ECONOMICS –

Antonio Ginés – IES. Hnos. Machado – Dos Hermanas - Spain

TOPIC I.- THE ECONOMIC ACTIVITY AND THE ECONOMIC SYSTEMS

ECONOMICS AND SCARCITY.-

Economics' definition.- It's a science that studies the human behaviour as the relation between the purpose and the limited means that have alternative applications. The scarcity implies that there are not enough resources to produce enough to cover all the needs. The scarcity also implies that all the society's objectives can not be met at the same time, so it must follow a priority politics.

Utility.- The scarcity concept is applied to everything useful. And useful means everything that has capacity to satisfy human's needs. Human societies have developed the politics to decide the priorities and the way to satisfy them.

OBSERVATION OF THE SOCIAL RELATIONS'S ECONOMIC CONTENT. THE ECONOMIC AGENTS.-

Economic agents' definition.- They're the persons or groups who make an economic activity.

Economic agent's types.-

Households.- They make the decisions about what to consume and they have the most of the productions factors

Firms.- They make the decisions about the production and the distribution

Public sector.- It's formed by the different civil services. It takes part in the economy in three ways:

By making laws that regulate the way that the other economic agents act when they go to the market

By redistributing the incomes

By offering, at a lower price or for free, goods and services that the society thinks that it must be able to receive all the population

THE NEED FOR CHOICE AND THE RECOGNITION OF THE OPPORTUNITY COST OF A DECISION.-

The opportunity cost.-

Definition.- It's what an agent loses when he makes a decision.

|

COMBINATION |

DISCOTHEQUE |

PUB |

OPPORTUNITY COST |

|---|---|---|---|

|

1 |

0 |

4 |

- |

|

2 |

1 |

2 |

2 |

|

3 |

2 |

0 |

2 |

Cannons-butter.- When the individuals group together in societies, they face different types of dilemmas. The classical is the dilemma between “the cannons and the butter”. The more we spend in national security to protect our coasts from the foreign aggressors (cannons), the less we'll spend in personal goods to improve the standard of living in our country (butter)

Pollution-incomes.- In the modern society, the dilemma between a clean environment and a high income level is also important. The legislation that forces the firms to reduce the pollution raises the cost to produce goods and services. Higher costs can create lower company profits, lower salaries, higher prices or all the three things at the same time.

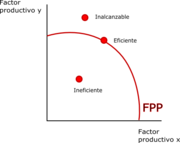

The Production Possibility Frontier (PPF).-

Definition.- It's the group of productive factors or technologies' combinations that reach the highest production. It reflects the highest good and services' amounts that a society can produce in a fixed time period and with ones production's factors and ones given technological knowledge

Situations that can be given in a country's productive structure.-

Inefficient productive structure.- To be under the PPF signifies that either not all the resources are used (idle resources) or the technology isn't adequate (technology can improve). A country with a rate of unemployment above 5%, will always itself find in this productive structure, because there is unused available labour.

Efficient productive structure.- It's located in the frontier or very near to it. There are no idle resources and the best technology is utilized

Unattainable productive structure.- It's located over the Possibilities Production. It's theoretical because no country can produce more than is possible

PPF's shape.- It's concave and decreasing. This shape is due to two reasons:

Decreasing.- In order to produce more of one good it is necessary to produce less of another

Concave.- The opportunity cost is increasing

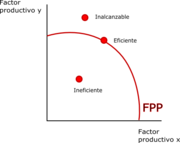

PPF's displacement.- It is displaceable, this is, the unattainable points can be reached. This displacement can be due to technological improvements, an increase in capital, an increase of workers or the discovery of new natural resources

EXCHANGE RELATIONS AND HISTORICAL DEVELOPMENT.-

Barter or exchange.-

Definition.- To buy or to sell by using a product or service instead of money as a exchange money, that is, to buy or to sell without use cash money

Origins.- It's beginnings go back to the first sedentary communities of human beings. These settlers knew agriculture and shepherding, they lived longer than their nomadic ancestors and they enjoyed better security. In addition the first jobs, like pottery or metal working, started to develop

Appearance of coins.- New products brought new needs that were impossible to satisfy in an autocratic society. Therefore bartering began with the need to exchange what is owned for what is needed. Although, on occasion, many intermediary exchanges were necessary to satisfy needs. That, combined with the growth of settlements and expansion of commercial networks facilitated the appearance of the concept of “coins” (which, initially, were sacks of salt).

Disappearance of barter.- In spite of everything, bartering didn't disappear with the arrival of the coins. In Ancient Egypt, the monetary and exchange systems lived together throughout history, the Phoenicians used it as the basis of their commercial system and the native people of Latin America also exchanged their products in markets.

Money.-

Explanation for the appearance of money.- When the exchange is frequent, the barter systems quickly find the need to have some goods with monetary properties. That greatly facilitates trade and the permanency of the families in an area, building the location's wealth and demographic growth and giving way to the free trade's natural process and the economy's development

Good-money.- Civilitations have adopted several goods as money (gold, silver, other metals or minerals, wheat, bars of tea in China, etc.)

First money in the West.- The first historical signs that we have of money shaped as a coin in the West are those of the Phoenicians.

Intrinsic value.- The money in that phase had an intrinsic value. The gold and silver in themselves had a value, and so they were exchanged. However, today, money only has a value as a exchange instrument (the paper from which a note is composed does not have value)

Money's issue.- The states started to issue notes and coins that gave right to the bearer to exchange them for gold or silver from the country's reserves.

Development of support of paper money.-

By the XVIII and XIX centuries.- Many countries had a bimetallic standard, based in gold and silver

Between 1870 and the 1st World War.- The Gold Standard was mainly adopted. Any citizen could convert the paper money into an equivalent amount of gold

Between World Wars.- Countries tried to return to the Gold Standard, but the economic situation and the crisis of 1929 ended the ability for an individual to convert notes to gold

By the end of the 2nd World War.- The allies established a new financial system in the Bretton Woods' Agreements. Here it was established that all the currencies would be converted in U.S. dollars and only the U.S. dollar would be convertible in gold bars at 35 dollars per ounce for the foreign governments

By 1971.- The USA's expansive fiscal politics, motivated mainly by the military expenditure in Vietnam, cause the abundance of dollars, which created doubts about its convertibility to gold. As a result the European central banks tried to convert their dollar reserves to gold, creating an unsustainable situation for the USA. Due to this, in December of 1971, the president of the United States, Richard Nixon, suspended on his own the dollar conversion to gold and devalued the dollar by 10%. By 1973, the dollar is devalued another 10%, until, finally, the dollar conversion to gold was finished

From 1973 until today.- The money that we use today has a value in the subjective belief that it will be accepted by the rest of the inhabitants of a country, or economical area, as a type of exchange. The monetary authorities and the Central Banks don't try to defend any particular level of exchange rate, but they take part in the exchange market to calm the short-term speculative fluctuations, with the objective of maintaining at short-term the prices' stability and avoiding situations like hyper-inflation, that destroy the value money leading to less of trust or deflation.

THE ECONOMIC SYSTEMS. FUNDAMENTAL CHARACTERISTICS. EVALUATION AND COMPARISON. ANDALUSIAN ECONOMIC'S PECULIARITIES.-

Capitalism.- (It emerged in Europe by the XVI century)

Characteristics.-

Capital over work.- Capital dominates over work as a element of production and creator of wealth

Priority of the profit.- The profit is fixed in economic action so that capital accumulates.

Private ownership.- The ownership of the means of production is private

Economy determined by the free market.- The distribution, production and prices of goods and services are usually determined by some type of free market

Free enterprise.- Free enterprise exists

Non intervention.- The State doesn't take part

Liberalism and neoliberalism.- The political doctrine that historically has led the defence and implementation of this economic and political system has been economic and classic liberalism whose founding fathers are considered to be John Locke, Juan de Mariana, Adam Smith and Benjamin Franklin. Liberal classical thinking, in economics, holds that the government's role must to be reduced as much as possible. It must only look after the legal code that will guarantee the respect of private property, the defence of what are called “negative freedoms”: the civil and political rights that depend on the resources obtained for private means, the domestic and external security's control by means of the Armed Forces and the police, and possibly the establishment of politics that were considered indispensable for a functioning market, because a greater presence of the State in the economy would disturb how it works. The most prominent contemporary representatives scholars are Ludwing von Mises and Friedrich Hayek for the Austrian school of economics; George Stigler and Milton Friedman for the Chicago school of economics. Both are in the controversial categorization of neoliberalism.

Other tendencies.- There are other tendencies in the economical thinking that assign different functions to the State. John Maynard Keynes holds that the State can increase the effective demand by avoiding the cyclical crisis.

The centralize planning economy.-

State organization.- The production factors are in the hands of the State, who is the only important economic agent. The market doesn't assign the resources, because it's handled by the State. These manipulations are made with multi-annual economic plans (five-year plans), which explains in great detail the supply, production methods, wages, infrastructure investment, . . .

Main problems.-

Forecast mistakes.- The market didn't send signals because this didn't exist (false market). Without signals, the planners didn't always get right in their forecasts and that caused a lack of adaptation to the reality and a scarce reaction capacity.

Scarce motivation.- Because the wages and the prices were fixed by the State, the firms needn't be competitive and the workers were unmotivated, because they earned the same if they did their work well or badly.

Excessive bureaucracy.- The planning needed a huge bureaucracy at the service of the State, so the decisions and the reaction capacity were slower.

History.-

Appearance and expansion.- This system, inspired by Marxist theory, appeared in Russia's Soviet Federal Socialist Republic after the 1st World War, due to the state of emergency and the war economy for the war against the White Army and the Triple Entente during the Russian Civil War, which happened in the first months after the October Revolution and the appearance of the first Soviet Republics, got worse with Stalin and his followers, when the Soviet Union was born, with the so-called one-country politics; models that were extended after the 2nd World War for all The East Europe and many asian countries, under the Soviet Union and the Komintern. Although at the beginning was more productive than the capitalism, soon the firms stopped being productive and the State became continuously in debt to maintain the full employment. As well, in the case of the USSR, it had to assign a huge amount of its budget to maintain the army and the war technology in its Cold War with the USA.

Self-destruction.- Finally, at the end of the 20th century, the USSR fell down with its economic system and nowadays Russia and the East countries go toward a Market Economy. China is looking for a balance, Cuba is trying to defend the centralized economic system by making some reforms or concessions in strategic sectors, like tourism, to the market economy, prevailing abroad. Actually, only North Korea follows a centralized economic model, almost without reforms of capitalist type or another type.

Mixed economy.-

In reality, no country with a totally market or centralized economy exists, but more or less a combination of both in increasing or decreasing degree.

Andalusian economy peculiarities.-

The Andalusian economy, like the Spanish economy, has a mixed economic system with a lot of importance placed on the market economy

TOPIC II.- PRODUCTION AND ECONOMIC INTERDEPENDENCE

PRODUCTION PROCESS.-

Definition.- A production process converts inputs into outputs (goods or services) with physical, technological, human and other types of resources

Planning.- A production process includes actions that happen in a planned way and produce a change or transformation of materials, objects or systems, at the end of which we obtain a product

FACTORS OF PRODUCTION.-

Evolution of the concept.-

Classic economists.- They use the three factors that Adam Smith defined, each factor takes part in the result of the production by means of a reward fixed by the market:

Land (that is rewarded by the income)

Labour (that is rewarded by the wage)

Capital (that is rewarded by interest)

Neoclassic economists.- They only use capital and labour

Present economy.-

Land.- (More and more changed by human intervention). Today land is considered, a component of capital or a component of a wider natural factor (natural resources or natural capital)

4th factor of production.- In the economy of knowledge and business development produced since the end of the 20th Century, people consider that technology and science (what has been called R&D -Research and Development- or even R, D&I -Research, Development and Innovation-) is a 4th factor of production that characterizes more and more the production in the industrialised countries. At the same time, to the concept of physical capital or financial capital is added the concept of human capital or intellectual capital, even social capital, as a way of explaining the improvement of the productivity that isn't due to the other factors

New factors of production.-

Natural capital

Physical capital

Material labour

Intangible capital (know-how, organization, non-physical but computable assets, intangible labour, knowledge economy)

Training.- Investment allows the volume of the factors of production to increase. Training can be considered a form of investment, because it increases the abilities of the workers and the production

ADDED VALUE.-

Definition.- Added Value is the increase in value that is produced in a good in each phase of the production process

Double accounting.- To avoid double accounting added value is calculated in each stage of the production process

|

Stage of the production |

Value of the sales |

Cost of the intermediate products |

Added value |

|---|---|---|---|

|

Wheat |

0.03 |

0 |

0.03 |

|

Flour |

0.09 |

0.03 |

0.06 |

|

Wholesale bread |

0.15 |

0.09 |

0.06 |

|

Retail bread |

0.22 |

0.15 |

0.07 |

|

TOTAL |

|

|

0.22 |

DIVISION OF LABOUR.-

Definition.- The division of labour, generally speaking, deals about specialization and cooperation of the labour forces in tasks and roles, with the objective of improving efficiency. When a worker executes all the different tasks necessary to manufacture a product, the performance is slow, so it is necessary to share the tasks.

Types.-

Industrial division.- The industrial division deals with division of tasks within an industry or firm.

Vertical division.- The vertical division is a group of jobs executed before by one person but today is divided into different professions.

Collateral division.- The collateral division is the division that separates different professions.

Example.- Adam Smith in his book “An Inquiry into the Nature and Causes of the Wealth of Nations” says that a person, on his own, can make less than one hundred pins per day, but if we share the job we could make up to ten thousand pins.

Advantages of division of labour.-

To save capital.- Each worker doesn't need to have all the tools that he would need for the different functions

To save time.- The worker doesn't need to constantly change tools.

To decrease mistakes.- The tasks that each worker executes are easier, so the mistakes decrease.

Invention of machines.-

Concentration and machinery.- When the worker has a small and easy task, he will pay more attention than if he executes one task where he must constantly take turns with his workmates; that is to say, when a worker executes a more difficult task he will lose his concentration as he waits for it. The text of Adam Smith “An Inquiry into the Nature and Causes of the Wealth of Nations” speaks also about the importance of the machinery (that the craftsmen build in order to speed up the work). They bring simplicity to the task

PRODUCTIVITY.-

Definition of total, marginal and average product.-

Total product.- The total product is the total amount in physical units that is obtained for the total amount of factor used

Marginal product.- The marginal product is the variation that the total production experiences when it uses one additional unit of factor

Average product or productivity.- The average product is the amount of units of product that are obtained for every unit of factor used

|

WORKERS |

TOTAL PRODUCT |

MARGINAL PRODUCT |

AVERAGE PRODUCT |

|---|---|---|---|

|

0 |

0 |

- |

- |

|

1 |

5.000 |

5.000 |

5.000 |

|

2 |

9.000 |

4.000 |

4.500 |

|

3 |

12.900 |

3.900 |

4.300 |

|

4 |

16.000 |

3.100 |

4.000 |

|

5 |

18.000 |

2.000 |

3.600 |

Other definitions of productivity.-

Production/resources.- It is the ratio of the obtained production through a production or services system and the resources used to obtain it

Results/time.- Also it can be defined as the ratio of the results and the time used to obtain them: the less time used to obtain the wanted result, the more productive the system is

Outputs/inputs.- It's the ratio of a system's outputs and inputs

Capacity of production and added value.- Productivity evaluates the capacity of a system to create the products that people desire and, at the same time, the degree it makes use of the resources used, that is, the added value.

Productivity-profitability.- A greater productivity using the same resources or producing the same goods or services equals greater profitability for the company. That's why, the company's Quality management systems tries to increase productivity.

Management quality.- Productivity is connected to the continuous improvement of the Quality management systems and thanks to this quality system people can prevent the quality defects avoiding that they arrive at the final user. Productivity is connected to the production standards, if people improve these standards then they will save resources and it will be reflected in the increase of their usefulness.

Types of productivity.-

Factor productivity.- It's the increase or decrease of output, it's caused by the variation of any factors that take part in the production: labour, capital, technique, etc.

Total factor productivity (TFP).- It's the difference between the increase rate of the production and the weighted increase rate of factors (labour, capital, ...). The TFP is a measurement of the effect of the economies of scale, in which the total production increases more in proportion to the amount that each factor of production increases.

Improvement of the productivity.- It's obtained by innovation in:

Technology

Organization

Human resources

Labour relations

Labour conditions

Others

INTERDEPENDENCE.-

Globalisation.- All countries (nation-states) are dependent in different degrees, in each one of the following areas: trade, technology, communications and migration, among others. All of this, in the context of globalization, forces the countries to be in a constant interdependence because they are connected in different areas, like those mentioned above.

Specialization.- The economic interdependence is a result of specialization

Variation.- The interdependence is not inflexible, because organizations, individuals and countries can change their production from one group of products to another.

Mutual dependence.- On the other hand, the relationships between imperialist nations and their colonies aren't unilateral, that is, not only do the colonies need the foreign powers for their development but the power countries also need the colonies to obtain raw material and as markets to sell their goods and/or to export their capitals.

FIRM DEFINITION.-

The firm is the basic economic unit in charge of satisfying the market's needs using material and human resources. It's in charge, therefore, of organizing the factors of production, capital and labour.

FUNCTIONAL AREAS OF THE FIRM (a possible division).-

Production and Logistics.- The business logistics manages and plans the activities of the purchasing, production, transport, warehousing, maintenance and distribution departments

Management and Human Resources.- Selects, hires, trains, employes and maintains collaborators of the organization. A person or a department (the Human Resources professionals and the organization managers) can do these tasks.

Commercial (Marketing).- Designs the product, assigns the prices and chooses the most appropriate channels of distribution and techniques of communication in order to launch a product that will satisfy truly the needs of the costumers. These tools are also known as Grundy's Four P's: product, price, distribution or place and advertising or promotion.

Finances and Administration.- It studies how the enterprise can obtain and manage the money that it need to achieve its objectives and how it arranges its assets

Sales.- It's in charge of the sales of the products of the enterprise and customer service.

FIRM CLASSIFICATION.-

According to the economic activity.-

The primary sector.- They are mainly extractive and they create the utility of the goods when they obtain the resources from nature (agricultural, livestock, fisheries, mining, etc.)

The secondary sector.- They physically convert some goods in others more useful. The industrial and building firms are in this group.

The tertiary sector.- (Services and trade), with activities such as transport, tourism, consultancy, etc.

According to the legal status.-

Firms that belong to only one person.- This person has an unlimited responsibility (with everything he owns). It's the simplest way to create a firm. They normally are small and familial firms.

Firms that belong at a group of persons.-

Corporations.- Such as the public limited company, unlimited company, limited partnership company and private company limited by shares.

Social economy.- Cooperatives and others.

According to the size.- There isn't unanimity among economists in defining small and large companies because an established criteria doesn't exist to measure them. The main criteria are: sales volume, net worth, number of workers, profits, etc. The most used is the number of workers:

Microenterprise.- It has 10 workers or less

Small enterprise.- It has between 11 and 50 workers

Medium-sized enterprise.- It has between 51 and 250 workers

Great enterprise.- It has more than 250 workers

According to the area of the activities.-

Local

Regional

National

Multinational

According to who is the owner.-

Private sector company.- The owners are individuals

Public sector company.- The owner is the State

Mixed company.- The owners are individuals and the State

Self-management company.- The owners are the workers

According to the market share.-

Applicant firm.- It wants to have more market share

Specialist firm.- It concentrates in a market segment as a near monopolist. This segment must to be big enough to be profitable, but not so big to attract the leader firms

Leader firm.- It's the most important firm and it is imitated by the others

Follower firm.- It hasn't an important market share and isn't a problem to the leader firm

THE OBTAINING AND ANALYSIS OF COST OF PRODUCTION AND PROFIT.-

Definition of total costs.- They are those that a company has in a production process or activity. They are the sum of fixed costs and variable costs: TC = FC + VC

Definition of fixed costs.- They are invariable if the activity level has small changes. Fixed costs are connected with productive structure and so they are also called structure costs, and they are used to make reports about the degree of use of that structure. Example: If we make more bread we needn't pay a bigger rent for our industrial unit.

Definition of variable costs.- They change if the activity level changes. That is, if the activity level decreases, these costs decrease, and if the activity level increases, these costs increase. Except when there are structural changes, in the economic units – or productive units – variable costs have a linear behaviour, because the average value per unit tends to be constant. In Microeconomic Theory variable costs are not linear, at the beginning they are more increasing but after that they are less increasing. Example: If we make more bread we need more flour.

Definition of profit.- It's the wealth that a person obtains from an economic process. Profit is total income minus total production and distribution costs. It's output value minus input value. Economic profit indicates the creation of wealth. Negative profit is called loss. In a free market, the greater profit a company has, the more successful a company is.

IDENTIFICATION OF MAIN ECONOMIC SECTORS IN ANDALUSIA.-

Primary Sector.- It has the least percentage of the total production but it has a big relative importance with the other productive sectors. This importance is greater if we compare it with the primary sector of other western economies, where it has been reduced to the smallest quantity. The primary sector produces 8.26% of the total and takes up 8.19% of the working population. It's a small competitive sector since other economies with far smaller working population produce far more. To this relative importance of the Andalusian primary sector must be added its long tradition in Andalusia, where it's deeply rooted. Primary sector can be divided into a series of subsectors: agriculture, fishing, livestock, hunting, forest resources, mining and energy industry.

Agriculture.- Traditionally the main products have been wheat, olive tree and grapevine. In the last decades traditional farming has decreased and farming of wheat, rise, beetroot, cotton and sunflower has increased. Greenhouse farming, mainly in Almeria has also increased.

Fishing.- It's a traditional activity in Andalusia and its importance is seen in the Andalusian diet. The Andalusian fishing fleet is the second most important of Spain, with a big fishing area that includes waters which do not belong to Andalusia. Major exploitation problems exist today due to the new fishing techniques and to the new fishing ships with a big draught and with powerful freezers that be able to fish for several weeks. This modern fishing is associated with deep sea fishing, while coastal fishing, except for the motorization of ships, continues to be a very traditional activity. All the previously mentioned problems have led to a rapid improvement in aquaculture, both along the coasts as well as in the fish farms inland. For example, the fish farm of Riofrio, in Granada, exports 40% of its caviar production, and it competes in international markets with Russian and Iranian caviar.

Livestock.- The Andalusian livestock is 10% of the national livestock, while the Andalusian agriculture is 30% of the national agriculture. Therefore, only 70% of the Andalusian needs for meat and milk are supplied by the Andalusian livestock. This situation is due to the climate but also to historical reasons.

Hunting.- In the big game hunting, the most important animals are deer and wild boars but also wild goats, mouflons, fallow deer, roe deer, etc. The most important in shooting are partridges, rabbits, hares, quails, thrush, pigeons, etc.

Forest resources.- Forest resources are very important due to their extension and diversification: grass, fruits, wood, etc., and due to other aspects such as the fixing of the ground, hydric regulation and maintenance of the flora and the fauna. In total, the forest area is 50% of the Andalusian area, and half of this area is wood (more than 10 trees per ha) the rest of the area without trees are pasture lands, bushes and rocky places. The value of the production of the forest areas is only 2% of the agricultural production. Hunting, wood, fruits (nuts), cork and the use of the grass are the most important sub-sectors

Mining and energy.- The exploitation of the mining resources was made without regard to the fact that this is a limited resource. Therefore, most of the mining areas (Linares-La Carolina, Riotinto and Guadiato basin) are now in decay due to the high cost of extraction and the low calorific power in the case of coal. Despite this low profitability and general crisis in the sector, it still has certain importance. If we compare the value of the extractions with the rest of Spain, we can state that, Andalusia has 59% of the metallic extractions, more than anything else, pyrite and iron. Andalusia has 98% of the extraction of gold and silver and 100% of strontium

Secondary sector.-

Industry.- The development, in the 19th century, of the industries tied to mining extraction (Garrucha and Carboneras, Riotinto, El Pedroso, Peñarroya and Linares-La Carolina) failed. At the beginning of the 21st century, in spite of the fact that a greater integration between the mining extraction and the industrial transformation exists, this is still insufficient and incomplete. The scarcity of energy products provokes a strong dependence on imported oil, even though Andalusia has a great potential for the development of renewable energy sources, more than anything solar energy and wind power. There are other less important industries such as the car industry, aeronautics, etc.

Construction.- At the beginning of 2008 the international financial crisis worsened, the banks saw a fall in their profits, and the market exchange experienced sharp falls. In this context, the construction industry begin to show evident signs crisis: a sharp fall in sales, a fall in the price of the constructions, a rise in the debt inability to pay, or a rise of unemployment in the sector (for example, half of the real state firms closed). In February, the Spanish economy showed evident symptoms of an economic crisis, as unemployment saw the largest increase in 25 years

Tertiary sector.- This sector has had a very important increase in the last decades. It was minority and now it is majority in the western economies. This process has been called tertiaritation of the economy and has been very important in the Andalusian economy. By 1975 the tertiary sector produced 51.1% of the Andalusian Gross Value Added (GVA) and it gave employment to 40.8%, while by 2007 produced 67.9% of the GVA and 66,42% of the jobs. However this increase of the Tertiary sector came before other developed economies and it was independent of the industrial sector

Trade.- It is focused in the export of food and agriculture products and in the import of energy products. The three main countries that buy Andalusian products are Germany, France and Italy with 33% of the total exports. The economies of these countries buy the majority of the Andalusian food and agriculture products. On the other hand, Algeria, Nigeria and Russia sell to Andalusia mainly oil and account for 24.2% of imports. The challenge for Andalusia in the future is to diversify its exports to include other more elaborate products with a bigger added value and to reduce its dependence on the import of energy products.

Tourism.- Andalusia is the first Spanish community in tourism with almost 30 million annual visitors. The main places are Costa del Sol and the Sierra Nevada. The Andalusian location, to the South of the Iberian peninsula, means that it is one of the warmest places in Europe. In all the territory predominates the Mediterranean climate, that gives a large number of sun hours, and joined with the existence of a lot of big beaches, it's ideal for the development of sun and beach tourism

READING AND INTERPRETATION OF ECONOMIC INFORMATION AND CHARTS.-

ANALYSIS OF ECONOMIC NEWS ABOUT CHANGES IN THE PRODUCTIVE SYSTEM OR IN THE ORGANIZATION OF THE PRODUCTION IN THE CONTEXT OF GLOBALIZATION.-

TOPIC III.- EXCHANGE AND MARKET

SUPPLY.-

Definition.- It's the amount of goods and services that producers offer at different prices and given conditions at a point in time

Elasticity.-

Definition.- It is the measure of the way quantity supplied reacts to a change in price.

Formula.- Es = % change in quantity supplied : % change in price

Example.- If, in response to a 10% rise in the price of a good, the quantity supplied increases by 20%, the price elasticity of supply would be 20%/10% = 2.

Inelastic – elastic.- When there is a relatively inelastic supply for the good the coefficient is low; when supply is highly elastic, the coefficient is high. Supply is normally more elastic in the long run than in the short run for produced goods. As spare capacity and more capital equipment can be utilised the supply can be increased, whereas in the short run only labour can be increased. Of course goods that have no labour component and are not produced cannot be expanded. Such goods are said to be "fixed" in supply and do not respond to price changes.

Stocks.- The quantity of goods supplied can, in the short term, be different from the amount produced, as manufacturers will have stocks which they can build up or run down.

Determinants of the price elasticity of supply.-

The existence of the naturally occurring raw materials needed for production

The length of the production process

The production spare capacity (the more spare capacity there is in an industry the easier it should be to increase output if the price goes up)

The ease of resources to move into the industry

The storage capacity of the merchants (if they have more goods in stock they will be able to respond to a change in price more quickly)

SHAPE OF THE CURVE.- The supply curve usually slopes upwards from left to right; that is, it has a positive association. The positive slope is often referred to as "law of supply," which means producers will offer more of a service, product, or resource as its price rises

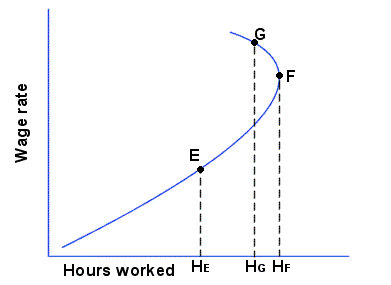

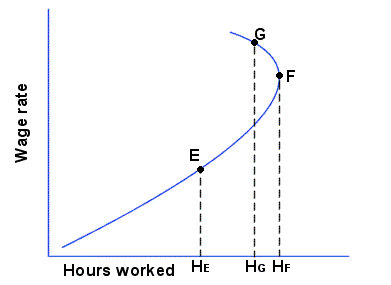

SUPPLY CURVES THAT DON'T SLOPE UPWARDS.- The labour supply curve will slope upwards to the right, as it does at point E for example. This individual will continue to increase his supply of labour services as the wage rate increases up to point F where he is working HF hours (each period of time). Beyond this point he will start to reduce the amount of labour hours he supplies (for example at point G he has reduced his work hours to HG). Where the supply curve is sloping upwards to the right (positive wage elasticity of labour supply), the substitution effect is greater than the income effect. Where it slopes upwards to the left (negative elasticity), the income effect is greater than the substitution effect. The direction of slope may change more than once for some individuals, and the labour supply curve is likely to be different for different individuals.

Determinants of individual supply.-

The price of the product.- The bigger price, the bigger supply

The costs of the production factors.- The bigger cost, the smaller supply

The size of the market.- The bigger market, the bigger supply

The availability of the production factors.- The bigger availability, the bigger supply

The number of competitor firms.- The bigger competition, the bigger supply

The amount of produced goods.- The bigger amount, the bigger supply

DEMAND.-

Definition.- It's the amount of goods and services that buyers are willing and able to purchase at different prices and giving conditions at a point in time

Determinants of individual demand.-

The price of the good.- The bigger price, the smaller demand

The level of income.- The higher level of income, the bigger demand

Personal tastes.- If a product is in fashion its demand increases

The population (number of people).- The bigger population, the bigger demand

The government policies.- The government can provoke that the demand of a product increases

The price of substitutive goods, and the price of complementary goods.-

Substitutive goods.- If the products are substitutive, the bigger price of one of them, the bigger demand of the other

Complementary goods.- If the products are complementary, the bigger price of one of them, the smaller demand of the other

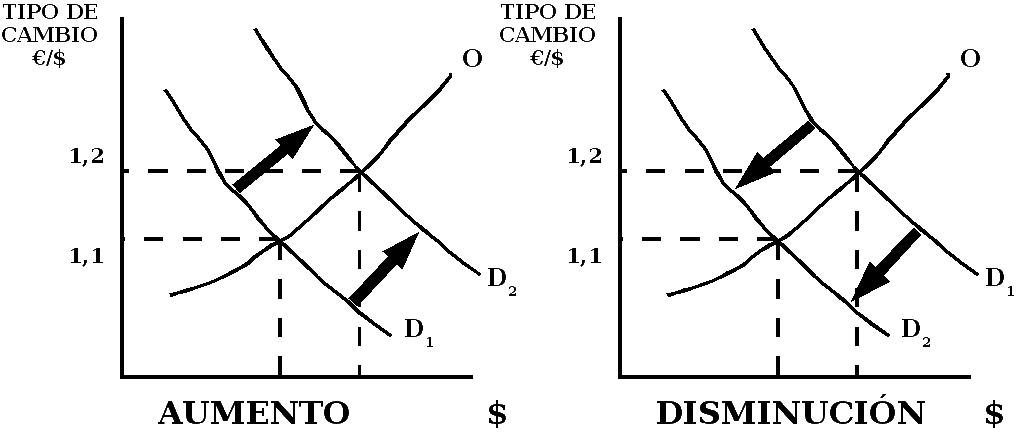

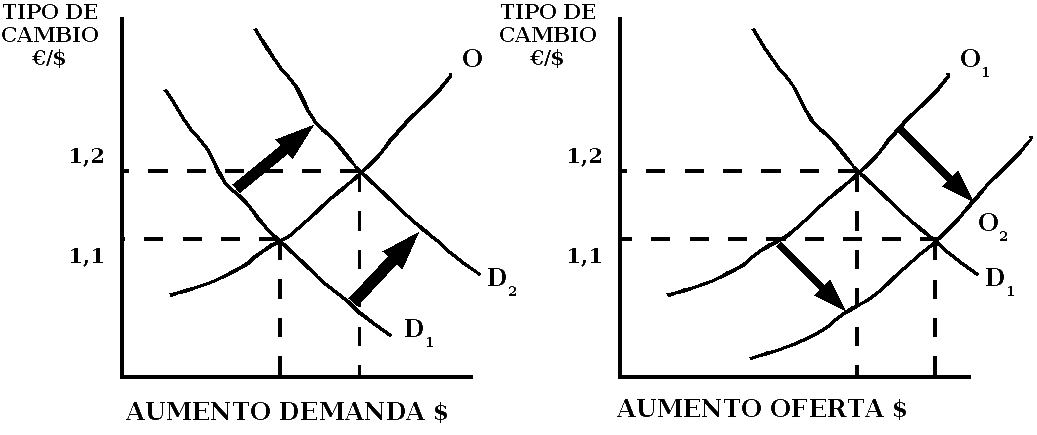

Movement along a demand curve.- There is movement along a demand curve when a change in price causes the quantity demanded to change. It is important to distinguish between movement along a demand curve, and a shift in a demand curve.

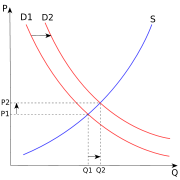

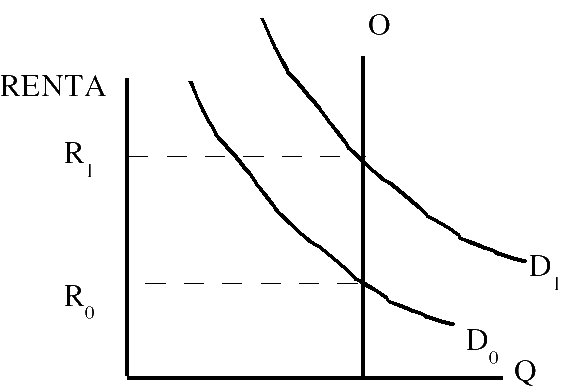

Shift of a demand curve.- The shift of a demand curve takes place when there is a change in the relationship between quantity and price that is brought about by a change in any of the factors influencing demand except price. A demand shift results in a new demand curve. When income rises, the demand curve for normal goods shifts right.

Demand-price curve.- The demand curve usually slopes downwards from left to right; that is, it has a negative association (for two theoretical exceptions: Veblen goods and Giffen goods).

Veblen goods.- It is claimed that some types of high-status goods, such as diamonds, Apple products or luxury cars, are Veblen goods, in that decreasing their prices decreases people's preference for buying them because they are no longer perceived as exclusive or high status products. Similarly, a price increase may increase that high status and perception of exclusivity, thereby making the good even more preferable.

Giffen goods.- A Giffen good, for example rice, is one which people consume more of as price rises, violating the law of demand. In normal situations, as the price of such a good rises, the substitution effect causes people to purchase less of it and more of substitute goods. In the Giffen good situation, cheaper close substitutes are not available. Because of the lack of substitutes, the income effect dominates, leading people to buy more of the good, even as its price rises.

ECONOMIC EQUILIBRIUM.-

Definition.- An economic equilibrium is simply a state of the world where economic forces are balanced and in the absence of external influences the (equilibrium) values of economic variables will not change. It is the point at which quantity demanded and quantity supplied are equal. Market equilibrium, for example, refers to a condition where a market price is established through competition such that the amount of goods or services sought by buyers is equal to the amount of goods or services produced by sellers. This price is often called the equilibrium price and will tend not to change unless demand or supply change.

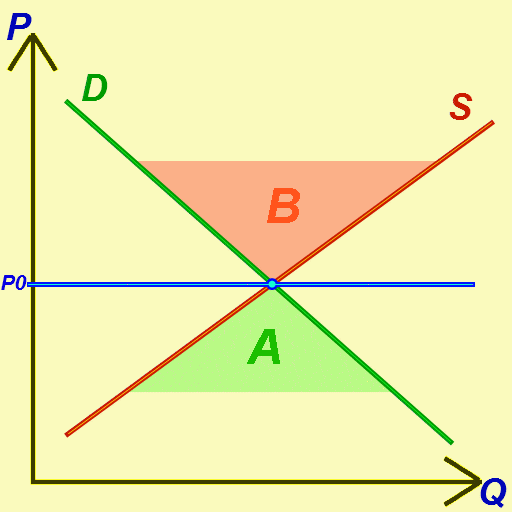

Interpretations.- In most interpretations, classical economists such as Adam Smith maintained that the free market would tend towards economic equilibrium through the price mechanism. That is, any excess supply (market surplus or glut) would lead to price cuts, which decrease the quantity supplied (by reducing the incentive to produce and sell the product) and increase the quantity demanded (by offering consumers bargains), automatically abolishing the glut. Similarly, in an unfettered market, any excess demand (or shortage) would lead to price increases, reducing the quantity demanded (as customers are priced out of the market) and increasing in the quantity supplied (as the incentive to produce and sell a product rises). As before, the disequilibrium (here, the shortage) disappears. This automatic abolition of non-market-clearing situations distinguishes markets from central planning schemes, which often have a difficult time getting prices right and suffer from persistent shortages of goods and services.

INDUCED DEMAND.-

Definition.- The induced demand is the phenomenon that after supply increases, more of a good is consumed. This is entirely consistent with the economic theory of supply and demand; however, this idea has become important in the debate over the expansion of transportation systems, and is often used as an argument against widening roads, such as major commuter roads. It is considered by some to be a contributing factor to urban sprawl

Price of road travel.- A journey on a road can be considered as having an associated cost or price (the generalised cost) which includes the out-of-pocket cost (e.g. fuel costs and tolls) and the opportunity cost of the time spent travelling, which is usually calculated as the product of travel time and the value of travellers' time. When road capacity is increased, initially there is more road space per vehicle travelling than there was before, so congestion is reduced, and therefore the time spent travelling is reduced - reducing the generalised cost of every journey (by affecting the second "cost" mentioned in the previous paragraph). In fact, this is one of the key justifications for construction of new road capacity (the reduction in journey times). A change in the cost (or price) of travel results in a change in the quantity consumed.

PERFECT COMPETITION.-

Definition.- In neoclassical economics and microeconomics, perfect competition describes the perfect being a market in which there are many small firms, all producing homogeneous goods.

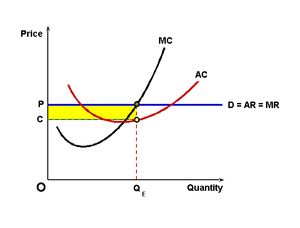

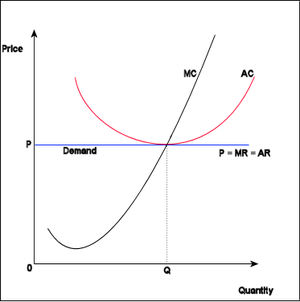

In the short-run.- Such markets are productively inefficient (we could produce the given output at a lower cost or could produce more output for given cost) as output will not occur where marginal costs (mc) is equal to average costs (ac), but allocatively efficient (the distribution of resources between alternatives fits with consumer taste), as output under perfect competition will always occur where marginal costs (mc) is equal to marginal revenue (mr), and therefore where marginal costs (mc) equals average revenue (ar). However, in the long term, such markets are both allocatively and productively efficient. In general a perfectly competitive market is characterized by the fact that no single firm has influence on the price of the product it sells. Because the conditions for perfect competition are very strict, there are few perfectly competitive markets.

Profit.- In the short-run, it is possible for an individual firm to make a profit. This situation is shown in this diagram, as the price or average revenue, denoted by P, is above the average cost denoted by C .

In the long period.- However, in the long period, positive profit cannot be sustained. The arrival of new firms or expansion of existing firms in the market causes the (horizontal) demand curve of each individual firm to shift downward, bringing down at the same time the price, the average revenue and marginal revenue curve. The final outcome is that, in the long run, the firm will make only normal profit (zero economic profit). Its horizontal demand curve will touch its average total cost curve at its lowest point.

Characteristics.-

Many buyers/Many Sellers – Many consumers with the willingness and ability to buy the product at a certain price, Many producers with the willingness and ability to supply the product at a certain price.

Low-Entry/Exit Barriers – It is relatively easy to enter or exit as a business in a perfectly competitive market.

Perfect Information - For both consumers and producers.

Firms Aim to Maximize Profits - Firms aim to sell where marginal costs meet marginal revenue, where they generate the most profit.

Homogeneous Products – The characteristics of any given market good or service do not vary across suppliers.

MONOPOLY.-

Definition.- A monopoly (from Greek monos, alone or single + polein, to sell) exists when a specific individual or enterprise has sufficient control over a particular product or service to determine significantly the terms on which other individuals shall have access to it. Monopolies are thus characterized by a lack of economic competition for the good or service that they provide and a lack of viable substitute goods. The verb "monopolize" refers to the process by which a firm gains persistently greater market share than what is expected under perfect competition

Competition laws.- In many jurisdictions, competition laws place specific restrictions on monopolies. Holding a dominant position or a monopoly in the market is not illegal in itself, however certain categories of behaviour can, when a business is dominant, be considered abusive and therefore be met with legal sanctions. A government-granted monopoly or legal monopoly, by contrast, is sanctioned by the state, often to provide an incentive to invest in a risky venture. The government may also reserve the venture for itself, thus forming a government monopoly.

Price.- If a company raises prices too high, then others may enter the market if they are able to provide the same good, or a substitute, at a lower price. The idea that monopolies in markets with easy entry need not be regulated against is known as the "revolution in monopoly theory".

Total profits.- The total profits a monopolist could earn if it sought to leverage its monopoly in one market by monopolizing a complementary market are equal to the extra profits it could earn anyway by charging more for the monopoly product itself. However, the one monopoly profit theorem does not hold true if customers in the monopoly good are poorly informed, or if the tied good has high fixed costs.

Alter the market.- A pure monopoly can -unlike a competitive firm- alter the market price for her own convenience: a decrease in the level of production results in a higher price. In the economics' jargon, it is said that pure monopolies "face a downward-sloping demand". An important consequence of such behaviour is worth noticing: typically a monopoly selects a higher price and lower quantity of output than a price-taking firm; again, less is available at a higher price.

Monopoly and efficiency.- It is often argued that monopolies tend to become less efficient and innovative over time, becoming "complacent giants", because they do not have to be efficient or innovative to compete in the marketplace. Sometimes this very loss of psychological efficiency can raise a potential competitor's value enough to overcome market entry barriers, or provide incentive for research and investment into new alternatives The theory of contestable markets argues that in some circumstances (private) monopolies are forced to behave as if there were competition because of the risk of losing their monopoly to new entrants. This is likely to happen where a market's barriers to entry are low.

Short run.- In the short run it can be good to allow a firm to attempt to monopolize a market. When monopolies are not broken through the open market, sometimes a government will step in, either to regulate the monopoly, turn it into a publicly owned monopoly environment, or forcibly break it up (see Antitrust law). Public utilities, often being naturally efficient with only one operator and therefore less susceptible to efficient breakup, are often strongly regulated or publicly owned. AT&T and Standard Oil are debatable examples of the breakup of a private monopoly. When AT&T was broken up into the "Baby Bell" components, MCI, Sprint, and other companies were able to compete effectively in the long distance phone market and began to take phone traffic from the less efficient AT&T server.

Ways for the appearance of a monopoly.-

Trust.- A special trust or business trust is a business entity formed with intent to monopolize business, to restrain trade, or to fix prices. Trusts gained economic power in the U.S. in the late 19th and early 20th centuries. Some but not all were organized as trust in the legal sense. They were often created when corporate leaders convinced (or coerced) the shareholders of all the companies in one industry to convey their shares to a board of trustees, in exchange for dividend-paying certificates. The board would then manage all the companies in 'trust' for the shareholders (and minimize competition in the process).

Cartel.- It's a form of oligopoly in which several providers FROM THE SAME SECTOR act together to coordinate services, prices or sale of goods

Mergers and acquisitions.-

Merger.- A merger is a combination of two companies into one larger company. Such actions are commonly voluntary and involve stock swap or cash payment to the target. Stock swap is often used as it allows the shareholders of the two companies to share the risk involved in the deal. A merger can resemble a takeover but result in a new company name (often combining the names of the original companies) and in new branding; in some cases, terming the combination a "merger" rather than an acquisition is done purely for political or marketing reasons.

Acquisition.- An acquisition, also known as a takeover or a “buyout”, is the buying of one company (the ‘target’) by another. An acquisition may be friendly or hostile. In the former case, the companies cooperate in negotiations; in the latter case, the takeover target is unwilling to be bought or the target's board has no prior knowledge of the offer. Acquisition usually refers to a purchase of a smaller firm by a larger one. Sometimes, however, a smaller firm will acquire management control of a larger or longer established company and keep its name for the combined entity. This is known as a reverse takeover. Another type of acquisition is reverse merger, a deal that enables a private company to get publicly listed in a short time period. A reverse merger occurs when a private company that has strong prospects and is eager to raise financing buys a publicly listed shell company. Achieving acquisition success has proven to be very difficult, while various studies have showed that 50% of acquisitions were unsuccessful.

Types of monopoly.-

Pure monopoly.- If there is a single seller in a certain industry and there are no close substitutes for the good being produced by her, then the market structure is that of a Pure monopoly

Artificial monopoly.- This is a monopoly created by the government by means of artificial barriers to entry such as patents and copyrights

Natural monopoly.- A natural monopoly occurs when, due to the economies of scale of a particular industry, the maximum efficiency of production and distribution is realized through a single supplier. Examples include water services and electricity. It may also depend on control of a particular natural resource.

Monopolistic competition.- It's a common market structure where many competing producers sell products that are differentiated from one another (ie. the products are substitutes, but are not exactly alike). Many markets are monopolistically competitive, common examples include the markets for restaurants, cereal, clothing, shoes and service industries in large cities.

Monopsony.- A monopsony (from Ancient Greek (monos) "single" + (opsonia) "purchase") is a market form in which only one buyer faces many sellers

Bilateral monopoly.- In a bilateral monopoly there is both a monopoly (a single seller) and monopsony (a single buyer) in the same market. In such market price and output will be determined by the non economic forces like bargaining power of both buyer and seller.

OLIGOPOLY.-

Definition.- It's a market form in which a market or industry is dominated by a small number of sellers (oligopolists). The word is derived from the Greek oligo' “few” plus -opoly as in monopoly and duopoly. Because there are few participants in this type of market, each oligopolist is aware of the actions of the others. The decisions of one firm influence, and are influenced by, the decisions of other firms. Strategic planning by oligopolists always involves taking into account the likely responses of the other market participants. This causes oligopolistic markets and industries to be at the highest risk for collusion.

Cartel.- Oligopolistic competition can give rise to a wide range of different outcomes. In some situations, the firms may employ restrictive trade practices (collusion, market sharing etc.) to raise prices and restrict production in much the same way as a monopoly. Where there is a formal agreement for such collusion, this is known as a cartel. A primary example of such a cartel is OPEC which has a profound influence on the international price of oil.

Price leadership.- Firms often collude in an attempt to stabilise unstable markets, so as to reduce the risks inherent in these markets for investment and product development. There are legal restrictions on such collusion in most countries. There does not have to be a formal agreement for collusion to take place (although for the act to be illegal there must be a real communication between companies) - for example, in some industries, there may be an acknowledged market leader which informally sets prices to which other producers respond, known as price leadership

Approaching perfect competition.- In other situations, competition between sellers in an oligopoly can be fierce, with relatively low prices and high production. This could lead to an efficient outcome approaching perfect competition. The competition in an oligopoly can be greater than when there are more firms in an industry if, for example, the firms were only regionally based and didn't compete directly with each other.

GOODS AND SERVICES MARKET.-

Running.- Supply and demand of the product determine an equilibrium price, and at that price the firms freely decide the amount that they are going to produce. Therefore, the market determines the price and each firm accepts this price as a fixed piece of information and they can't have an influence on it.

Output of each firm.- Each firm is going to produce the quantity that its supply curve indicates for this price. the supply curve of each firm is conditioned for its production cost

Minimization of costs and equalization of profits.- The inefficient firms won't be able to abandon the sector in the short-run, but in the long-run they will sell their installations, therefore, there is a trend to minimize costs and to equalize profits in perfect competition

LAND MARKET.-

Perfectly inelastic supply curve.- Land was sometimes defined in classical and neoclassical economics as the "original and indestructible powers of the soil." Georgists hold that this implies a perfectly inelastic supply curve (i.e., zero elasticity).

Shifts of the demand curve.-

LABOUR MARKET.-

Definition.- Labour markets function through the interaction of workers and employers. Labour economics looks at the suppliers of labour services (workers), the demanders of labour services (employers), and attempts to understand the resulting pattern of wages, employment, and income.

Demand for labour and wage determination.- Labour demand is a derived demand, in other words the employer's cost of production is the wage, in which the business or firm benefits from an increased output or revenue. If the Marginal Revenue Product (MRP) is greater than a firm's Marginal Cost, then the firm will employ the worker. The firm only employs however up to the point where MRP=MC, not lower, in economic theory.

Wage differences.- Wage differences exist, particularly in mixed and fully/partly flexible labour markets. For example, the wages of a doctor and a port cleaner, both employed by the NHS, differ greatly. But why? There are many factors concerning this issue. This includes the MRP (see above) of the worker. A doctor's MRP is far greater than that of the port cleaner. In addition, the barriers to becoming a doctor are far greater than that of becoming a port cleaner. For example to become a doctor takes a lot of education and training which is costly, and only those who are socially and intellectually advantaged can succeed in such a demanding profession. The port cleaner however requires minimal training. The supply of doctors therefore would be much more inelastic than the supply of port cleaners. The demand would also be inelastic as there is a high demand for doctors, so the NHS will pay higher wage rates to attract the profession.

Labour supply curve.- The labour supply curve will slope upwards to the right, as it does at point E for example. This individual will continue to increase his supply of labor services as the wage rate increases up to point F where he is working HF hours (each period of time). Beyond this point he will start to reduce the amount of labor hours he supplies (for example at point G he has reduced his work hours to HG). Where the supply curve is sloping upwards to the right (positive wage elasticity of labor supply), the substitution effect is greater than the income effect. Where it slopes upwards to the left (negative elasticity), the income effect is greater than the substitution effect. The direction of slope may change more than once for some individuals, and the labor supply curve is likely to be different for different individuals.

CAPITAL MARKET.-

Capital market.- The capital market is the market for securities, where companies and governments can raise longterm funds. It is a market in which money is lent for periods longer than a year. The capital market includes the stock market and the bond market.

Money market.- The money market is the global financial market for short-term borrowing and lending. It provides short-term liquidity funding for the global financial system. The money market is where short-term obligations such as Treasury bills, commercial paper and banker's acceptances are bought and sold.

The main determinants of capital market.- The main determinants are income and interest rate

LIMITS TO THE MARKET MECHANISM AND ITS REPERCUSSION ON CONSUMERS.-

First World – Third World.- A number of Third World countries were former colonies and with the end of imperialism many of these countries, especially the smaller ones, were faced with the challenges of nation and institution-building on their own for the first time. Due to this common background a lot of these nations were for most of the 20th century, and are still today, "developing" in economic terms. This term when used today generally denotes countries that have not "developed" to the same levels as OECD countries, and which are thus in the process of "developing". In the 1980s, economist Peter Bauer offered a competing definition for the term Third World. He claimed that the attachment of Third World status to a particular country was not based on any stable economic or political criteria, and was a mostly arbitrary process. The large diversity of countries that were considered to be part of the Third World, from Indonesia to Afghanistan, ranged widely from economically primitive to economically advanced and from politically non-aligned to Soviet- or Western-leaning. The only characteristic that Bauer found common in all Third World countries was that their governments "demand and receive Western aid" (the giving of which he strongly opposed). Thus, the aggregate term "Third World" was challenged as misleading even during the Cold War period.

Manufactured products - raw materials.- Third world countries sell raw materials and buy manufactured products that are more expensive

TOPIC IV.- NATIONAL MAGNITUDES AND INDICATORS OF A ECONOMY

INTERPRETATION OF NATIONAL AND INDIVIDUAL WEALTH.-

Wealth-income.- Wealth is the amount of properties owned by someone. Income is the sum of all the wages, salaries, profits, interests payments, rents and other forms of earnings received in a given period of time

National wealth.- Therefore, national wealth will be the amount of properties owned by a nation

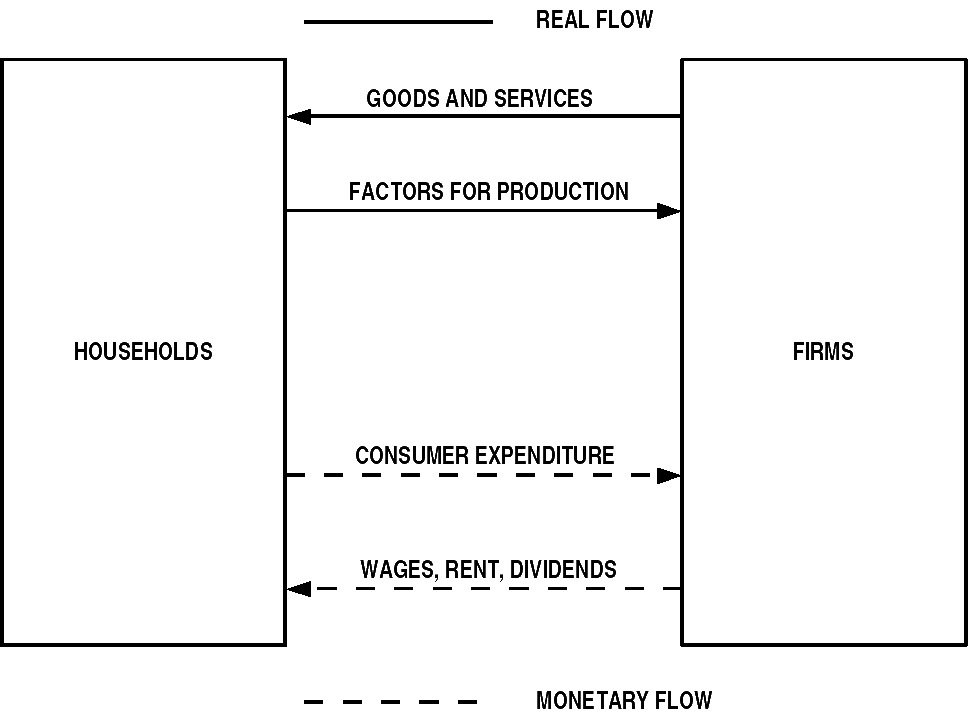

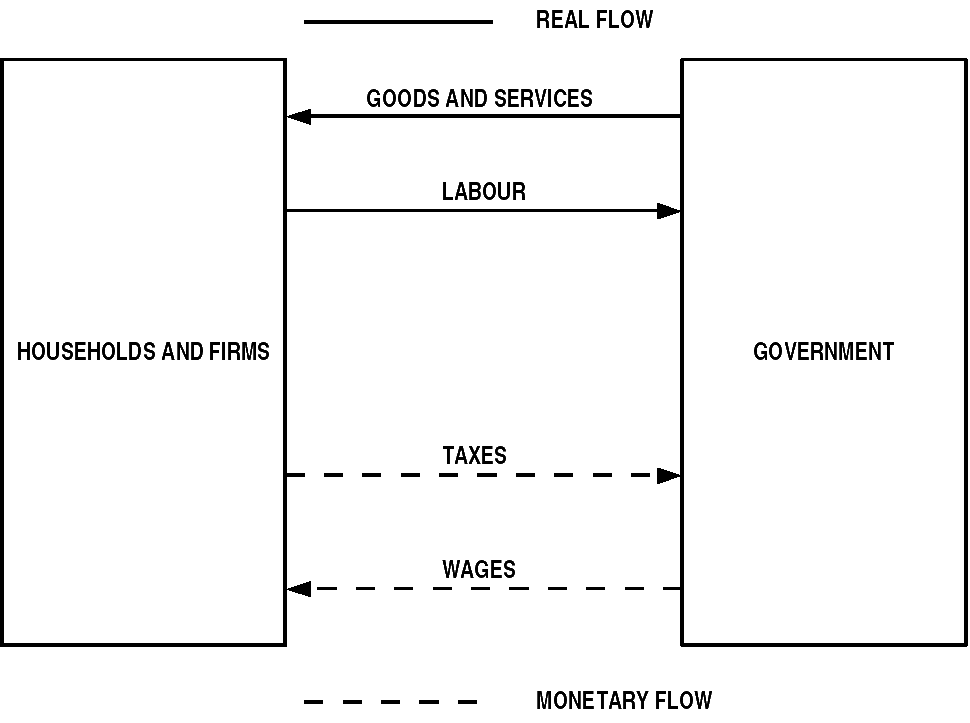

CIRCULAR FLOW OF INCOME.-

Relationship between households and firms.-

Relation between households and firms and the government.-

OBTAINING THE DOMESTIC PRODUCT AND CALCULATION AND INTERPRETATION OF THE MAIN RELATED MAGNITUDES.-

Gross domestic product (GDP).-

Definition.- The gross domestic product (GDP) or gross domestic income (GDI), a basic measure of an economy's economic performance, is the market value of all final goods and services made within the borders of a nation in a year.

GDP can be defined in two ways:

GDP at market prices.- It is equal to the total expenditures for all final goods and services produced within the country in a stipulated period of time (usually a 365-day year). GDPmp = consumption + gross investment + government spending + (exports – imports), or, GDPmp = C + I + G + (X – M)

GDP at factor cost.- It is equal to the sum of the value added at every stage of production (the intermediate stages) by all the industries within a country, in the period. GDPfc = Primary Sector + Secondary Sector + Tertiary Sector

Relationship between GDPfc and GDPmp.- GDPfc = GDPmp – indirect taxes + subsidies on production and imports. GDPfc = GDPmp – Ti + Su

Net domestic product at factor cost.- The net domestic product at factor cost (NDPfc) equals the gross domestic product at factor cost (GDPfc) minus depreciation on a country's capital goods. NDPfc = GDPfc - Dep

Net National Product at factor cost.- Net National Product at factor cost (NNPfc) is Net Domestic Product at factor cost (NDPfc) plus income earned by its citizens abroad, minus income earned by foreigners in the country. NNPfc = NDPfc + ICA – IFC

Net National Product at market prices.- Net National Product at market prices is Net National Product at factor cost plus Indirect Taxes minus subsidies on production and imports. NNPmp = NNPfc + Ti - Su

Example.- Calculate the NDPfc with this information: C = 500; I = 100; G = 200; X = 20; M = 30; Ti = 70; Su = 15; Dep = 25; ICA = 33; IFC = 27

NDPfc = C + I + G + (X – M) – Ti + Su – Dep = 500 + 100 + 200 + (20 – 30) – 70 + 15 – 25 = 710

INCOME DISTRIBUTION.-

Definition of income distribution.- Income distribution is how a nation’s total economy is distributed amongst its population.

Analysis.-

Geographical.- This analysis measures the differences among the inhabitants of the regions

Functional.- This analysis measures the differences among the factors: land, labour and capital

Measure.-

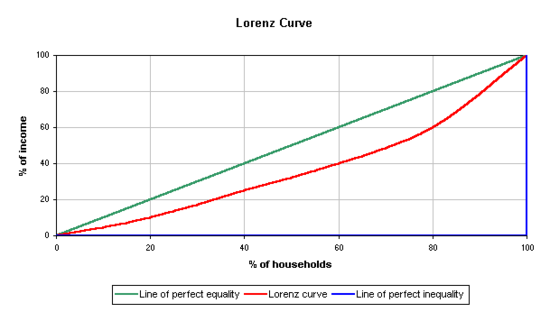

Lorenz curve.- The Lorenz curve is often used to represent income distribution, where it shows for the bottom x% of households, what percentage y% of the total income they have. The percentage of households is plotted on the x-axis, the percentage of income on the y-axis.

Perfect equality.- Every point on the Lorenz curve represents a statement like "the bottom 20% of all households have 10% of the total income.". A perfectly equal income distribution would be one in which every person has the same income. In this case, the bottom "N"% of society would always have "N"% of the income. This can be depicted by the straight line "y" = "x"; called the "line of perfect equality."

Perfect inequality.- By contrast, a perfectly unequal distribution would be one in which one person has all the income and everyone else has none. In that case, the curve would be at "y" = 0 for all "x" < 100%, and "y" = 100% when "x" = 100%. This curve is called the "line of perfect inequality."

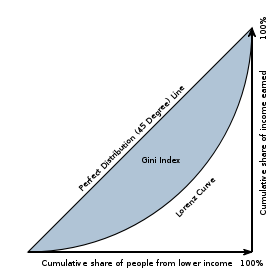

Gini coefficient.- The Gini coefficient is the area between the line of perfect equality and the observed Lorenz curve, as a percentage of the area between the line of perfect equality and the line of perfect inequality. It is defined as a ratio and can range from 0 to 1 (0% to 100%): A low Gini coefficient indicates more equal income or wealth distribution, with 0 corresponding to perfect equality (everyone having exactly the same income), while higher Gini coefficients indicate more unequal distribution, with 1 corresponding to perfect inequality (i.e., a situation with more than one individual, where one person has all the income).

Social impact.- In the neoliberal system a debate exists on whether the market can regulate itself and distribute the wealth of a country in a balanced way or if the government must take part. Radical neoliberalism says that the government mustn't take part in the economy just to guarantee stability. The updated socialism and centre sectors are part of a softer neoliberalism and promote a government more worried about social subjects, but without abandon the ideology of the contemporary liberalism

Wealth distribution – GDP does not take disparity in incomes between the rich and poor into account.

Non-market transactions – GDP excludes activities that are not provided through the market, such as household production and volunteer or unpaid services.

Underground economy – Official GDP estimates may not take into account the underground economy, in which transactions contributing to production, such as illegal trade and tax-avoiding activities, are unreported, causing GDP to be underestimated.

Non-monetary economy – GDP omits economies where no money comes into play at all, resulting in inaccurate or abnormally low GDP figures. For example, in countries with major business transactions occurring informally, portions of local economy are not easily registered. Bartering may be more prominent than the use of money, even extending to services

Quality of goods – People may buy cheap, low-durability goods over and over again, or they may buy high-durability goods less often. It is possible that the monetary value of the items sold in the first case is higher than that in the second case, in which case a higher GDP is simply the result of greater inefficiency and waste.

Quality improvements and inclusion of new products – By not adjusting for quality improvements and new products, GDP understates true economic growth. For instance, although computers today are less expensive and more powerful than computers from the past, GDP treats them as the same products by only accounting for the monetary value.

What is being produced – GDP counts work that produces no net change or that results from repairing harm. For example, rebuilding after a natural disaster or war may produce a considerable amount of economic activity and thus boost GDP. The economic value of health care is another classic example -it may raise GDP if many people are sick and they are receiving expensive treatment, but it is not a desirable situation. Alternative economic measures, such as the standard of living or discretionary income per capita better measure the human utility of economic activity.

Externalities – GDP ignores externalities or economic “bads” such as damage to the environment. By counting goods which increase utility but not deducting bads or accounting for the negative effects of higher production, such as more pollution, GDP is overstating economic welfare. The Genuine Progress Indicator is thus proposed by ecological economists and green economists as a substitute for GDP. In countries highly dependent on resource extraction or with high ecological footprints the disparities between GDP and GPI can be very large, indicating ecological overshoot. Some environmental costs, such as cleaning up oil spills are included in GDP.

Sustainability of growth – GDP does not measure the sustainability of growth. A country may achieve a temporarily high GDP by over-exploiting natural resources.

Basket of goods.- GDP growth can vary greatly depending on the basket of goods used and the relative proportions used to deflate the GDP figure.

Comparable basket of goods.- Cross-border comparisons of GDP can be inaccurate as they do not take into account local differences in the quality of goods, even when adjusted for purchasing power parity. This type of adjustment to an exchange rate is controversial because of the difficulties of finding comparable baskets of goods to compare purchasing power across countries. This is especially true for goods that are not traded globally, such as housing.

Alternatives to GDP.-

Human Development Index (HDI) .- HDI uses GDP as a part of its calculation and then factors in indicators of life expectancy and education levels.

Genuine Progress Indicator (GPI) or Index of Sustainable Economic Welfare (ISEW).- The GPI and the similar ISEW attempt to address many of the above criticisms by taking the same raw information supplied for GDP and then adjust for income distribution, add for the value of household and volunteer work, and subtract for crime and pollution.

Wealth Estimates.- The World Bank has developed a system for combining monetary wealth with intangible wealth (institutions and human capital) and environmental capital. Some people have looked beyond standard of living at a broader sense of quality of life or well-being. It also states that GDP is a statistic crucial to the success of a specified country

Private Product Remaining.- Murray Newton Rothbard and other Austrian economists argue that because government spending is taken from productive sectors and produces goods that consumers do not want, it is a burden on the economy and thus should be deducted. Rothbard argues that even government surpluses from taxation should be deducted to create an estimate of PPR.

European Quality of Life Survey.- This survey, the first wave of which was published in 2005, assessed quality of life across European countries through a series of questions on overall subjective life satisfaction, satisfaction with different aspects of life, and sets of questions used to calculate deficits of time, loving, being and having.

Gini Coefficient.- Considers the disparity of income within a nation.

Gross National Happiness.- The Centre for Bhutanese Studies in Bhutan is currently working on a complex set of subjective and objective indicators to measure 'national happiness' in various domains (living standards, health, education, cultural vitality and diversity, time use and balance, good governance, community vitality and psychological well-being). This set of indicators would be used to assess progress towards Gross National Happiness, which they have already identified as being the nation's priority, above GDP.

Happy Planet Index.- The Happy Planet Index (HPI) is an index of human well-being and environmental impact, introduced by the New Economics Foundation (NEF), in July 2006. It measures the environmental efficiency with which human well-being is achieved within a given country or group. Human well-being is defined in terms of subjective life satisfaction and life expectancy.

ECONOMIC GROWTH, DEVELOPMENT AND SUSTAINABILITY.-

Definition and measuring.- Economic growth is the increase in the amount of the goods and services produced by an economy over time and is dependent on an increase in the creation of money. Growth is conventionally measured as the percent rate of increase in real gross domestic product, or real GDP. GDP is usually calculated in real terms, i.e. inflation-adjusted terms, in order to net out the effect of inflation on the price of the goods and services produced. In economics, "economic growth" or "economic growth theory" typically refers to growth of potential output, i.e., production at “full employment” which is caused by growth in aggregate demand or observed output.

Distinction.- Economists draw a distinction between short-term economic stabilization and long-term economic growth. The topic of economic growth is primarily concerned with the long run.

Short-run.- The short-run variation of economic growth is termed the business cycle, and almost all economies experience periodical recessions

Long-run.- The long-run path of economic growth is one of the central questions of economics; in spite of the problems of measurement, an increase in GDP of a country is generally taken as an increase in the standard of living of its inhabitants. Over long periods of time, even small rates of annual growth can have large effects. A growth rate of 2.5% per annum will lead to a doubling of GDP within 28 years, whilst a growth rate of 8% per annum (experienced by some Four Asian Tigers) will lead to a doubling of GDP within 9 years. This exponential characteristic can exacerbate differences across nations. A growth rate of 5% seems similar to 3%, but over two decades, the first economy would have grown by 165%, the second only by 80%.

Econometrics.- In the early 20th century, it became the policy of most nations to encourage growth of this kind. To do this required enacting policies, and being able to measure the results of those policies. This gave rise to the importance of econometrics, or the field of creating measurements for underlying conditions. Terms such as "unemployment rate", “Gross Domestic Product” and "rate of inflation" are part of the measuring of the changes in an economy.

Increase GDP without creating inflation.- In mainstream economics, the purpose of government policy is to encourage economic activity without encouraging the rise in the general level of prices. This combination is seen as, at the macro-scale to be indicative of an increasing stock of capital. The argument runs that if more money is changing hands, but the prices of individual goods are relatively stable, then it is proof that there is more productive capacity, and therefore more capital, because it is capital that is allowing more to be made at a lower cost per unit.

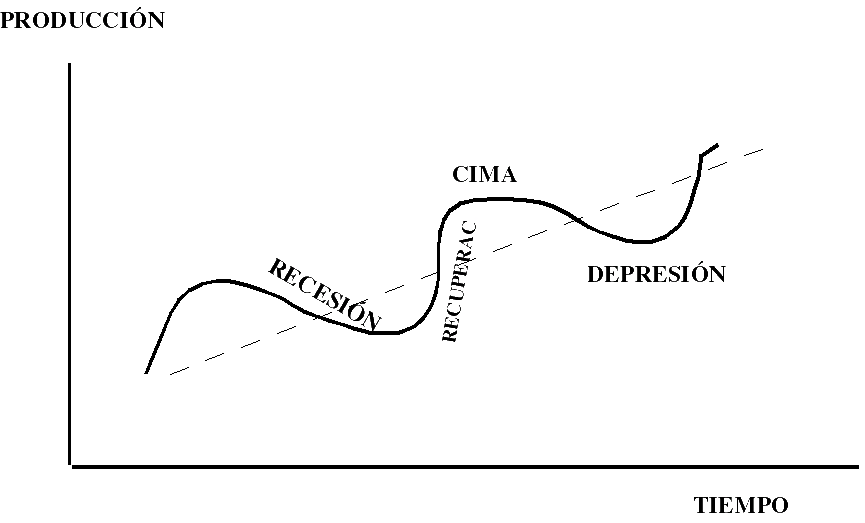

Business cycle.-

Definition.- The term business cycle (or economic cycle) refers to economy-wide fluctuations in production or economic activity over several months or years. These fluctuations occur around a long-term growth trend, and typically involve shifts over time between periods of relatively rapid economic growth (expansion or boom), and periods of relative stagnation or decline (contraction or recession).

Phases.-

Peak.- All the economic activity is in a period of prosperity

Recession.- A recession is a general slowdown in economic activity over a sustained period of time, or a business cycle contraction. During recessions, many macroeconomic indicators vary in a similar way. Production as measured by Gross Domestic Product (GDP), employment, investment spending, capacity utilization, household incomes and business profits all fall during recessions. An economic crisis is a sharp transition to a recession.

Depression.- A depression is a sustained, long downturn in one or more economies. It is more severe than a recession, which is seen as a normal downturn in the business cycle. Considered a rare and extreme form of recession, a depression is characterized by abnormal increases in unemployment, restriction of credit, shrinking output and investment, numerous bankruptcies, reduced amounts of trade and commerce, as well as highly volatile relative currency value fluctuations, mostly devaluations. Price deflation or hyperinflation are also common elements of a depression.

Expansion.- The expansion is an increase in the level of economic activity, and of the goods and services available in the market place. Its is a period of economic growth as measured by a rise in real GDP. Typically it relates to an upturn in production and utilization of resources.

Negative effects of the growth.-

Crime or pollution.- Growth has negative effects on the quality of life such as crime, prisons, or pollution

Consumerism.- Growth encourages the creation of artificial needs. Industry cause consumers to develop new tastes, and preferences for growth to occur.

GEO-4.- The 2007 United Nations GEO-4 report warns that we are living far beyond our means. This report supports the basic arguments and observations made by Thomas Malthus in the early 1800s, that is, economic growth depletes non-renewable resources rapidly.

Distribution of income.- The gap between the poorest and richest countries in the world has been growing.. Although mean and median wealth has increased globally, it adds to the inequality of wealth.