional grocery stores out of major commercial areas

It is the responsibility of the management.

Decision on the channel.- The decision about the channel is very important. In theory at least, there is a form of trade-off: the cost of using intermediaries to reach a wider distribution is supposedly lower. Indeed, most manufacturers of consumer goods could never justify the cost of selling directly to their consumers, except by mail order. Many suppliers seem to assume that once their product has been sold in the channel, at the beginning of the distribution chain, their job is done. Even the distribution chain is simply assuming a part of the responsibility of the suppliers; and, if they have any aspiration to go to the market, their work should really be extended to direct the whole process involved in this chain, until the product or service reaches the end user. This can involve a number of decisions on the part of the provider:

Channel members

Channel motivation

Monitor and direct channels

Channel Marketing Types.-

Intensive distribution.- Where most resellers sell the product (with ready-made products, for example, and particularly brand leaders in consumer goods markets) price competition may be evident.

Selective distribution.- This is the normal pattern (in both consumer and industrial markets) where the appropriate reseller sells the product.

Exclusive distribution.- Only specially selected resellers or authorized dealers (typically only one per geographic area) are allowed to sell the product.

Channel motivation.- It’s quite difficult to motivate direct employees to provide the necessary sales and support service. Motivating the owners and employees of an independent organization in a distribution chain requires even more effort. There are many resources to achieve such motivation. Perhaps the most common is the incentive: suppliers offer a better margin, to encourage channel owners to promote the product more than their competitors; or a compensation is offered to the distribution sales staff, so that they are encouraged to promote the product.

Supervising and directing channels.- Almost in the same way that the sales and distribution activities of the organization need to be supervised and directed, so it will be with those of the distribution chain. In practice, many organizations use a mix of different channels; in particular, they can complement a direct sales force, with agents, covering small and potential clients. These channels show the marketing strategies of an organization. Effective management of the distribution channel requires making and implementing decisions in these areas.

Types of intermediaries.-

Sales representatives.- Or they link manufacturers and wholesalers or wholesalers and retailers and are paid a commission based on sales

Wholesalers.- They buy from manufacturers and sell to retailers

Retailers.- They buy from wholesalers and sell to the final consumer

Role of intermediaries.- They reduce the number of contacts needed to sell the products (for example, without any intermediary, three manufacturers would need thirty contacts to sell their products to ten final consumers, but with an intermediary they would need only thirteen)

Choice between direct distribution and indirect distribution.-

Direct distribution costs = Fixed costs + Variable costs; DDC = FC + VC

Indirect distribution costs = Variable costs; IDC = VC

Example.- If the fixed direct distribution costs of a manufacturer are €150,000, the sellers commission is 12% and the intermediaries' margin is 26%, with a sales amount of €630,000. What type of distribution is the best?

DDC = 150,000 + (0.12 x 630,000) = €225,600

IDC = 0.26 x 630,000 = €163,800 (this is the best)

Promotion.-

Definition.- Promotion is the communication link between sellers and buyers with the purpose of influencing, informing or persuading the purchase decision of a potential buyer.

Types of promotion.-

Promotion on the line.- Promotion in the media (eg TV, radio, newspapers, internet, mobile phones, and historically illustrated songs) in which the advertiser pays an advertising agency to place the ad

Promotion below the line.- All the rest of the promotion. Much of this attempts to be subtle enough for the consumer to be ignored that the promotion is taking place. Examples: sponsorship, appearance of products in movies or series, sales promotions, merchandising, direct mail, personal selling, public relations, trade shows

Advertising.-

Definition.- Advertising is a non-personal form of communication that tries to persuade an audience (viewers, readers or listeners) to buy or take some action on products, ideals or services. It includes the name of a product or service and how that product or service could benefit the consumer, to persuade a target market to buy or consume that particular brand. These brands are usually paid for or identified through sponsors and views on various media.

Code.- Advertisers, advertising agencies and the media agree to a code of advertising standards that they intend to uphold. The general objective of such codes is to ensure that any advertisement is "legal, decent, honest and truthful."

Goals.-

Inform about the new product

Persuade the consumer to buy the product

Remember that the product exists

Advertising prohibited.-

Misleading advertising

Advertising that damages the dignity of the person

Subliminal advertising

Unfair advertising

Sponsorship.- Sponsoring something is supporting an event, an activity, a person or an organization financially or through the provision of products or services.

Product placement.- Or embedded marketing, is a form of advertising, where branded goods or services are placed in a context that usually lacks advertisements, such as movies, the plot of television shows, or new programs. Product placement is often undisclosed at the time the good or service is offered. Product placement became common in the 1980s.

Sales promotion.- Marketing communication media and non-media are used for a predetermined, limited time to increase consumer demand, stimulate market demand or improve product availability. Examples include: a temporary price reduction, a loyalty reward program, coupons, etc.

Merchandising.-

Definition.- Merchandising are the methods, practices and operations used to promote and sustain certain categories of commercial activities. In the broadest sense, merchandising is any practice that contributes to the sale of products to a retailer.

Examples.- The distribution of the products in the store, the place to put the products on the shelves, the light, the colors, the music, the temperature, etc.

Direct mail.- Also known as advertising mail or junk mail, it is the sending of advertising material to mailboxes

Public Relations (PR).- Public Relations is a field concerned with maintaining the public image for commercial companies and organizations. Common activities include speaking at conferences, working with the media, crisis communications, social engagement with the media, and communicating with employees.

Trade fairs.- A trade fair or expo is an exhibition organized so that the company in a specific industry can showcase and demonstrate its latest products or services, study the activities of rivals, and examine recent market trends and opportunities.

Personal sale.-

It is a sale through a direct deal with the buyer

One type of personal selling is telemarketing (selling using the phone, fax or internet)

The price.-

Price strategies.-

Prices based on competition.- Establish the price based on the prices of similar competing products.

Cost-based pricing.- Cost-based pricing is the simplest method of pricing. The company calculates the cost of producing the product and adds a percentage (profit) so that this price gives us the sale price. This method, while simple, has two shortcomings: it does not take demand into account, and there is no way to determine whether potential customers will buy the product at the calculated price.

Skim.- Selling a product at a high price, sacrificing high sales to earn a high profit, yet skimming the market. Usually used to reimburse the cost of the original research investment in the product - commonly used in electronic markets when there is a new range, such as DVD players, they are first shipped on the market at a high price

Limit price.- A limit price is the price set by a monopolist to discourage economic entry into a market, and is illegal in many countries

Hook item.- This pricing strategy is illegal under EU and US competition rules No market leader would want to sell low unless this is part of their overall strategy

Market oriented price.- Set a price based on the analysis and compiled research of the target market

Penetration price.- The price is deliberately set at a low level to win the interest of customers and establish market positioning

Price discrimination.- Establish a different price for the same product in different segments for the market. For example, this can be for different ages or for different opening hours, such as movie tickets.

Premium price.- Premium pricing is the practice of keeping the price of a product or service artificially high to encourage favorable perceptions among buyers based solely on price. The practice is intended to exploit the (not necessarily justifiable) tendency for shoppers to assume that expensive items enjoy an exceptional reputation or represent exceptional quality and distinction.

Predatory price.- Aggressive pricing planned to drive competitors out of the market. It is illegal on some sites

Price based on the contribution margin.- The price based on the contribution margin maximizes the benefit derived from an individual product, based on the difference between the price of the product and the variable costs (the contribution margin of the product per unit), and on one's assumptions regarding the relationship between the price of the product and the number of units that can be sold at that price. The contribution of the product to the total profit of the company (eg operating income) is maximized when a price is chosen to maximize the following: Contribution margin per unit x Number of units sold.

Psychological price.- Price designed to have a positive psychological impact. For example, selling a product for $3.95 or $3.99, more than $4.

Dynamic price.- A flexible pricing mechanism made possible by advances in information technology, and used for the most part by internet-based companies. Responding to market fluctuations or large amounts of data collected from customers - varying from where they live to what they buy to how much they have spent on past purchases - dynamic pricing allows online companies to adjust the price of identical goods so that corresponds to the client's willingness to pay. The aviation industry is often cited as a dynamic pricing success story. In fact, it employs the technique so cleverly that most passengers on a given plane have paid different ticket prices for the same flight.

Pricing leadership.- An observation made in the behavior of the oligopoly in which one company, usually the dominant competitor among several, leads the way in determining prices, followed by the others soon

Target price.- Pricing method through which the established price of a product is calculated to produce a particular rate of return on investment for a specific volume of production. The target price method is most often used for essential utilities, such as electric and gas companies, and companies with high capital investment, such as car manufacturers.

Absorption price.- Pricing method in which all costs are covered. The product price includes the variable cost of each item plus a proportional amount of the fixed costs. A form of cost-based pricing

Price based on marginal cost.- In business, the practice of setting the price of a product to equal the extra cost of producing an extra unit of production. Under this policy, a producer charges, for each unit of the product sold, only the addition to the total cost resulting from materials and direct labor. Businesses often set prices near marginal cost during periods of poor sales. If, for example, an item has a marginal cost of $1 and a normal selling price is $2, the firm selling the item might want to lower the price to $1.10 if demand has languished. The business would choose this proposition because the increased 10-cent profit from the transaction is better than selling nothing.

Marketing strategy.- Marketing strategy is a process that can allow an organization to focus its limited resources on the greatest opportunities to increase sales and achieve a sustainable competitive advantage. A marketing strategy should be centered on the key concept that customer satisfaction is the main goal.

MARKETING STRATEGIES AND BUSINESS ETHICS.-

Possible analytical frameworks for marketing ethics.- (None of these frameworks allows, by itself, a convenient and complete categorization of the great variety of topics in marketing ethics)

Value-oriented framework.- Analyzing ethical problems on the basis of the values that they infringe (eg honesty, autonomy, privacy, transparency)

Shareholder-oriented framework.- Analyzing ethical problems on the basis of who they affect (eg clients, competitors, society as a whole).

Process-oriented framework.- Analyzing ethical issues in terms of the categories used by marketers (eg research, price, promotion, location).

Specific topics in marketing ethics.-

Market research.- Dangerous ethical points in market research include: invasion of privacy and cataloging.

Market audience.- Dangerous ethical points include: targeting the vulnerable (eg children, the elderly) and excluding potential customers from the market (homosexuals, ethnic minorities and obese)

MARKETING AND INFORMATION AND COMMUNICATION TECHNOLOGIES.-

Electronic commerce.-

Definition.- Electronic commerce, commonly known as e-commerce or eCommerce or e-business consists of buying and selling products or services through electronic systems such as the internet and other computer networks. The amount of electronically conducted commerce has grown dramatically with the spread of internet use. The use of commerce is conducted in this way, encouraging innovations in electronic funds transfer, supply chain management, internet marketing, online transaction processing, electronic data exchange, inventory management systems and collection systems. automatic data. Modern electronic commerce typically uses the World Wide Web at least at some point in the transaction life cycle,

B2C.- Electronic commerce that is conducted between companies and consumers, is called business-to-consumer or B2C.

B2B.- Electronic commerce that is conducted between companies is called business-to-business or B2B.

Internet Marketing.-

Definition.- Also called i-marketing, web-marketing, online-marketing, Search Engine Marketing (SEM) or e-Marketing, it’s the marketing of products or services through the internet.

A broader scope.- Internet marketing is sometimes considered as having a broader scope because it does not refer only to the Internet, email and wireless media, but also includes the management of digital customer data and management systems of the customer relationship.

Also refers.- Internet marketing also refers to the placement of media through many different stages of the customer engagement cycle through a search engine marketing (SEM), a search engine optimization ( SEO), banners on specific websites, email marketing and web 2.0 strategies

Email Marketing.- It’s a form of direct marketing that uses email as a means of business communication or fundraising messages to an audience. In its broadest sense, every email sent to a potential or current customer could be considered email marketing.

PART 3.- FINANCING OF COMPANIES

ECONOMIC AND FINANCIAL STRUCTURE OF THE COMPANY.-

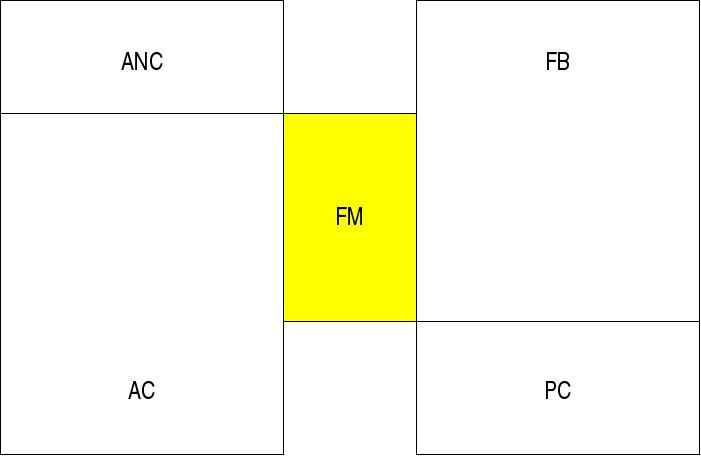

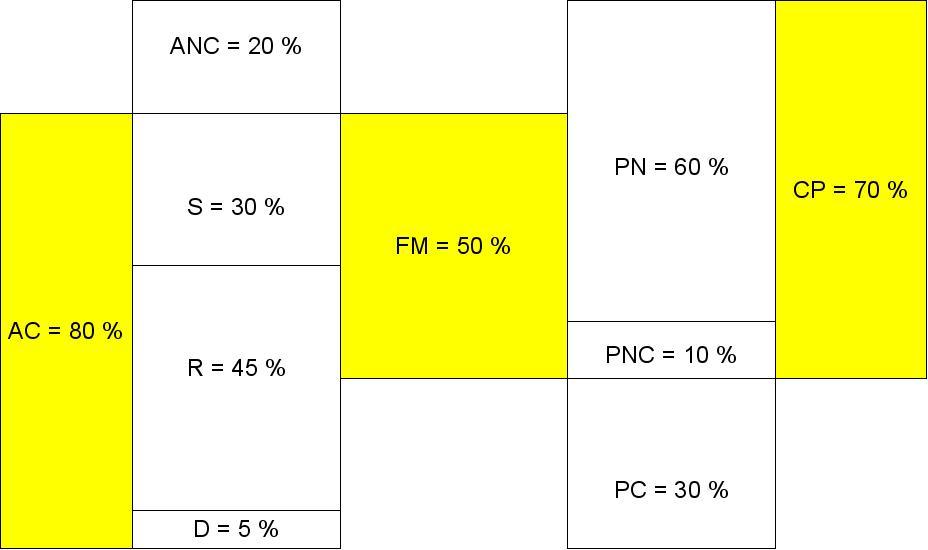

Structures.- Patrimony is made up of an economic structure, goods and rights (Assets) and a financial structure, obligations (Equity and Liabilities).

Equality.- The Assets must be equal to the Equity plus the Liabilities because what the company has bought (Assets) has been paid by someone (Equity and Liabilities)

Profitability.- The profitability of the Assets must be greater than the financial cost of the Equity and Liabilities

THE INVESTMENT: DEFINITION AND TYPES.-

Definition. - Investment is the dedication of money or capital to buy financial instruments or other assets to earn a profitable return in the form of interest, income or appreciation of the value of the instrument.

Types.-

According to the object of the investment.-

Industrial equipment

Raw material

Trucks, cars, boats, planes, etc.

A company or shares

According to their function in the company.-

Renovation

Expansion

Improvement and modernization

Strategic

According to who makes the investment.-

Private

Public

INVESTMENT ANALYSIS.-

Main characteristics of an investment.- Liquidity, profitability and security

Investment selection methods.-

Project |

Initial payment |

R1 |

R2 |

R3 |

R4 |

P1 |

100 |

60 |

45 |

|

|

P2 |

200 |

100 |

50 |

|

|

Q3 |

300 |

170 |

140 |

20 |

10 |

Payback period.- The payback period in investment selection refers to the period of time required for the return of an investment to return the sum of the original investment. For example, a $1,000 investment that is returned at $500 per year would have a payback period of two years. The time value of money isn’t taken into account. The payback period instinctively measures how long it takes for something to pay for itself. If all else is equal, shorter payback periods are preferable to longer ones. The payback period is widely used due to its ease of use despite its recognized limitations. It’s generally agreed that this investment decision tool should not be used in isolation. (years= a; months = m; days = d)

![]()

![]()

PB1= 1 a, 10 m and 20 d1st

PB2 = The project doesn’t recover 3rd

![]()

![]()

PB3 = 1a, 11 m and 4d 2nd

Net Present Value (NPV).- (ex. The discount rate is 2%)

Definition.- The Net Present Value of a time series of incoming/outcoming cash flows, is defined as the sum of the current values of the individual cash flows.

Reduced.- Each incoming/outgoing flow is reduced to its current value. Then they are added. Therefore, the NPV is the sum of all the terms

Selection.- If there is a choice between two alternatives, the greater is the better

![]()

![]()

![]() 2nd

2nd

![]() 3rd

3rd

![]() 1st

1st

The internal rate of return (IRR) .-

Definition.- The internal rate of return of an investment is the interest rate at which the costs of the investment match the benefits of the investment. This means that all returns on the investment are inherent in the time value of money and that the investment has a net present value of zero at this interest rate.

Acceptable.- An investment is considered acceptable if its internal rate of return is greater than the cost of capital.

![]()

![]()

![]()

if x = 1 + r

![]()

![]()

![]()

![]()

![]()

![]()

x = 1.0348; so r = 0.0348 = 3.48% 2nd

![]()

![]()

![]()

x = 0.8090; so r = -0.191 = -19.1% 3rd

I3 (more or less 8% through trial and error) = - 300 + 157.41 + 120.03 + 15.88 + 7.35 = 0.671st

FINANCING.-

Definition.- Company financing is an area of finance that deals with the financial decision-making of companies' business and the tools and analysis used to make these decisions.

TYPES OF FINANCIAL RESOURCES.-

Types of financing.-

According to its origin.-

Internal financing or self-financing.-

Definition.- Internal financing is the name for a company using its profits as a source of capital for new investments, instead of: a) distributing them to the owners of the company or other investors and b) obtaining capital elsewhere.

They are.- They are amortizations and reserves

External financing.-

Definition.- External financing consists of new money from outside the company brought in for investment.

They are.- They are the capital and liabilities

According to who is the owner of the resources.-

Own resources.-

Definition.- Equity is the asset minus the liability

They are.- They are the capital, amortizations and reserves

Third-party resources.- They are the liability

Internal financing or self-financing.-

Inexpensive.- Internal financing is generally thought to be less expensive for the company than external financing because the company doesn’t have to incur transaction costs to obtain it, nor does it have to pay the taxes associated with paying dividends.

Determinant.- Many economists debate whether the availability of internal financing is an important determinant of the company's investment or not. A related controversy is whether the fact that internal financing is empirically correlated with investment implies that firms are obligated to credit and therefore depend on internal financing for investment.

Financial options.- There are several options for a company to finance itself without external help:

Amortization.- Deduction of the value of the asset, reduces the profit before taxes

Building reserves.- Eg pension reserves

Retained earnings.- The earnings aren’t paid to the owners of the company

Change asset.- Selling real estate or other tangible assets owned by the company

Advantages of internal financing.-

Capital is immediately available

No interest payments

No control processes with regard to solvency

Replacement credit line

No influence of third parties

Disadvantages of internal financing.-

Expensive because internal funding isn’t tax deductible

No capital increase

Not as flexible as external financing

Losses (capital reduction) are not tax deductible

Limited in volume (the volume of external financing is also limited but there is more capital available outside - in the markets - than within the company)

Types of internal financing or self-financing.-

Maintenance self-financing.- They cover the depreciation of assets (amortizations and provisions)

Enrichment self-financing.- Increase the company's assets (reserves)

Depreciation.- Depreciation is the reduction in the value of an asset used for business purposes during a certain amount of time due to use, over time, wear and tear, technological age or obsolescence, depletion, insufficiency, decay, oxidation, deterioration or other factors

Annual amortization fee.- For example, a vehicle that depreciates over 5 years, is purchased at a cost of $17,000, and will have a residual value of $2,000, it will depreciate at $3,000 per year

![]()

![]()

Composition of external financing.-

Capital.-

Passive.-

Operating credits.- They’re short-term credits and finance current assets.

Financing credits.- They’re long-term credits and finance non-current assets

Social capital. The shares.-

Nominal value.-

Definition.- It’s the value of a share in the title

![]()

Market value.- Share price:

Below par.- MV <NV

At par.- MV = NV

Above par.- MV> NV

Theoretical value.-It’s the price of a share according to objective criteria

![]()

![]()

![]()

Types of shares.-

According to the form of representation.-

By means of a title

By means of an account entry

According to the type of contribution.-

Monetary contribution

Contribution in kind

According to its ownership.-

Related to the name of a person (nominative)

Bearer shares

The shares must be registered:

As long as they are not fully paid

If the shareholders have agreed in the company bylaws that several shareholders should give something to the company

If the shareholders have agreed in the company bylaws that the shares can’t be freely sold

When determined by law

According to the political rights of the shares.-

With the right to vote

Without voting rights (they have a guaranteed minimum dividend of 5% or another higher according to the company's bylaws, they will also have the ordinary dividend of such shares)

According to the privileges that the shares have.-

Ordinary

Privileged (the law doesn’t admit as a privilege to have an interest rate, to change the number of votes per share and the subscription right)

Shareholders' rights.-

To receive dividends

To participate in the patrimony after liquidation

To have a subscription right

To vote

To receive information

To challenge the agreements of the company

Types of shares according to the relationship between their issue value and their nominal value.-

Shares issued with a premium or above par.-

The issue value is greater than the nominal value

Premium = Issue Value - Nominal alue

Shares issued at par.- The Issue Value is the same as the Nominal Value

Shares issued below par (partially or fully released shares) .-

The Issue Value is less than the Nominal Value or they’re given free of charge to former shareholders

Society pays the difference using its reserves

Capital increase and subscription rights.-

Definition.- The subscription right is the right of former shareholders to acquire newly issued shares, issued by a company in a correct issue, a usual but not always public offering.

Success of the capital increase.- For a capital increase to be successful, the issue value of the new shares must be less than the market value of the old shares, because, otherwise, buying an old share would be more beneficial to buy a new one

Compensation to former shareholders.- The subscription right compensates former shareholders for the relative loss of influence within the company and for the distribution of their savings among the owners of the new shares.

The purchase of the new shares and the subscription right.- To subscribe new shares we must buy the number of subscription rights according to the agreements of the company (e.g. if a company increases its capital in the proportion 1 x 3, to buy 100 shares we must buy 300 rights, in addition)

The sale of subscription rights.- The owner of the old shares who doesn’t want to buy the new ones can sell their subscription rights on the market

Value of the subscription right.- The value of the subscription right depends on the market but we can calculate a theoretical value with the following formula:

Example: Calculate the theoretical value of the subscription right of a 2 x 5 capital increase, if the Market Value of the old shares is €2.5 and the Issue Value of the new ones is €2.2

![]()

Bonds issue.-

Definition.- A bond is a debt security that is a part of a loan, in which the authorized issuer owes the holders an amount and, depending on the terms of the bond, is obliged to pay interest (the coupon) and/or to return the principal at a later date, maturity period. A bond is a formal contract to pay back money with interest at fixed intervals.

Like a loan.- Therefore, a bond issue is like a loan: the issuer is the one who asks for the money (debtor), the holder is the one who lends money (the creditor), and the coupon is the interest. Bonds issue provide the borrower with external funds to finance long-term investments, or, in the case of government bonds, to finance current spending.

Differences between bonds and shares.- Bonds and shares are both titles, but the main difference between the two is that the shareholders have a part of the equity in the company (they are owners), while the bondholders have a part of the credit from a company (they are lenders). Another difference is that bonds usually have a defined period, or maturity, after which the bond is redeemed, while shares can be pending indefinitely.

Types of bonds.- The following descriptions aren’t mutually exclusive, and more than one of them may apply to a particular bond.

Fixed interest bonds.- They have a coupon that remains constant throughout the life of the bonds.

Floating interest bonds.- They have a variable coupon that is linked to a referenced interest rate, such as Euribor. For example, the coupon can be defined as three months Euribor + 0.20%. The coupon rate is recalculated periodically, typically every one to three months.

Bonds with zero coupon.- They don’t pay regular interest. They are issued at a substantial discount to par value, so that the interest actually reaches maturity (and is usually taxed as such). The bondholder receives the full amount of the principal on the redemption day.

Bonds linked to inflation.- In which the principal amount and interest payments are indexed to inflation. The interest rate is normally lower than for fixed income bonds with a comparable maturity.

Asset-backed securities.- These are bonds whose interest and principal payments are backed by underlying cash flows from other assets.

Subordinated bonds.- Those that have a lower priority than other obligations of the issuer in the event of liquidation. In bankruptcy, there is a hierarchy of creditors. First the liquidator is paid, then government taxes, etc. The first bondholders queued for payment are those bondholders who are high-ranking bondholders. After they have been paid, the subordinated bondholders are paid. As a consequence, the risk is higher. Consequently, subordinated bonds usually have a lower credit rating than high-ranking ones.

The stock market.-

Definition.- A stock market is an entity that provides trading facilities for stockbrokers and traders, to trade stocks and other securities. Stock markets also provide facilities for the issuance and redemption of securities in addition to other financial instruments and capital events including the payment of rent and dividends.

Primary and secondary markets.- The initial offer of shares and bonds for investors is by definition made in the primary market and the subsequent contracting is made in the secondary market.

National Stock Market Commission.- It’s an entity that supervises, inspects and controls the Spanish stock market

The role of the stock market.-

Raise capital for businesses.- The Stock Market provides companies with the easea to raise capital for expansion through selling shares to the investing public.

Mobilize savings for investment.- When people take out their savings and invest in stocks, it leads to a more rational allocation of resources because the funds, which could have been consumed, or put in useless deposits with banks, are mobilized and redirected to promote activities business with benefits for various economic sectors such as agriculture, commerce and industry, resulting in stronger economic growth and high levels of productivity of companies.

Facilitate company growth.- Companies view acquisitions as an opportunity to expand product lines, increase distribution channels, avoid volatility, increase their market share, or acquire other necessary business assets. A takeover offer or a merger agreement through the stock market is one of the simplest and most common ways for a company to grow by acquisition or merger.

Sharing benefits.- Both casual and professional investors in securities, through dividends and the increase in the price of securities that can result in capital gains, will participate in the patrimony of profitable businesses.

Corporate governance.- Having a wide and varied field of owners, companies tend to improve their management standards and efficiency to satisfy the demands of these shareholders and the more rigorous rules for public corporations imposed by public securities markets and government. Consequently, it is presumed that public companies tend to have better management records than privately held companies (those companies where the shares aren’t publicly sold, often owned by the founders of the company and/or their families and their heirs, or otherwise by a small group of investors).

Create investment opportunities for small investors.- As opposed to other businesses that require a huge capital outlay, investing in stocks is open to both large and small investors in securities because one person buys the number of shares that they can afford. Therefore the Stock Market provides the opportunity for small investors to own shares in the same companies as large investors.

Barometer of the economy.- In the stock market, the price of shares rises and falls depending, in large part, on market forces. Stock prices tend to rise or remain stable when companies and the broader economy show signs of stability and growth. An economic recession, depression, or financial crisis could eventually lead to a stock market crash. Therefore the movement of the prices of the actions and in general of the indexes of values can be an indicator of the general tendency in the economy.

The financial system.-

Definition of financial system.- The financial system is the system that allows the transfer of money between savers and people who borrow. It’s made up of banks, savings banks, insurance companies, the stock market, etc.

Commercial banks (typical operations) .-

Passive operations (borrow money).-

Current accounts

Savings accounts

Deposits

Active operations (lend money) .-

Loans.- It’s short-term or long-term external financing (if it’s for a year or less, it’s short-term and, if not, it’s long-term). The user receives the entire amount agreed from the beginning, forcing him to return this and all interest on certain days established in advance

Credit accounts.- It’is short-term external financing. The bank allows the customer to credit for a certain period of time and up to a certain amount, forcing the customer to pay a commission and return the desired amounts within the stipulated limit.

Discount of effects.- It’s short-term external financing (normally, 30, 60 or 90 days). The bank anticipates a person the amount of a bill of exchange.

Guarantee.-

Personal guarantees.- In financing up to five years (we must be responsible with all our personal assets)

Real guarantees (mortgage or pledge).- In financing over five years

Factoring.- It’s short-term external financing. The factoring is a financial transaction through which a company sells its receivables (eg. invoices) to a third party (called a factor) at an interest rate in exchange for immediate money with which to finance lasting businesses. It's expensive

Confirming.- It’s short-term external financing. A financial institution manages the payments of a company to its suppliers. It’s the opposite of factoring (in which the collections of a company from its clients are managed).

Leasing.- It is long-term external financing. Leasing is a process by which a company can obtain the use of a certain fixed asset for which it must pay a series of contractual, periodic, and tax deductible payments. In the end, the user has three options: buy the asset, continue with the leasing or return the asset.

Renting.- It’s long-term external financing. It’s a long-term rental that includes a series of services and that you don’t have the right to purchase.

Deficit in account.- It is short-term external financing. It occurs when the client withdraws more money than is in the account. They are the typical red numbers.

Commercial credit.- It’s short-term external financing. It occurs when suppliers allow us not to pay you at the same time you receive the goods but a time later.

Spontaneous financing funds.- It’s short-term external financing. It occurs because companies don’t pay the Corporation Tax, Social Security contributions or the remuneration of their workers on a daily basis but once a month or with another cadence; so, in the meantime, they can dispose of that money.

Working capital.-

Definition.- Working capital is a financial measure that represents the operating liquidity available to a company.

Formulas.-

Working capital = Current assets - Current liabilities