ECONOMY

4TH ESO - Created by Antonio Ginés -

TOPIC 1.- ECONOMY. AGENTS. OPPORTUNITY COST. PPF. ECONOMIC SYSTEMS. CIRCULAR FLOW. COMPANY, BUSINESSMAN AND ENTREPRENEUR.FUNCTIONS AND OBJECTIVES OF THE COMPANIES. CLASSES

WHAT IS ECONOMY?.-

Economy in our daily life.- We are constantly making economic decisions. For example, when we choose to buy a magazine and stop buying another thing or when we decide to save to buy the latest model of the console that we like instead of spending the money now on something else.

Economics as a science.- Economics is a science that studies human behavior in society as the relationship between aims and limited means that have alternative applications.

Scarcity.- Scarcity implies that there aren’t enough resources to produce enough to cover all needs. Scarcity also implies that all the objectives of society can’t be satisfied at the same time, therefore it’s necessary to follow a priorities policy.

Human needs.- Human needs are unlimited since, who doesn’t have a car wants to have one, even if it’s an urban one; when you get the urban, you want to have a superior one, for example a compact, when you get the compact you want to have a better one, for example a minivan. Even when you have a good car, youe want to have a little one to drive around town. Ultimately, we always want more, we never are content with what we have.

Goods and services.- Companies, with their operation, produce goods or provide services to their customers. Goods are tangible (eg a chair, a computer, a motorcycle), while services are not (eg education, health, security).

Difference between Microeconomics and Macroeconomics.- While Microeconomics studies the economic behavior of individual economic agents such as domestic economies or families and companies, Macroeconomics is responsible for the general study of the economy of an autonomous community, a country or of a trade bloc like the European Union

Difference between positive economics and normative economics.- While positive economics indicates “what is”, normative economics indicates “what should be”. For example, while positive economics says: "if interest rates fall, people ask for more loans," normative economics indicates whether or not interest rates should be lowered, depending on the current economic situation.

THE ECONOMIC AGENTS.-

Definition of economic agents.- They are the people or groups that carry out an economic activity

Types of economic agents.-

Families or households.- They make the decisions about what to consume and are the owners, they have most of the rest of the production factors (K and W)

Companies.- They make decisions about what to produce, how to produce and distribution

Public sector.- It is made up of different public administrations and other public entities (including public companies). It takes part in the economy in three ways:

Creating laws that regulate the way in which other economic agents act when they go to the market

Redistributing income from those who have the most to those who have the least

Offering, at a lower price or for free, goods and services that society thinks the entire population should receive (education and health)

THE COST OF OPPORTUNITY.-

Definition.- It’s what an agent loses when making a decision

COMBINATION |

WHEAT |

BARLEY |

OPPORTUNITY COST |

|

1 |

0 |

5 |

- |

|

2 |

1 |

3 |

2 |

|

3 |

2 |

0 |

3 |

|

Cannons-butter.- When individuals are grouped together in societies, they face different types of dilemmas. The classic is the dilemma between "cannons and butter." The more we spend on national security to protect our coasts from foreign aggressors (cannons), the less we’ll spend on personal goods to improve the standard of living in our country (butter)

Pollution-rent.- In modern society, the dilemma between a clean environment and a high level of income is also important. Legislation that forces companies to reduce pollution raises the cost of producing goods and services. Higher costs can create lower company profits, lower wages, higher prices, or all three at the same time.

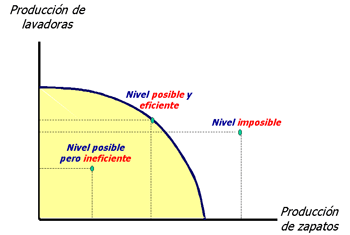

THE POSSIBILITIES PRODUCTION FRONTIER (PPF).-

Definition.- It’s the group of productive factors or combinations of technologies that reach maximum production. It reflects the maximum quantities of goods and services that a society can produce in a given period of time and with given production factors and technological knowledge.

Situations that can occur in the productive structure of a country.-

Inefficient productive structure.- Being under the PPF means that either not all resources are used (idle resources) or the technology is not adequate (technology that can be improved). A country with an unemployment rate above 5% will always find itself in this productive structure, because there is unused labor available.

Efficient production structure.- It’s located on the border or very close to it. There are no idle resources and the best technology is used.

Unattainable productive structure.- It is located above the Production Possibilities. It’s theoretical because no country can produce more than is possible, indefinitely (overtime could temporarily achieve higher production levels)

Form of the PPF.- It is concave and decreasing. This form is due to two reasons:

Decreasing.- To produce more of one good it’s necessary to produce less of another

Concave.- The opportunity cost is increasing

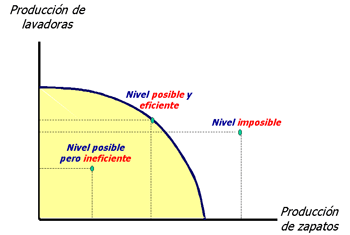

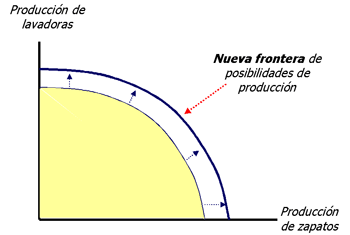

Displacement of the PPF.- It’s movable, that is, unreachable points can be reached. Displacement may be due to technological improvements, an increase in capital, an increase in workers, or the discovery of new natural resources.In this case, displacement affects the production of both goods equally. However, different cases can arise. For example, if the displacement is due to the immigration of untrained individuals, they can be expected to join companies engaged in low-skilled manual activities such as those related to agriculture. If the displacement is due to a new technology, it could also be thought that it affects some sectors more and others less. Therefore, the expansion of production possibilities are not the same in all cases. We can reflect on a graph like the previous one how the displacements would be.

THE ECONOMIC SYSTEMS. PECULIARITIES OF THE ANDALUSIAN ECONOMY.-

Capitalism (emerged in Europe in the 16th century) .-

Features.-

Capital over labor.- Capital dominates over labor as an element of wealth production

Priority of profit.- Profit is the guide of economic action for capital accumulation

Private ownership.- Ownership of the means of production is in the hands of the families

Economy determined by the free market.- The distribution, production and prices of goods and services are usually determined by the interaction of supply and demand

Free enterprise.- Each company is freely dedicated to what it decides to produce with no limitations other than the qualification requirements necessary to carry out that activity

Non-intervention.- The State limits itself to intervening in very specific cases

The centrally planned economy.-

The state organization.- The production factors are in the hands of the State, which is the only important economic agent. The market doesn’t allocate resources, because it’s manipulated by the State. These manipulations are made with multi-year economic plans (five-year plans), which explain in great detail the supply, production methods, salaries, investments in infrastructure,. . .

Main problems.-

Forecast errors.- The market doesn’t send signals because it doesn’t exist (false market). Without signals, the planners weren’t always correct in their forecasts and this caused a lack of adaptation to reality and a poor reaction capacity

Low motivation.- Because wages and prices were set by the State, companies didn’t need to be competitive and workers were unmotivated, because they earned the same if they did their job well or badly.

Excessive bureaucracy.- Planning required a huge bureaucracy at the service of the State, so decisions and reaction capacity were slower.

Mixed economy.- In reality, there is no country with a totally market or centralized economy, but more or less a combination of both in increasing or decreasing degree.

Particularities of the Andalusian economy.- The Andalusian economy, like the Spanish economy, has a mixed economy system with great importance placed on the market economy.

CIRCULAR FLOW OF INCOME.-

Relationship between families and companies.-

The real flow that goes from the companies to the families is the goods and services and, as a counterpart, the monetary flow that goes from the families to the companies is the consumption expenses

The real flow that goes from families to companies are the production factors and, as a counterpart, the monetary flow that goes from companies to families are wages, income, dividends, etc.

Relationship between families and businesses and the government.-

The real flow that goes from the State to families and companies is goods and services and, as a counterpart, the monetary flow that goes from families and companies to the State is taxes.

The real flow that goes from families and companies to the State is work and, as a counterpart, the monetary flow that goes from the State to families and companies is wages.

DEFINITION OF THE COMPANY.- A company is a set of human, material, financial and technical factors organized and driven by management, which tries to achieve objectives in accordance with the purpose previously assigned

THEORIES ABOUT THE CONCEPT OF THE ENTREPRENEUR.-

Capitalist entrepreneur or business owner - Early 19th century

Innovative entrepreneur (Shumpeter) .- He is capable of launching a new business opportunity taking advantage of an invention or an unexploited idea (it isn’t who invents it but who exploits it)

Entrepreneur who assumes risks (Knigth) .- He has expenses that he will recover or not

Galbraith's technostructure.- In new large companies, the ones who actually hold business power are not the partners of the company but the senior managers who control it

ENTREPRENEUR.- An entrepreneur is a person who organizes and runs a company, usually with a lot of initiative and risk. Instead of working as an employee, an entrepreneur creates a small business and takes the risk. The entrepreneur is seen as an innovative leader with new ideas and processes. Entrepreneurs tend to be good at perceiving new opportunities and often have positive trends in their perception (eg, a tendency to find new possibilities and see market needs that haven’t yet been addressed) and a tendency to take risks which makes it more likely that they will exploit the opportunity. The innovative spirit is characterized by innovation and the acceptance of risk. While entrepreneurship is often associated with startups, small and for profit, entrepreneurial behavior can be seen in small, medium and large, new or established companies, and in for-profit and non-profit organizations, including the voluntary sector, charities and governments. For example, in the 2000s, the field of social entrepreneurship has been identified as one in which entrepreneurs combine business activities with humanitarian, environmental, or community goals.

FUNCTIONS AND OBJECTIVES OF THE COMPANY.-

Company functions.-

Directive.- Decides how the objectives of the company will be achieved through planning, organization, coordination and control

Technical or production.- Performs activities for the manufacture of goods or the provision of services

Research and development.- Improvement of methods and programming and launch of work plans

Financial.- Get the necessary financial resources

Human resources management.- Select, hire, train, motivate and promote staff

Purchases.- Acquisitions

Commercial.- Sell

Administrative.- Control the documentation

Goals.-

Economic or profitability.- Maximum benefit

Growth.-

Intensive.- In a new area (SEAT enters Russia); a very similar product (SMART)

Integrated.- In another phase of the same production process

Backwards.- CALVO - Fishermen

Forwards.- CALVO - HIPERCOR

Horizontal.- CONTINENT AND PRYCA IN CARREFOUR

Diversified.- Another activity (BMW produced aircraft engines and began to manufacture cars)

Social.- Cover social needs (ecology, security, help to people in need, etc.)

CLASSES OF COMPANIES.-

According to their economic activity.-

Commercial.- They buy and sell products without transformation

Industrial.- Transform products

Services.- They provide services

According to the economic sector to which they belong.-

Primary sector companies.- Extractive activities (agriculture, livestock, fishing, mining, etc.)

Secondary sector companies.- Industry and construction

Tertiary sector companies.- Services

According to its size.-

By number of workers.-

Microenterprise.- From one to five workers

Small business.- From six to fifty workers

Medium-size company.- From fifty-one to five hundred workers

Large company.- More than five hundred workers

Other criteria to measure the size of companies.-

Own resources or Net Equity

The active

Production volume

The sales figure

The use of factors of production (in addition to the number of employees)

The benefits

One multi-criteria value (using several at the same time)

According to the ownership of the capital.-

State-owned.- The capital is in the hands of the State

Private-owned.- The capital is in the hands of individuals

Mixed.- Part of the capital is in private hands and part is of the State

According to the geographical area.-

Local.-

Nationals.-

International.-

According to its legal form.-

Individual entrepreneur.- It’s that natural person who, having the necessary legal capacity, regularly exercises a business activity on his own account.

Individual Limited Liability Companies (EIRL).- They are legal persons, formed exclusively by a natural person, with their own assets and different from that of the owner, who carry out activities of a purely commercial nature (not second category activities). The EIRL are subject to the rules of the Commercial Code, whatever their purpose, being able to carry out all kinds of civil and commercial operations, except those reserved by law for Public Limited Companies (SA).

Communities of goods.- It consists of a group of individual entrepreneurs who share some good

Civil companies.- Are those that, without being public limited companies or limited liability companies, carry out an activity that can’t be industrial or commercial (eg a law firm)

Partnership.- The partners, who can be capitalists or industrialists, have unlimited liability. They have no minimum capital.

Limited partnership.- General partners have unlimited liability while limited partners have limited liability. They have no minimum capital.

Limited partnership by shares.- They are a mix between the limited partnership and the public limited company.

Limited liability company.- The partners have limited liability.The minimum capital is €3,000.

New company limited liability company.- It’s a specialty of the limited liability company. The minimum capital of €3,000 and the maximum of €120,000.

Public limited company.- The partners have limited liability. The minimum capital is € 60,000.

European public limited company.- It is a specialty of the public limited company.

Listed public limited company.- These are public limited companies that are listed on the Stock Market.

Labor companies.- They can be labor limited liabilities companies or labor public limited companies. Most of the capital must be in the hands of working partners of the company with an indefinite contract and no partner can have more than a third of the capital stock.

Cooperatives.-They don’t have profit motive. In principle, the partners have limited liability. They can be for work, housing, transportation, consumption, credit, etc.

TOPIC 2.- FINANCING. TAXATION. FACTORS. CLASSIFICATION OF ACTIVITIES. PRODUCTIVITY. EFFICIENCY. R + D + i. COSTS. BREAK EVEN POINT. SECTORS

TYPES OF FINANCING.-

According to its origin.-

Internal financing or self-financing.-

Definition.- Internal financing is the name for a company using its profits as a source of capital for new investments, instead of: a) distributing them to the owners of the company or other investors and b) obtaining capital elsewhere.

They are.- They are amortizations and reserves

External financing.-

Definition.- External financing consists of new money from outside the company brought in for investment.

They are.- They are the capital and liabilities

According to who is the owner of the resources.-

Own resources.-

Definition.- Equity is the asset minus the liability

They are.- They are the capital, amortizations and reserves

Third-party resources.- They are the liability

INTERNAL FINANCING OR SELF-FINANCING.-

Is it cheap or expensive? .-It’s thought that internal financing is generally less expensive for the company than external financing because the company doesn’t have to incur transaction costs to obtain it, nor does it have to pay the taxes associated with the payment dividends.

Is it decisive or not?- Many economists debate whether the availability of internal financing is an important determinant of the company's investment or not. A related controversy is whether the fact that internal financing is empirically correlated with investment implies that firms are obligated to credit and therefore depend on internal financing for investment.

Options for self-financing.- There are several options for a company to finance itself without external help:

Amortization.- Deduction of the value of the asset, reduces the profit before taxes

Create reserves.- Eg pension reserves

Withhold profits.- Profits are not paid to the owners of the company

Change asset.- Selling real estate or other tangible assets owned by the company

Advantages of internal financing.-

Capital is immediately available

No interest payments

No control processes with regard to solvency

Replacement credit line

No influence of third parties

Disadvantages of internal financing.-

Internal financing is not tax deductible

No capital increase

Not as flexible as external financing

Losses (capital reduction) are not tax deductible

Limited in volume (the volume of external financing is also limited but there is more capital available outside - in the markets - than within the company)

Types of internal financing or self-financing.-

Maintenance self-financing.- They cover the depreciation of assets (amortizations and provisions)

Enrichment self-financing.- Increase the company's assets (reserves)

EXTERNAL FINANCING.-

Capital.-

Passive.-

Operating credits.- They are short-term credits and finance current assets.

Financing credits.- They are long-term credits and finance non-current assets

SHORT TERM FINANCING.-

Commercial credits.- Normally the providers allow us to pay them in thirty, sixty or ninety days for which, it’s as if they were lending us money during that time.

Short-term loans.- The user receives the total amount agreed from the beginning, forcing him to return this and all interest on certain days established before.

Credit accounts.- The bank allows the customer a credit for a certain period of time and up to a certain amount, forcing the customer to pay a commission and return the desired amounts within the stipulated time limit.

Discount of bills.- The bank advances to a person the amount of a commercial bill (bills of exchange and promissory notes).

Factoring.- Factoring is a financial transaction through which a company sells its collection rights (eg invoices) to a third party (called factor) at an interest in exchange for immediate money with which to finance lasting businesses. It's expensive

LONG TERM FINANCING.-

Long-term loans.-

Issuance of bonds.- It is a very large loan divided into titles called bonds. It’s usually three or five years.

Own financing.- Mainly capital and reserves

TAXATION.-

Taxes; elements and definitions.-

Taxable event.- It’s the reason for which the tax obligation arises

Taxable base.- It’s the quantification of the taxable event

Net taxable base.- It’s the taxable base minus deductions, reductions and compensations

Tax rate.- It’s the percentage that is applied to the net taxable base to calculate the tax quota

Tax quota.- It’s the result of applying the tax rate to the net taxable base

Tax debt.- It’s the tax rate plus surcharges and minus bonuses

Types of tributes.-

Fee.- A fee is a tax whose taxable event consists of the private use or special use of the public domain, the provision of services or the performance of activities under public law that refer, affect or benefit the obligated party in a particular way, when the services or activities aren’t voluntarily requested or received by the taxpayers or aren’t provided or carried out by the private sector. Eg we pay a fee when we get the DNI.

Special contributions.- They are the taxes whose chargeable event is the acquisition by the taxpayer of a benefit or an increase in value of their property as a result of public works or the establishment or expansion of public services. Eg we pay a special contribution if they renew the pavement of our street.

The Value-Added Tax.- The VAT is an indirect tax on consumption, that is, financed by the final consumer. An indirect tax is the tax that isn’t received by the treasury directly from the taxpayer. VAT must be collected by companies at the time of any sale of products (transfer of goods and services). Companies have the right to be reimbursed the VAT that they have paid to other companies on purchases made in exchange for invoices (tax credit), subtracting it from the amount of VAT charged to their customers (tax debit), having to deliver the difference to the treasury. End consumers are obliged to pay VAT without the right to reimbursement,

Personal Income Tax.- Personal Income Tax is a personal, progressive and direct tax levied on the income obtained in a calendar year by natural persons residing in Spain. It’s the most significant pillar of the tax system.

Corporate Tax.- It’s as periodic, proportionate, direct and personal tribute whose taxable income is obtained by legal persons and other entities without personality. Taxes the income of companies and other legal entities. It’s applied throughout the Spanish territory, with the exception of the Basque Country and Navarra (by means of a concert).

Tax on Patrimonial Transmissions and Documented Legal Acts.- It’s a tax that levies: a) the transmissions of goods for consideration that aren’t taxed by the Value Added Tax, b) the formalization of certain notarial, commercial and administrative documents in Spanish territory or abroad that take effect in Spain and c) the constitution, increase and decrease of capital, merger, spin-off and dissolution of companies, the contributions made by the partners to replace social losses and the transfer to Spain of the headquarters of effective address or registered office of a company.

Real Estate Tax.- The RET is a tax that levies the value of the ownership and other real rights that fall on real estate located in the municipality that collects the tax. Its management is shared between the State Administration and the City Councils.

Tax on Economic Activities.- The TEA is a tax that is directly levied on the performance of any type of economic activity, both natural and legal persons. Unlike other taxes, its amount is constant regardless of the balance of the activity. It’s a direct, mandatory, proportional, real and shared management tax.

PRODUCTION FACTORS.-

Definition.- They are resources, material or not, that when combined in the production process add value in the production of goods and services

Evolution of the concept.-

Classical economists.- They use the three factors that Adam Smith defined, each factor participates in the result of production through a reward set by the market:

Land (which is rewarded with rent)

Work (which is rewarded with wages)

Capital (which is rewarded with interest)

Neoclassical economists.- They only use capital and labor because they simplify their economic analyzes. The land is considered included within the capital

Current economy. New production factors.-

Natural capital (land).- Today the land is considered a component of capital or a component of a broader natural factor (natural resources or natural capital).

Physical capital.- Understood as tools and machinery

Material work.- Non-intellectual work

Intangible capital (know-how, organization, non-physical but computable assets, intangible work, knowledge economy) .- Fourth production factor.

CLASSIFICATION OF PRODUCTIVE ACTIVITIES.-

According to the segment where the product is directed.-

Production by order.- The product has been manufactured because the client has ordered it

Production for the market.- The product has been manufactured for the market in general.

According to the degree of differentiation of the product.-

Mass production.- All products are the same

Individualized production.- Each product is different

According to the continuity of the production process.-

Continuous process.- The activity doesn’t stop

Discontinuous process.- The activity ends with the manufacture of the product and begins again when we make another product (eg the construction of an industrial unit)

AVERAGE PRODUCT OR PRODUCTIVITY.-

Definition.- The average product is the amount of product units obtained for each unit of factor used

Other definitions of productivity.-

Production/resources.- It’s the relationship between the production obtained by a system of production or services and the resources used to obtain it.

Results/time.- It can also be defined as the relationship between the results and the time used to obtain it: the less time used to obtain the desired result, the more productive the system.

Outputs/Inputs.- It is the relationship between the outputs and the inputs of a system

Productivity-profitability.- Greater productivity using the same resources or producing the same goods or services results in greater profitability for the company. Therefore, the quality management system tries to increase productivity.

Types of productivity.-

One factor productivity.- It is the relationship between the amount obtained from a product and the amount of factor that has been used for its production

Global productivity.- It’s the relationship between the monetary value of the production of a period and the monetary value of the amount of resources used to achieve it.

Improved productivity.- It is obtained by innovating in:

Technology (for example, the Internet)

Organization (for example assembly line)

Human resources (through training)

Labor relations (improvement of labor legislation)

Working conditions (for example, occupational health)

Other

DIFFERENCE BETWEEN EFFICACY AND EFFICIENCY.-

Difference.- While efficacy consists in achieving the objectives in any way, efficiency consists in achieving the objectives with the greatest possible economy of means.

Example.- For example, an office worker will be effective if he writes a personalized letter to each of the hundred clients of the company to inform them of our offers and our products (which takes him three hours without stopping). Another clerk would be efficient if he combined the database with customer data with a sample letter (which takes him fifteen minutes).

RESEARCH, DEVELOPMENT AND INNOVATION.- In the knowledge economy and business development produced since the end of the 20th century, people consider that technology and science (what has been called R + D - Research and Development - or even R + D + i - Research, Development and Innovation -) is a fourth factor of production that characterizes more and more production in industrialized countries. At the same time, the concept of physical capital or financial capital is added to the concept of human capital or intellectual capital, even social capital, as a way of explaining the improvement in productivity that isn’t due to the other factors.

OBTAINING AND ANALYSIS OF THE COST OF PRODUCTION.-

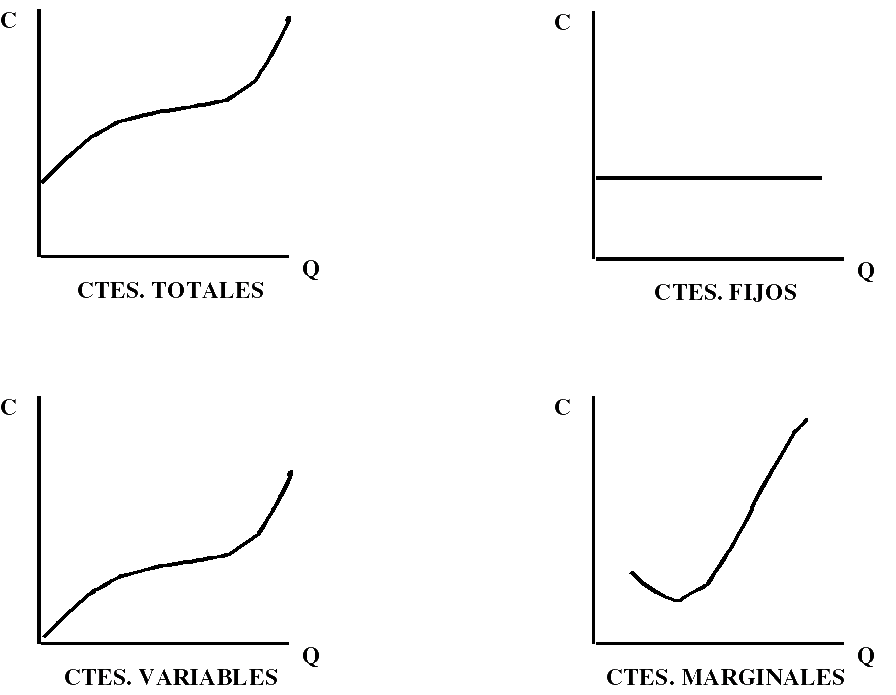

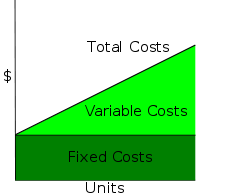

Total costs.- Are those that a company has in a production process or activity. They are the sum of the fixed costs and the variable costs: TC = FC + VC

Fixed costs.- They are invariable if the quantity produced has small changes. Fixed costs are connected to the productive structure and for that reason they are called structural costs, and they are used to make reports on the degree of use of that structure. Example: If we make more bread, we won’t pay more rent for our industrial unit.

Variable costs.- They change if the activity level changes. That is, if the level of activity decreases, these costs decrease, and if the level of activity increases, these costs increase. Example: If we make more bread we need more flour. Except when there are structural changes, in the economic units - or productive units - the variable costs have a linear behavior, because the average value per unit tends to be constant. In Microeconomic Theory, variable costs are not linear, at first they grow at a more than proportional rate but after the inflection point they grow at a less than proportional rate.

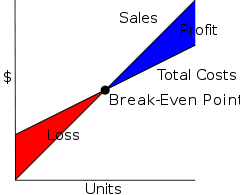

BREAK-EVEN POINT.-

Overview.- In economics and business, specifically cost accounting, the break-even point is the point where costs or expenses and income are equal: there is no net loss or profit. A profit or loss has not been made, although the opportunity costs have been paid, and the capital has received a risk-adjusted return.

Example.- If a business sells less than 200 tables each month, it will make a loss, if it sells more, it will make a profit. With this information, the manager will then need to see if they expect to be able to make and sell 200 tables per month.

Implementation.- If they think they cann’t sell that much, to ensure viability they could:

Fixed costs.- Try to reduce fixed costs (renegotiating the rent for example, or maintaining better control of telephone bills or other costs)

Variable costs.- Try to reduce variable costs (the price you pay for tables by finding a new supplier)

Price.- Increase the sale price of your tables.

Either.- Any of these would reduce the break-even point. In other words, the business wouldn’t need to make as many tables to ensure that it could pay its fixed costs.

Calculation.- In the linear model of cost, volume and profit analysis, the break-even point, in terms of units sold (Q) can be directly calculated in terms of total revenue (I) and total costs (TC) as:

![]()

![]()

![]()

![]()

![]()

where:

CF are the fixed costs

P is the price of the unit sold, and

CVu is the unit variable cost

The amount (P - CVu) is of interest in its own right, and is called the Unit Contribution Margin: it is the marginal benefit per unit

IDENTIFICATION OF THE MAIN ECONOMIC SECTORS IN ANDALUSIA.-

Primary Sector.- It has the lowest percentage of total production but it has a great relative importance with the other productive sectors. This importance is greater if we compare it with the primary sector of other Western economies, where it has been reduced to a minimum. The primary sector produces 8.26% of the total and employs 8.19% of the working population. It’s an uncompetitive sector since other economies with a much smaller working population produce much more. To this relative importance of the Andalusian primary sector must be added its long tradition in Andalusia, where it is deeply rooted. The primary sector can be divided into a series of subsectors: agriculture, fishing, livestock, hunting, forest resources, mining and energy.

Secondary sector.-

Industry.- The development, in the 19th century, of the industries linked to mining extraction (Garrucha and Carboneras, Riotinto, El Pedroso, Peñarroya and Linares - La Carolina) failed. At the beginning of the 21st century, although there is a greater integration between mining extraction and industrial transformation, this is still insufficient and incomplete. The shortage of energy products causes a strong dependence on imported oil, although Andalusia has great potential for the development of renewable energy, especially solar energy and wind energy. There are other less important industries such as automotive, aeronautics, etc.

Building. - At the beginning of 2008 the international financial crisis got much worse, banks had a fall in their profits, and the stock market had sharp falls. In this context, the construction industry begins to show obvious signs of crisis: a sharp drop in sales, a drop in housing prices, a rise in non-performing loans or an increase in unemployment in the sector (for example, the half of the real estate agencies close) in February 2008, the Spanish economy shows obvious symptoms of economic crisis, because unemployment has the highest growth in the last 25 years.

Tertiary sector.- This sector has had a very important growth in the last decades. It was a minority and is now a majority in Western economies. This process has been called outsourcing of the economy and has been very important in the Andalusian economy. In 1975 the tertiary sector produced 51.1 of Andalusian gross added value (GVA) and employed 40.8%, while in 2007 it produced 67.9% of GVA and 66.42% of jobs. However, this growth in the tertiary sector was earlier than in other developed economies and was independent of the industrial sector.

TOPIC 3.- MONEY. BANKING RELATIONS. RISKS. INSURERS

EXCHANGE RELATIONS AND HISTORICAL EVOLUTION.-

Barter or exchange.-

Definition.- Buy or sell using a product or service instead of money as a bargaining chip, that is, buying or selling without using cash.

Origins.- Its beginnings go back to the first sedentary communities of human beings. These colonizers knew agriculture and herding, lived longer than their nomadic ancestors, and enjoyed better security. In addition, the first works, such as pottery or metallurgy, began to develop.

Appearance of the coins.- New products brought new needs that were impossible to satisfy in an autocratic society (political concept that means an undemocratic government and, normally, entails an economy closed to the outside). Therefore began bartering: with the need to exchange what was owned for what was necessary. Although, at times, many intermediate exchanges were necessary to satisfy needs. This, combined with the growth of settlements and the expansion of commercial networks, facilitated the appearance of the concept of "coins" (which were initially bags of salt).

Disappearance of barter.- In spite of everything, barter didn’t disappear with the arrival of coins. In Ancient Egypt, the monetary system and exchange lived together throughout history, the Phoenicians used it as the basis of their trading system and the native people of Latin America also exchanged their products in markets.

Money.-

Explanation of the appearance of money.- When exchange is frequent, barter systems quickly find the need to have some merchandise with monetary properties. This greatly facilitates trade and the permanence of families in the area, building the wealth of the place and demographic growth and giving rise to the natural process of free trade and the development of the economy.

Money-merchandise.- Civilizations have adopted over the centuries various goods such as money (gold, silver, other metals or minerals, wheat, tea tablets in China, etc.) that have monetary properties, such as divisibility. , durability, etc.

First money in the West.- The first historical signs that we have of money in the form of currency in the West are those of the Phoenicians.

Intrinsic value.- Money in this phase had an intrinsic value. Gold and silver themselves had a value, and that is why they were exchanged. However, today, money has only value as an instrument of exchange (the paper of which a banknote is composed has no value).

Issuance of money.- The states began to issue notes and coins that gave the bearer the right to exchange them for gold or silver from the country's reserves. Then fiat money appeared, which has no intrinsic value

Evolution of the backing of paper money.-

18th and 19th centuries.- Many countries had a bimetallic pattern, based on gold and silver.

Between 1870 and the First World War.- The Gold Standard was mainly adopted. Any citizen could convert paper money into an equivalent amount of gold.

Between the two World Wars.- Countries tried to return to the Gold Standard, but the economic situation and the crisis of 1929 ended the ability for an individual to convert banknotes into gold.

At the end of World War II.- The allies established a new financial system in the Bretton Woods Agreements (in July 1944 in the United States). Here it was established that all currencies would be converted into US dollars and only the US dollar would be convertible into gold bars at $35 per ounce for foreign governments.

In 1971.- The expansionary fiscal policies of the United States, motivated mainly by the military spending in Vietnam, cause the abundance of dollars, which created doubts about their convertibility into gold. This is why European central banks tried to convert their dollar reserves into gold, creating an unsustainable situation for the United States. Because of this, in December 1971, the President of the United States, Richard Nixon, unilaterally suspended the conversion of the dollar to gold and devalued the dollar by 10%. In 1973, the dollar was devalued another 10%, until, finally, the conversion of the dollar to gold ended.

From 1973 to today.- The money that we use today has a value in the subjective belief and legal obligation that will be accepted by the rest of the inhabitants of a country, or economic area, as an instrument of exchange. The monetary authorities and central banks of developed countries don’t attempt to defend any particular exchange rate level, but intervene in the foreign exchange market to calm speculative fluctuations in the short term, with the aim of maintaining price stability in the short term and avoid situations such as hyperinflation, which destroys the value of money leading to a decrease in confidence or, on the contrary, the opposite can also occur, that is, deflation (generalized and sustained fall in prices or loss of money value).

THE EURO.- The euro (€) is the currency used by the institutions of the European Union as well as the official currency of 23 countries, including 19 of the 27 member states of the European Union (EU) collectively known as the eurozone, which are: Germany, Austria, Belgium, Cyprus, Slovakia, Slovenia, Spain, Estonia, Finland, France, Greece, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, the Netherlands and Portugal. The remaining 4 correspond to European microstates that have agreements with the EU, which are: Vatican City, Monaco, San Marino and Andorra. Furthermore, the euro has been unilaterally adopted by Montenegro and Kosovo. Therefore, the euro is in daily use by some 332 million Europeans. More than 175 million people around the world use currencies pegged to the euro, including more than 150 million Africans.

TYPES OF MONEY.-

M0.- Banknotes and coins in circulation and in bank vaults, plus reserves of commercial banks kept in their accounting at the Central Bank (minimum reserves and surplus or voluntary reserves). This is the basis from which other forms of money are created and is traditionally the most liquid measure of the money supply. M0 is usually called the monetary base.

M1.- Same as M0 + demand deposits (also known as current accounts and other deposits that function as demand deposits) + traveler's checks.

M2.- Same as M1 + savings deposits (savings accounts or savings books), and also fixed-term deposits of up to two years and deposits available with notice of up to three months.

M3.- Same as M2 + all other long-term deposits, institutional money market funds, short-term repurchase agreements (repos), along with other more liquid assets.

MONEY, DEFINITION AND FUNCTIONS.-

Definition.- Money is that good that achieves the following functions: medium of exchange, unit of account and store of value.

Functions.-

Medium of exchange.- When money is used to mediate in the exchange of goods and services, it’s performing a function as a medium of exchange. This avoids the inefficiencies of a barter system, such as the problem of double coincidence of needs.

Unit of account.- A unit of account is a standard numerical unit of measurement of the market value of goods, services and other transactions. Also known as a "measure" or "standard" of the relative value and installment payments, a unit of account is a necessary requirement for the formulation of trade agreements that involve indebtedness. To function as a "unit of account," what is being used as currency must:

Be divisible.- Divisible into smaller units without losing value; precious metals can be minted from bars, or cast into bars again

Be homogeneous.- That is, a unit or piece must be perceived as equivalent to any other, for example: diamonds, works of art or real estate are not advisable as money

Have a certain weight, measure or size.- A specific weight, measure or size to be accounting comparable. For example, coins are often made with ridges around the edges, so that any extraction of material from the coin (lowering its value as a commodity) is easily detected.

Store of value.- To act as a store of value, a commodity, a form of money, or financial capital must be able to be saved, stored and recovered with confidence - and be predictably useful when it is recovered. Legal tender such as paper or electronic money, which is no longer backed by gold in most countries, is not considered by some economists as a store of value in exceptional situations (strong currency depreciation)

ELECTRONIC MONEY.- Electronic wallet, smart cards or chip cards. They are cards that are used for small purchases and that aren’t associated with any account. If they are stolen, the thieves can only withdraw the money that is loaded on the card, which is usually small amounts; that is, they don’t have access to all the money in the current account, like normal cards.

BANKING RELATIONS.-

Money as a financial asset.- A financial asset is a title or an accounting entry, whereby the buyer of the title acquires the right to receive future income from the seller. The main financial assets are loans, stocks, bonds, and bank deposits.

Basic characteristics of financial assets.-

Liquidity.- The most liquid asset would be money, followed by the different types of deposits, commercial credits, treasury bills, loans, government bonds and, finally, government obligations.

Security.- It is determined by the solvency of the issuer and the guarantees that it can present for the debtor.

Profitability.- It’s the interest obtained by the holder by accepting the risk involved in the temporary transfer of money.

Deposits.-

Demand deposits.- Customers can have their money at any time. They are the current accounts.

Saving deposits.- They work practically the same as demand deposits but they have passbooks. They are savings accounts.

Term deposits.- Clients can only dispose of their money when the agreed period has passed, otherwise they should pay a penalty.

Ways to mobilize money.-

Check.- It’s a document by which a customer orders his bank to pay a certain amount, from his current account, to another person.

Promissory note.- It’s a title by which a person (drawer or signer) is obliged to pay another (holder), or his order, an amount on a specified date and place.

Bank receipt.- It’s a document issued by the bank that certifies that a service or product has been paid for.

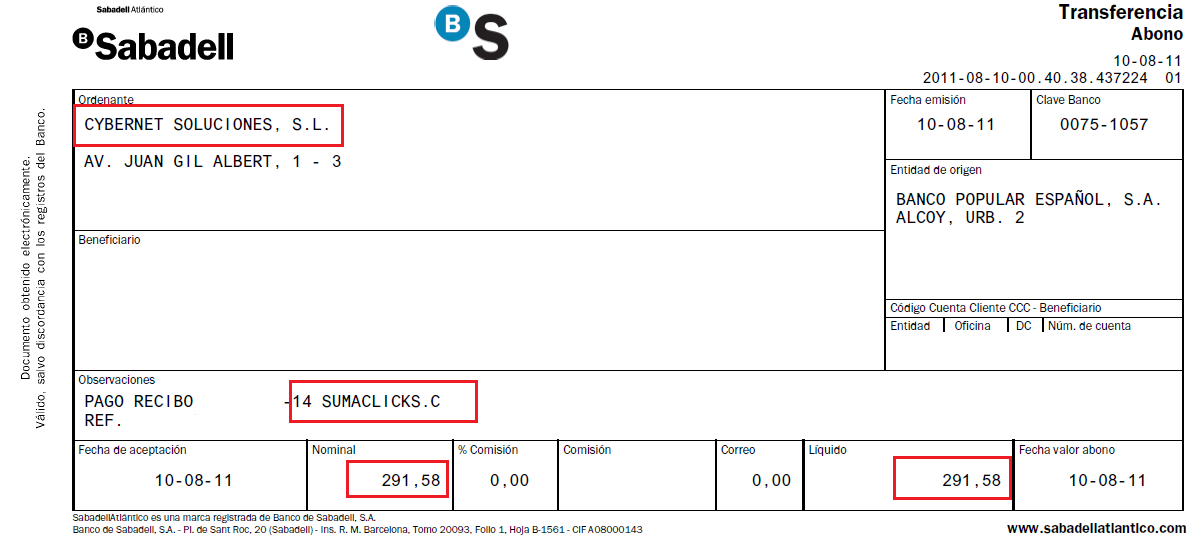

Bank transfer.- It’s an operation by which the client sends an amount of money from his account to the account of another person.

Bank card.- It’s a card that the bank gives to its clients and that allows them to withdraw money, pay and carry out other operations. There are two types of cards:

Debit-cards.- The client can only withdraw the money that is in his account.

Credit-cards.- The client can withdraw the money in his account and a greater amount than his bank allows.

Ways to save or invest.-

Fixed-term deposits.- Clients can only dispose of their money when the agreed period has passed, otherwise they should pay a penalty.

Treasury Bills.- They are securities (of €1,000), and issued by the Public Treasury, in monthly auction, for 3, 6, 9, 12 and 18 months.

State Bonds.- These are parts (of €1,000 nominal) of a loan, for three or five years, that we make to the State.

Obligations of the State.- They are similar to bonds but with a term of more than five years.

Investment funds.- They are collective investment institutions, normally managed by a bank, that gather funds from different investors to invest them in different financial instruments.

Savings insurance.- It’s a type of life insurance by which the insurance company undertakes to pay the insured an amount on a certain date if the insured is alive on that date.

Pension plan.- It’s a voluntary system to receive financial benefits for retirement, survival, permanent disability, dependency and death that complement the Social Security.

The indebtedness.-

Quick lines of credit.- These are small loans that are granted by specialized companies and by banks almost immediately.

Personal consumer loans.- These are loans to satisfy personal needs regardless of the client's business or professional activity and whose amount amounts to at least 200 euros.

Mortgage loans.- These are loans with real guarantee, over five years, in which the asset that guarantees the payment is a property.

The personal budget.-

Income.- For example, payslip, income from investments made, etc.

Expenses.- For example, housing, food, clothing, transportation, etc.

Example of personal budget.-

|

JAN |

FEB |

MAR |

APR |

MAY |

JUN |

JUL |

AUG |

SEP |

OCT |

NOV |

DEC |

|

Income |

|

|

|

|

|

|

|

|

|

|

|

|

|

Salary |

1,500 |

1,500 |

1,500 |

1,500 |

1,500 |

2,200 |

1,500 |

1,500 |

1,500 |

1,500 |

1,500 |

2,200 |

|

Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

living place |

500 |

500 |

500 |

500 |

500 |

500 |

500 |

500 |

500 |

500 |

500 |

500 |

|

Food |

300 |

300 |

300 |

300 |

300 |

300 |

300 |

300 |

300 |

300 |

300 |

300 |

|

Clothing |

100 |

0 |

0 |

0 |

0 |

0 |

200 |

0 |

0 |

0 |

0 |

300 |

|

Telephone |

25 |

25 |

25 |

25 |

25 |

25 |

25 |

25 |

25 |

25 |

25 |

25 |

|

Car |

120 |

150 |

160 |

200 |

240 |

100 |

300 |

400 |

100 |

150 |

100 |

300 |

|

Total |

1,045 |

975 |

985 |

1,025 |

1,065 |

925 |

1,325 |

1,225 |

925 |

975 |

925 |

1,425 |

|

Balance |

455 |

525 |

515 |

475 |

435 |

1,275 |

175 |

275 |

575 |

525 |

575 |

775 |

|

Accum. |

455 |

980 |

1,495 |

1,970 |

2,405 |

3,680 |

3,855 |

4,130 |

4,705 |

5,230 |

5,805 |

6,580 |

|

Electronic banking.- It’s the Internet banking that allows its clients to carry out operations such as consultation of movements, transfers, purchases and sales without the need to go to a branch. There are banks that operate exclusively over the Internet and others that have branches where customers can go to physically carry out an operation but also offer their customers the possibility of carrying out these operations over the Internet.

TYPES OF RISKS.-

Pure risks.- They are those in which you can’t have a profit, you can only have a loss or neither loss nor gain. Example.- If we have an exit from the road with the car, two things can happen: that we have an accident and that the repair of the car amounts to €3,000 (so we will have a loss) or that nothing happens to the car or to us (so we will have neither profit nor loss).

Personal.- They threaten the physical integrity of the person (eg disease)

Real.- Affect movable or immovable property (eg a fire)

Patrimonial.- They imply an economic loss but don’t affect physical integrity (eg civil liability -the one who commits a crime has to compensate for the damages, for which he has an economic loss-)

Speculative risks.- They are those in which you can have profit, loss or neither loss nor profit. Example.- if we buy a ticket on Friday of the ONCE, which costs €3, three things can happen: that we obtain a prize of €60,000 for which we will win €59,997 (60,000 - 3), that we don’t obtain any prize for what we will lose the €3 of the ticket or that we win the refund so we will have neither gains nor losses (3-3).

ENVIRONMENTS THAT WE CAN FIND US WHEN DECIDING.-

Certainly.- The behavior of the uncontrollable variables is known and the only problem is to select the most convenient strategy

Risk.- The probability of the uncontrolled variables is known and whoever decides must combine the selection of the appropriate strategy with the probability of each situation.

Uncertainty.- The probabilities of the uncontrollable variables are not known.

REACTIONS TO THE RISK.-

Sympathy.- There are people who want to take risks, these people can succeed in life or they can lose everything.

Antipathy.- There are people who do not want to take risks, so they will never progress in life.

Neutrality.- There are other people who don’t care to take risks or not. They are in an intermediate position between the other two.

THE COST OF RISK.-

Individual.- If hail spoils a harvest, the farmer experiences an economic loss that may lead him to have to leave his land and seek another profession.

Social.- If no one wants to risk farming because hail can fall and end everything, society as a whole will be harmed because there will not be enough food for all people.

Role of insurers.- They cover possible risks by compensating the insured with a previously agreed amount; in this way, people can dare to carry out an activity that carries some risk since if this occurs, it will not affect them in the same way as if it were not insured. For this, the insured has to pay a premium to the insurer periodically (monthly, quarterly, annually)

TECHNIQUES TO FACE THE RISK.-

Avoid or prevent the risk.- For example, if a clinic installs a lead screen in an X-ray room, it prevents the rays from affecting the nurses who have to do the X-rays.

Reduce the risk.- For example, if we have our car in a garage instead of having it on the street, it is more difficult for it to be damaged or stolen.

Transfer the risk.- For example, a farmer takes out insurance against hail, that way, if hail falls, it will be the insurance company that has the loss and not him.

Absorb risk.- For example, a company creates a fund to cover possible losses for which it is insuring itself.

THE INSURANCE POLICY.-

Definition.- It’s the document that contains its conditions.

Parts.-

General conditions.- Information is provided on: coverage, exclusions, obligations of the insured, statements of the insured, premium and effects of non-payment, claim procedure, termination of insurance, etc.

Particular conditions.- It’s informed about: insurance requirements, insured matter; details of the insurer, contractor, insured and beneficiary; object or material insured, amount insured, premium and form of payment, franchises, duration of insurance, etc.

TOPIC 4.- CLASSIFICATION OF INSURANCE. SOCIAL PROTECTION. BUDGET. THE PUBLIC ADMINISTRATIONS. SUSTAINABILITY OF PENSIONS. CYCLES. DISTRIBUTION OF INCOME. INEQUALITY. MOBILITY

CLASSIFICATION OF INSURANCE.-

Personal insurance.-

Life insurances.-

Risks insurance.- The insurer agrees to indemnify the beneficiary if the insured dies before a certain date

Savings insurance.- The insurer undertakes to pay the insured an amount on a certain date in the event that the insured is alive on that date.

Mixed insurance.- It is a mixture of the other two.

Death insurance.- The insurer is responsible for the burial or incineration expenses of the insured's dead body.

Health insurance.- The insurer is responsible for the health care of the insured and his family.

Accident insurance.- The insurer is responsible for the expenses caused by an accident of the insured (within certain limits).

Retirement plan.- The insurer pays a benefit in the event of death, disability of the insured or termination of the insurance contract. It can be a one-time or periodic payment.

Damage insurance.-

Fire insurance.- The insurer pays compensation in the event of a fire on the insured property.

Theft and robbery insurance.- The insurer pays compensation in the event of theft or robbery of the insured property.

Transport insurance.- The insurer pays compensation in case of damage during the transport of goods.

Automobile insurance.- The insurer pays the expenses caused by the insured in an accident.

Multi-risk home insurance.- It’s an insurance that covers many eventualities: theft, assistance, repairs, civil liability, etc.

Property insurance.-

Civil liability insurance.- The insurer covers the insured's obligation to compensate for damage caused by a breach of contract or to repair the damage caused to another.

Legal defense insurance.- The insurer covers the legal defense of the insured (within limits).

Loss of profit insurance.- The insurer covers the loss of a legitimate profit by the victim or his relatives as a consequence of the damage, and that this wouldn’t have occurred if the damaging event hadn’t been verified (for example, the destruction of the merchandise of an entrepreneur).

Credit insurance.- The insurer covers the non-payment by a debtor of the insured.

Surety insurance.- The insurer undertakes to compensate the insured for the damages suffered in the event that the policyholder fails to comply with the legal or contractual obligations that he maintains with him.

SOCIAL SECURITY.- There are two pension systems: public and mandatory and private and voluntary, which complement the previous ones.

The benefits provided by the public Social Security system are:

Contributory unemployment benefit.- 4 months of unemployment benefit are granted with the minimum unemployment contingency contribution of 360 days. From there, 2 more months of benefit are granted for every 6 more months of contributions due to unemployment contingencies, up to the maximum of 24 months of benefit for 6 years of contributions in the last 6 years. The amount of the benefit is calculated based on the unemployment contribution bases of the last 180 days of contributed work. The amount of this benefit is received once a month and is, during the first six months of protection, equal to 70% of the worker's salary in his previous job, and from the seventh month onwards, 50% of the salary

Permanent disability benefit.- It’s a pension that the worker receives when he has a decrease or a disability from work. Could be:

Partial for the usual profession.- It causes the worker a decrease of not less than 33% in the performance for said profession.

Total for the usual profession.- Disables the worker for his usual profession but can dedicate himself to a different one.

Absolute for all work.- Disables the worker for all profession or trade.

Great disability.- When the permanently disabled worker needs the assistance of another person for the most essential acts of life.

Benefit for death or survival.- They compensate the situation of economic need that produces, for certain people, the death of others.

Retirement benefit.- It covers the loss of income that a person suffers when, reaching the established age, they cease to work as an employed or self-employed person, ending their working life, or reduce their working hours and salary in the terms legally established.

Pension plans and pension funds.- It’s a voluntary system to receive financial benefits for retirement, survival, permanent disability, dependency and death that complement the Social Security. The assets that are created for pension plans are called pension funds.

BUDGET COMPOSITION.-

The budget of the State.- House of His Majesty the King, General Courts, Ombudsman, Court of Accounts, Constitutional Court, Council of State, etc.

The budgets of the autonomous Bodies of the General State Administration.- Spanish Agency for International Cooperation, State Mobile Park, Traffic Headquarters, etc.

The Social Security budget.-

The budgets of the State Agencies.- Cervantes Institute, Spanish Data Protection Agency, National Intelligence Center, State Tax Administration Agency, National Competition Commission, Economic and Social Council, Spanish Institute of Foreign Trade, Nuclear Safety Council and Prado Museum.

The budgets of public bodies, whose specific regulations confers limiting character to the credits of their budget of expenses.-

The budgets of the state mercantile companies.-

The budgets of the foundations of the state public sector.-

The budgets of public business entities and other public bodies.-

The budgets of the funds lacking legal personality.-

PUBLIC INCOME.-

Direct taxes and social contributions

Income tax

Capital gains tax

Social contributions

Other direct taxes

Value added tax

Specific consumptions tax

Outside traffic tax

Other indirect taxes

Taxes, public prices and other income

Fees

Public Prices

Other income from the provision of services

Sale of goods

Refunds from current operations

Other income

Of autonomous bodies

Of the Social Security

Of Companies, Public Business Entities, Foundations and other entities of the Public Sector.

From Autonomous Communities

From outside

Interest on advances and loans granted

Interest on deposits

Dividends and profit shares

Real estate income

Products of concessions and special uses

Sale from the real investments

Of land

Of the other real investments

Reimbursements for capital operations

From autonomous bodies

From Autonomous Communities

From the outside

Repayments of loans granted to the Public Sector

Repayments of loans granted outside the Public Sector

PUBLIC SPENDING.-

Non-financial operations

Current operations.-

Personal expenses

Current expenses on goods and services

Financial expenses

Current transfers

Contingency fund and other contingencies

Capital operations

Real investments

Capital transfers

Financial assets

Financial liabilities (-)

Transfers between subsectors

Current transfers

Capital transfers

ROLE OF THE CENTRAL GOVERNMENT IN SPAIN.

In general.- Directs the internal and foreign policy, the civil and military administration and the defense of the State. It exercises the executive function and regulatory power in accordance with the Constitution and the laws.

Legislative.- To dictate bills, legislative decrees, decree laws and regulations.

International.- Direct foreign policy related to defense and international relations.

Justice.- Propose the appointment of the State Attorney General, of two members of the Constitutional Court and file the unconstitutionality appeal.

THE AUTONOMOUS COMMUNITIES.-

Functions.- The autonomous communities have legislative power, which resides in their assembly. In addition to other functions: budgetary, control of the regional executive, election of the government, of the President of the executive, participation in the reforms of the Constitution, control of the constitutionality of Laws and provisions with force of law, participation in the composition of the Senate.

Advantages of autonomy.- They are closer to their citizens so they better understand their problems, they allow the citizens of that autonomy to manage their problems (within a limit).

Disadvantages of the autonomies.- They compete with each other to try to attract investment, they are not coordinated under conditions, there is inequality in the provision of services depending on whether we are in one autonomy or another, problems with languages, more officials.

CITY COUNCIL FUNCTIONS.- Manage the city's own services such as lighting, cleaning, sewerage, etc., the regulation of urban traffic and the city's sanitary control.

THE SUSTAINABILITY OF PENSIONS.-

Reasons for doubting the sustainability of pensions.-

The crisis has greatly increased unemployment so that there are now far fewer people working to pay pensions than those who are retired.

The jobs that can be found now are precarious, with very low salaries that hardly contribute to Social Security.

Life expectancy doesn’t stop growing.

Possible solutions.-

Complementing Social Security pensions with private pension plans.

Reduce pensions

Raise the retirement age

End precariousness at work

Take steps to get out of this economic crisis and create jobs

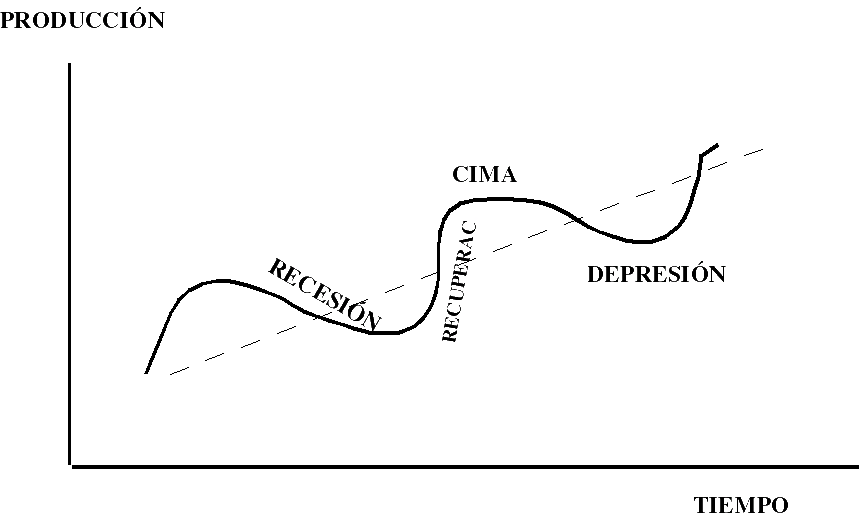

ECONOMIC CYCLES.-

Definition.- The term business cycle refers to fluctuations in the economy, in a broad sense, in production or economic activity over several months or years. These fluctuations occur around a long-term increasing trend, and typically involve shifts over time between periods of relatively rapid economic growth (boom or bust), and periods of relative stagnation or decline (contraction or recession).

Phases.-

Top.- All economic activity is in a period of prosperity, the economy is in full employment or is close to it so that all productive resources are employed. There is a surplus.

Recession.- A recession is a general slowdown in economic activity over a sustained period of time, or a contraction of the business cycle. During recessions, many macroeconomic indicators vary in a similar way. Output, measured by Gross Domestic Product (GDP), employment, investment spending, utilization capacity, household income, and business profits, all fall during recessions. An economic crisis is a sudden transition to a recession. There is a deficit

Depression.- A depression is a sustained and long decline in economic activity. It’s more severe than a recession, which is seen as a normal downturn in the business cycle. Considered a rare and extreme form of recession, a depression is characterized by abnormal growth in unemployment, restricted credit, decreased production and investment, numerous bankruptcies, reduced trade, and highly volatile fluctuations in relative value of the currency, mainly devaluations, and the value of the Public Debt. Deflation or hyperinflation are also elements that can occur in a depression. There is a deficit.

Expansion.- Expansion is a growth in the level of economic activity, and of the goods and services available in the market. It’s a period of economic growth measured by an increase in real GDP. Typically it refers to a rebound in production and use of resources. There is a surplus.

Public Spending and Cycles.- Keynesian economics suggests that adjusting government spending and tax rates are the best ways to stimulate aggregate demand. This can be used in times of recession or low economic activity as an essential tool to promote the framework for strong economic growth and, consequently, full employment. In theory, if this policy generated a deficit, it would be paid for by the income generated by economic growth.

Public debt.- It’s the set of debts that the Spanish State maintains against individuals who may be Spanish or from another country. In Spain, the currently existing public debt securities are Treasury Bills, State Bonds and State Obligations, mainly taking into account their repayment term. The public debt amounted to 93.4% of the Gross Domestic Product in 2013. The EU's target is for a public debt of 60%.

Risk premium.- It is the difference between the profitability of the risky investment and the risk-free profitability. In Spain, the risk premium is calculated by comparing the interests that the German State pays to those who buy its debt and those that the Spanish State pays for its debt. If the interests of the German are at 1.5% and those of the Spanish are at 2.3 percent, it is said that the risk premium is 80 points (2.3 - 1.5) x 100. While the higher this premium, the more expensive it will be for Spain to borrow money.

MEASURE OF PERSONAL INCOME DISTRIBUTION.-

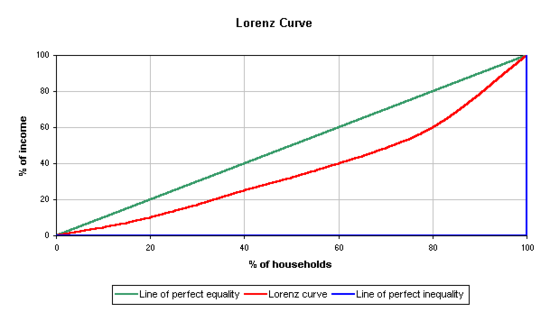

Lorenz curve.- The Lorenz curve is often used to represent the distribution of income where it shows at the bottom the percentage of families and the percentage of total income they have. The percentage of families is plotted on the X axis, the percentage of income on the Y axis.

Perfect equality.- Each point of the Lorenz curve represents a state such as “20% of all families have 10% of total income”. A perfectly equal income distribution would be one in which each person has the same income. In this case, "N% of the company would have N% of the income". This can be represented by a straight line y = x, called the line of perfect equality or equidistribution.

Perfect inequality.- On the contrary, a perfectly unequal distribution would be one in which one person has all the income and the others nothing. In that case, the curve would be y = 0 for x <100% and y = 100% when x = 100%. This curve is called the line of perfect inequality

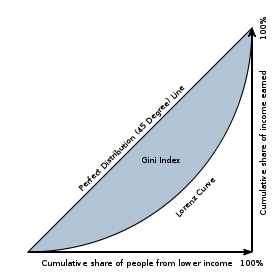

Gini coefficient.- The Gini coefficient is the area between the line of perfect equality and the observed Lorenz curve. The larger this area, the greater the inequality. It is defined as a proportion and can vary from 0 to 1 (0% to 100%): A low Gini coefficient indicates more distribution of income or wealth, with 0 corresponding to perfect equality (all having exactly the same income) , while higher Gini coefficients indicate a more unequal distribution, with 1 corresponding to perfect inequality (eg a situation with more than one individual, where one person has all the income)

Inequality.- It is harmful to a country. If we compare two countries with the same GDP but that in one the income is well distributed and in the second there is a small group of very rich people and the rest are very poor, the first is going to work much better than the second. On the other hand, if all citizens of a country have equal access to education, no genius will be lost, but if only the rich can study in a country, a lot of grey matter will be lost.

Mobility.-

Social.- The states must promote that individuals can move from one social class to another based on their merits without any limitation. For example, in India, some very poor social classes find it very difficult, if not impossible, to move up.

Geographical.- Countries in which, like the United States, individuals tend to change cities and even states to find work, tend to have more economic growth than those in which individuals only look for work in their place of residence since they are missing out on opportunities for career advancement.

TOPIC 5.- THE INTEREST RATE. INFLATION. UNEMPLOYMENT. INTERNATIONAL TRADE. BLOCS

THE INTEREST RATES.-

Relationship between interest rates and economic growth.- The contraction of the money supply can be achieved indirectly by increasing nominal interest rates. Monetary authorities in different nations have different levels of control over interest rates. By increasing interest rates under its control, a monetary authority can contract the money supply, because high interest rates encourage savings and discourage borrowing. Lowering interest rates would increase the money supply.

Relationship between the interest rate and inflation.- If financial entities lend at low interest rates, families will ask for money, increasing demand, to buy goods and services, and prices may rise if supply doesn’t increase in the same proportion, generating inflation (if it is a generalized phenomenon).

INFLATION.-

Types of inflation according to the value of the ratio.-

Hyperinflation.- Economists generally agree that high inflation rates and superinflation are caused by excessive growth in the money supply.

Moderate inflation.- The points of view on which factors determine low to moderate inflation are more varied. Low or moderate inflation can be attributed to fluctuations in real demand for goods and services, or changes in available supplies, such as during times of scarcity (in periods of hardship or crisis), in addition to the growth of the money supply. However, the consensus view is that a long sustained period of inflation is caused by a money supply growing (at a rate) faster than the rate of economic growth.

Causes of moderate inflation.-

Monetarists point of view.-

Money supply.- Monetarists believe that the most important factor influencing inflation or deflation is the management of the money supply, facilitating or hindering credit. They consider that fiscal policy, or public spending and taxation, are ineffective in controlling inflation.

Monetary phenomenon.- Monetarists claim that the empirical study of monetary history shows that inflation has always been a monetary phenomenon. The theory of the quantity of money simply indicates that the total amount of spending in an economy is fundamentally determined by the total quantity of money in existence (circulation).

Point of view of the Keynesians.-

Main cause.- Keynesian economic theory proposes that changes in the money supply don’t directly affect prices, and that visible or measurable inflation is the result of pressures in the economy expressing themselves in prices. Supply is a major (but not the only) cause of inflation

Three types. - There are three main types of inflation, as part of what Robert J. Gordon calls the “model triangle”.

Demand inflation.- It’s caused by increases in aggregate demand due to the increase in private and public spending. Demand inflation is generated for a faster rate of economic growth as a result of excess demand due to favorable market conditions that stimulate investment and expansion.

Cost inflation.- It’s caused by a drop in the aggregate supply of certain goods and services. This may be due to natural disasters, a drop in potential production or increased prices of inputs for other reasons (in the production system). For example, a sudden decrease in the supply of oil, leading to increased oil prices, can cause cost inflation. Producers to whom oil is a part of their costs will pass it on to consumers in the form of increased prices.

Self-built inflation.- It’is induced by adaptive expectations, and is often connected to the “price/wage spiral”. This type of inflation is based on the assumption that workers try to keep their wages above prices (above inflation), and that companies pass on these higher labor costs to their customers as higher prices, leading to a “ vicious circle".

Consumer price index.- Inflation is usually measured by calculating the variation ratio of a price index, usually the Consumer Price Index. The Consumer Price Index measures the prices of a selection of goods and services purchased by a “typical consumer”. Therefore, inflation is the percentage change in a price index over time (if the index goes from 100 to 102, inflation would be 2%).

UNEMPLOYMENT.-

Types.-

Frictional.- Frictional unemployment occurs when a worker changes from one job to another. While he’s looking for a job, he’s experiencing frictional unemployment. This applies to new graduates looking for a job as well. This is a productive part of the economy, increasing the long-term welfare of workers and economic efficiency, and it’s also a type of voluntary unemployment. It’s the result of imperfect information in the job market, because if job seekers knew that they would be employed for a particular vacancy, almost no time would be wasted in getting a new job by eliminating this form of unemployment. Frictional unemployment is always present in an economy, therefore,

Classic.- Classic unemployment or real wage unemployment can occur when real wages for a job are set above the agreed minimum level (in Spain the Minimum Wage). Liberal economists like FA Hayek argue that unemployment increases further if the government intervenes in the economy to try to improve the conditions of those with jobs. For example, the minimum wage increases the cost of low-skilled laborers above market equilibrium, resulting in people who want to work at the starting line but can’t as the imposed wage is greater than their value as workers, becoming unemployed. They believed that laws restricting layoffs made it less likely for businesses to hire up front, as hiring becomes riskier, leaving many young people unemployed and unable to find work. Some, such as Murray Rothbard, suggest that even social taboos (non-market, supply and demand criteria) can prevent wages from falling to the agreed level (MW).

Cyclical or Keynesian.- Cyclical or Keynesian unemployment, also known as demand-poor unemployment, occurs when there is not enough aggregate demand in the economy. This is caused by a recession in the business cycle, and wages don’t fall to find the equilibrium level.

Structural.-

Definition.- Structural unemployment is caused by a mismatch between jobs offered by employers and potential workers. This can refer to geographic locations, skills, and many other factors. If such a mismatch exists, frictional employment is likely to be more significant as well. For example, in the late 1990s there was a technology bubble, creating demand for IT specialists. In 2000-2001 this bubble burst. A real estate bubble soon formed, creating demand for real estate agency workers, and many computer scientists had to retrain to find employment.

Permanent.- André Gorz believes that structural unemployment could be permanent in modern society, as the microchip revolution and the explosion in computer science and the robotization of work, even in the least developed countries in the industry increases productivity.

Seasonal.- Seasonal unemployment results from fluctuations in labor demands in certain industries due to the seasonal nature of production. In such industries there is a seasonal pattern in the demand for labor. During the period when the industry is at its peak there is a high degree of seasonal employment, but during the off-peak period, there is seasonal unemployment. Seasonal unemployment occurs when an occupation isn’t in demand in certain seasons.

Voluntary and involuntary.- Although there have been various definitions of voluntary and involuntary unemployment in the economic literature, a simple distinction is often applied. Voluntary unemployment is attributed to the decisions of individuals, while involuntary unemployment exists because of the socioeconomic environment (including market structure, government intervention, and the level of aggregate demand) in which individuals operate. In these terms, much or most of frictional unemployment is voluntary, as it reflects individual search behavior. On the other hand, cyclical unemployment, structural unemployment, and classical unemployment, are largely involuntary in nature. But nevertheless, the existence of structural unemployment may reflect choices made by unemployment in the past, while classical unemployment may result from legislative and economic choices made by unions and political parties. Thus, in practice, the distinction between voluntary and involuntary unemployment is hard to draw. The clearest cases of involuntary unemployment are those where there are fewer job vacancies than unemployed workers, even when wages can be adjusted so that if all vacancies were filled, there would be unemployed workers. This is the case with cyclical unemployment, whereby macroeconomic forces lead to microeconomic unemployment.

Unemployment rate.- The active population are job providers; it’s all people, not military, who are employed or unemployed. The fraction of the workforce that is looking for a job but can’t find it determines the unemployment rate.

INTERNATIONAL TRADE.-