ECONOMY

- Antonio Ginés - IES Hnos. Machado - Dos Hermanas - Seville -

Pag

TOPIC 1.- ECONOMIC ACTIVITY AND ECONOMIC SYSTEMS. PRODUCTION AND ECONOMIC INTERDEPENDENCE

PART A.- ECONOMIC ACTIVITY AND ECONOMIC SYSTEMS

ECONOMY AND SCARCITY.-

Definition of economy.- It’s a science that studies human behavior in society as the relationship between aims and limited means that have alternative applications. Scarcity implies that there aren’t enough resources to produce enough to cover all needs. Scarcity also implies that all the objectives of society can’t be satisfied at the same time, therefore it’s necessary to follow a policy of priorities.

Utility.- The concept of scarcity is applied to everything that is useful. And useful means everything that has the capacity to satisfy human needs. Human societies have developed policies to decide priorities and how to satisfy them

OBSERVATION OF THE ECONOMIC CONTENT OF SOCIAL RELATIONS.THE ECONOMIC AGENTS.-

Definition of economic agents.- They’re the people or groups that do an economic activity

Types of economic agents.-

Families or households.- They make the decisions about what to consume and are the owners, they have most of the rest of the production factors (K and T)

Companies.- They make decisions about what to produce, how to produce and distribution

Public sector.- It’s made up of different public administrations and other public entities (including public-owned companies). It takes part in the economy in three ways:

Creating laws that regulate the way in which other economic agents act when they go to the market

Redistributing income from those who have the most to those who have the least

Offering, at a lower price or for free, goods and services that society thinks the entire population should receive (education and health)

THE NEED TO CHOOSE AND THE RECOGNITION OF THE OPPORTUNITY COST OF A DECISION.-

The opportunity cost.-

Definition.- It’s what an agent loses when making a decision

COMBINATION |

WHEAT |

BARLEY |

OPPORTUNITY COST |

1 |

0 |

5 |

- |

2 |

1 |

3 |

2 |

3 |

2 |

0 |

3 |

Cannons-butter.- When individuals are grouped together in societies, they face different types of dilemmas. The classic is the dilemma between "cannons and butter." The more we spend on national security to protect our coasts from foreign aggressors (cannons), the less we will spend on personal property to improve the standard of living in our country (butter)

Pollution-income.- In modern society, the dilemma between a clean environment and a high level of income is also important. Legislation that forces companies to reduce pollution raises the cost of producing goods and services. Higher costs can create lower company profits, lower wages, higher prices, or all three at the same time.

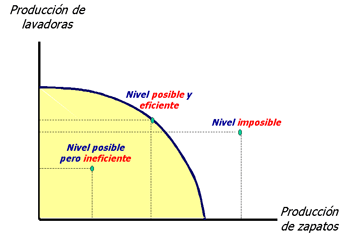

The Production Possibilities Frontier (PPF).-

Definition.- It’s the group of productive factors or combinations of technologies that reach maximum production. It reflects the maximum quantities of goods and services that a society can produce in a given period of time and with given production factors and technological knowledge.

Situations that can occur in the productive structure of a country.-

Inefficient productive structure.- Being under the PPF means that either not all resources are used (idle resources) or the technology isn’t adequate (technology that can be improved). A country with an unemployment rate above 5% will always find itself in this productive structure, because there is unused labor available.

Efficient production structure.- It’s located on the border or very close to it. There are no idle resources and the best technology is used.

Unattainable productive structure.- It’s located above the Production Possibilities. It’s theoretical because no country can produce more than is possible, indefinitely (overtime could temporarily reach higher production levels)

Shape of the PPF.- It’s concave and decreasing. This form is due to two reasons:

Decreasing.- To produce more of one good it is necessary to produce less of another

Concave.- The opportunity cost is increasing

All the economies of the world can be represented with a diagram of these characteristics. Thus, we can simplify and assume that the production of world economies can be divided between civilian goods and military goods. For example, North Korea has an economy highly geared towards the production of military goods at the cost of reducing the production of civilian goods and, consequently, the needs of citizens are partly neglected. The graph would be similar to the previous one

Displacement of the PPF.- It’s movable, that is, unreachable points can be reached. Displacement may be due to technological improvements, an increase in capital, an increase in workers, or the discovery of new natural resources.

In this case, displacement affects the production of both goods equally. However, different cases can arise. For example, if the displacement is due to the immigration of untrained individuals, they can be expected to join companies that engage in low-skilled manual activities such as those related to agriculture. If the displacement is due to a new technology, it could also be thought that it affects some sectors more and others less. Therefore, the expansion of production possibilities aren’t the same in all cases. We can reflect on a graph like the previous one how the displacements would be.

EXCHANGE RELATIONSHIPS AND HISTORICAL EVOLUTION.-

Barter or exchange.-

Definition.- Buy or sell using a product or service instead of money, that is, buying or selling without using cash.

Origins.- Its beginnings go back to the first sedentary communities of human beings. These colonizers knew agriculture and herding, lived longer than their nomadic ancestors, and enjoyed better security. In addition, the first works, such as pottery or metallurgy, began to develop.

Appearance of the coins.- New products brought new needs that were impossible to satisfy in an autocratic society (political concept that means an undemocratic government and, normally, entails an economy closed to the outside). Therefore began bartering: with the need to exchange what was owned for what was necessary. Although, at times, many intermediate exchanges were necessary to satisfy needs. This, combined with the growth of settlements and the expansion of commercial networks, facilitated the appearance of the concept of "coins" (which were initially sacks of salt).

Disappearance of barter.- In spite of everything, barter didn’t disappear with the arrival of coins. In ancient Egypt, the monetary system and exchange lived together throughout history, the Phoenicians used it as the basis of their trading system and the native people of Latin America also exchanged their products in markets.

Money.-

Explanation of the appearance of money.- When exchange is frequent, barter systems quickly find the need to have some merchandise with monetary properties. This greatly facilitates trade and the permanence of families in the area, building the wealth of the place and demographic growth and giving rise to the natural process of free trade and the development of the economy.

Money-merchandise.- Civilizations have adopted over the centuries various goods such as money (gold, silver, other metals or minerals, wheat, tea tablets in China, etc.) that have monetary properties, such as divisibility. , durability, etc.

First money in the West.- The first historical signs that we have of money in the form of currency in the West are those of the Phoenicians.

Intrinsic value.- Money in this phase had an intrinsic value. Gold and silver themselves had a value, and that is why they were exchanged. However, today, money has only value as an instrument of exchange (the paper of which a banknote is composed has no value).

Issuance of money.- The states began to issue notes and coins that gave the bearer the right to exchange them for gold or silver from the country's reserves. Then fiat money appeared, which has no intrinsic value

Evolution of the backing of paper money.-

18th and 19th centuries.- Many countries had a bimetallic pattern, based on gold and silver.

Between 1870 and the First World War.- The Gold Standard was mainly adopted. Any citizen could convert paper money into an equivalent amount of gold.

Between the two World Wars. - Countries tried to return to the Gold Standard, but the economic situation and the crisis of 1929 ended the ability for an individual to convert banknotes into gold.

At the end of World War II.- The allies established a new financial system in the Bretton Woods Agreements (in July 1944 in the United States). Here it was established that all currencies would be converted into US dollars and only the US dollar would be convertible into gold bars at $35 per ounce for foreign governments.

In 1971.- The expansive fiscal policies of the United States, motivated mainly by the military spending in Vietnam, cause the abundance of dollars, which created doubts about their convertibility into gold. This is why European central banks tried to convert their dollar reserves into gold, creating an unsustainable situation for the United States. Because of this, in December 1971, the President of the United States, Richard Nixon, unilaterally suspended the conversion of the dollar to gold and devalued the dollar by 10%. In 1973, the dollar was devalued another 10%, until, finally, the conversion of the dollar to gold ended.

From 1973 to today.- The money that we use today has a value in the subjective belief and legal obligation that will be accepted by the rest of the inhabitants of a country, or economic area, as an instrument of exchange. The monetary authorities and central banks of developed countries don’t attempt to defend any particular exchange rate level, but intervene in the foreign exchange market to calm speculative fluctuations in the short term, with the aim of maintaining price stability in the short term. term and avoid situations such as hyperinflation, which destroys the value of money leading to a decrease in confidence or, on the contrary, the opposite can also occur, that is, deflation (generalized and sustained fall in prices or loss of money value).

THE ECONOMIC SYSTEMS. KEY FEATURES. VALUATION AND COMPARISON. PECULIARITIES OF THE ANDALUSIAN ECONOMY.-

Capitalism (emerged in Europe in the 16th century) .-

Features.-

Capital over labor.- Capital dominates over labor as an element of wealth production

Priority of profit.- Profit is the guide of economic action for capital accumulation

Private ownership.- Ownership of the means of production is in the hands of the families

Economy determined by the free market.- The distribution, production and prices of goods and services are usually determined by the interaction of supply and demand

Free enterprise.- Each company freely dedicates itself to what it decides to produce with no limitations other than the qualification requirements necessary to carry out that activity

Non-intervention.- The State limits itself to intervening in very specific cases that are developed in the following section

Liberalism and neoliberalism.- The political doctrine that has historically led the defense and implementation of this economic and political system has been economic and classical liberalism whose founding fathers are considered to be John Locke, Juan de Mariana, Adam Smith and Benjamin Franklin. Classical liberal thinking holds that the role of government should be reduced as much as possible. It should only be in charge of the legal code that guarantees respect for private property, the defense of what are called “negative freedoms”: civil and political rights, the control of internal and external security through the Armed Forces and the police, and possibly the establishment of policies that were considered essential for the functioning of the market, because a greater presence of the State in the economy would disturb its functioning. The most prominent contemporary representatives are Ludwing von Mises and Friedrich Hayek for the Austrian school of economics; George Stigler and Milton Friedman from the Chicago School of Economics. Both are in the controversial categorization of neoliberalism.

Other trends.- There are other trends in economic thought that assign different functions to the State. John Maynard Keynes argues that the state can increase effective demand by spending on goods and services avoiding cyclical crises.

The centralized planned economy.-

The state organization.- The factors of production are in the hands of the State, which is the only important economic agent. The market doesn’t allocate resources, because it’s manipulated by the State. These manipulations are made with multi-year economic plans (five-year plans), which explain in great detail the supply, production methods, salaries, investments in infrastructure, etc.

Main problems.-

Forecast errors.- The market doesn’t send signals because it doesn’t exist (false market). Without signals, the planners weren’t always correct in their forecasts and this caused a lack of adaptation to reality and a poor reaction capacity

Low motivation.- Because wages and prices were set by the State, companies didn’t need to be competitive and workers were unmotivated, because they earned the same if they did their job well or badly.

Excessive bureaucracy.- Planning required a huge bureaucracy at the service of the State, so decisions and reaction capacity were slower.

History.-

Appearance and expansion.- This system, inspired by Marxist theory, appeared in the Russian Soviet Federative Socialist Republic after the First World War, due to the state of emergency and the war economy due to the war against the White Army and the Triple Entente during the Russian Civil War, which occurred in the first months after the October Revolution and the emergence of the first Soviet Republics, worsened with Stalin and his followers, when the Soviet Union was born, with the so-called one-country policy; models that spread after the Second World War throughout Eastern Europe and many Asian countries, under the Soviet Union and the Komintern. Although at firts it was more productive than capitalism, companies soon ceased to be productive and the State became continually in debt to maintain full employment. Also, in the case of the USSR, it had to allocate a huge amount of its budget to maintain the army and war technology in its Cold War with the United States.

Self destruction.- Finally, at the end of the 20th century, the USSR fell with its economic system and today Russia and the Eastern countries are moving towards a market economy. China is looking for a balance, Cuba is trying to defend the centralized economy system by making some reforms or concessions in strategic sectors, such as tourism, to the market economy, prevailing abroad. Currently, only North Korea follows a centralized economy model, with almost no capitalist or other reforms.

Mixed economy.- In reality, there is no country with a totally market or centralized economy, but more or less a combination of both is increasing or decreasing degree.

Particularities of the Andalusian economy.- The Andalusian economy, like the Spanish economy, has a mixed economy system with great importance placed on the market economy.

PART B.- PRODUCTION AND ECONOMIC INTERDEPENDENCE

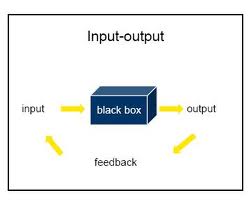

PRODUCTIVE PROCESS.-

Definition.- A production process converts inputs (physical, technological, human and other resources) into outputs (goods and services).

Planning.- A production process includes actions that occur in a planned way and produce a change or transformation of materials, objects or systems, at the end of which we obtain a material or immaterial product.

PRODUCTION FACTORS.-

Definition.- They’re resources, materials or not, that when combined in the production process add value in the production of goods and services

Evolution of the concept.-

Classical economists.- They use the three factors that Adam Smith defined, each factor participates in the result of production through a reward set by the market:

Land (which is rewarded with rent)

Work (which is rewarded with wages)

Capital (which is rewarded with interest)

Neoclassical economists.- They only use capital and labor because they simplify their economic analyzes. The land is considered included within the capital

Current economy.New factors of production.-

Natural capital (land).- More and more changed by human intervention. Today land is considered a component of capital or a component of a broader natural factor (natural resources or natural capital).

Physical capital.- Understood as tools and machinery

Material work.- Non-intellectual work

Intangible capital (know-how, organization, non-physical but computable assets, intangible work, knowledge economy) .- Fourth factor of production. In the knowledge economy and business development produced since the end of the 20th century, people consider that technology and science (what has been called R + D - Research and Development - or even R + D + i - Research, Development and Innovation -) is a fourth factor of production that characterizes more and more production in industrialized countries. At the same time, the concept of physical capital or financial capital is added to the concept of human capital or intellectual capital, even social capital, as a way of explaining the improvement in productivity that is not due to the other factors.

Training.- Investment allows the volume of production factors to increase. Training can be considered an investment, and not an expense, because it increases the skills of workers.

VALUE ADDED.-

Definition.- The added value is the increase in the value that is produced in a good in each phase of the production process. Profit is a part of the added value.

Double accounting.- To avoid double accounting, the added value is calculated at each stage of the production process

Production stage |

Sales value |

Cost of intermediate products |

Added value |

Wheat |

0.03 |

0 |

0.03 |

Flour |

0.09 |

0.03 |

0.06 |

Wholesale bread |

0.15 |

0.09 |

0.06 |

Retail Bread |

0.22 |

0.15 |

0.07 |

TOTAL |

|

|

0.22 |

DIVISION OF LABOUR.-

Definition.- The division of labor, generally speaking, deals with the specialization and cooperation of labor forces in tasks and roles, with the aim of improving efficiency. When a worker performs all the different tasks necessary to make a product, performance is slow, so it’s necessary to divide the tasks.

Types.-

Industrial division.- The industrial division deals with the division of tasks in an industry or company

Vertical division.- The vertical division is a group of jobs that a person performed before but over time they have been divided into different professions

Collateral division.- The collateral division is the division that separates different professions.

Example.- Adam Smith in his book "The Wealth of Nations" says that where a single blacksmith could not produce more than ten pins per day, the factory uses the workers in several different tasks (stretching the wire, cutting it, sharpening it, etc. ), and thus comes to produce about 5,000 pins per worker employed. Along with this large increase in the quantities produced, there is an equally extraordinary decrease in the price of pins.

Advantages of the division of labor.-

Save capital.- Each worker doesn’t need to have all the tools they would need for the different functions.

Save time.- The worker doesn’t need to constantly change tools

Reduce errors.- The tasks that each worker executes are easier, that is why errors decrease. When the worker has a small and easy task, he will pay more attention than if he executes a task where he must constantly rotate with his colleagues; that is, when a worker executes a more difficult task, he will lose his concentration when he waits for it. Adam Smith's text "Investigation into the Nature and Causes of the Wealth of Nations" also talks about the importance of machinery (which craftsmen build to speed up work). They bring simplicity to the task.

Invention of machines and/or tools.- To simplify their work, workers create new tools or suggest ideas to improve the production process

PRODUCTIVITY.-

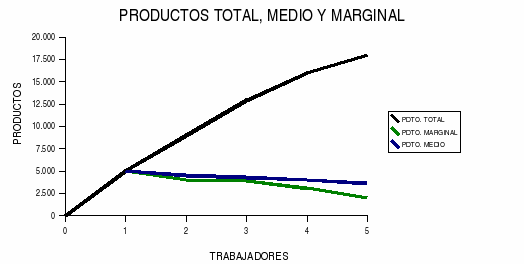

Definition of total, marginal and average product.-

Total product.- The total product is the total amount in physical units that is obtained for the total amount of factor used

Marginal product.- The marginal product is the variation that total production experiences when it uses an additional unit of factor.

Average product or productivity.- The average product is the amount of product units obtained for each unit of factor used

WORKERS |

TOTAL PRODUCT |

MARGINAL PRODUCT |

AVERAge PRODUCT |

0 |

0 |

- |

- |

1 |

5,000 |

5,000 |

5,000 |

2 |

9,000 |

4,000 |

4,500 |

3 |

12,900 |

3,900 |

4,300 |

4 |

16,000 |

3,100 |

4,000 |

5 |

18,000 |

2,000 |

3,600 |

O

ther

definitions of productivity.-

Production/resources.- It’s the relationship between the production obtained by a production or services system and the resources used to obtain it.

Results/time.- It can also be defined as the relationship between the results and the time used to obtain it: the less time used to obtain the desired result, the more productive the system.

Outputs/inputs.- It’s the relationship between the outputs and the inputs of a system

Production capacity and added value.- Productivity assesses the ability of a system to create the products that people want and, at the same time, the degree to which they make use of the resources used, that is, the added value.

Productivity-profitability.- Greater productivity using the same resources or producing the same goods or services results in greater profitability for the company. Therefore, the quality management system tries to increase productivity.

Quality management.- Productivity is connected with the continuous improvement of quality management systems and thanks to this quality system people can prevent quality defects by preventing them from reaching the end user. Productivity is connected with production standards, if people improve these standards then they will save resources and this will be reflected in the increase of their utility.

Types of productivity.-

Factor productivity.- It’s the relationship between the amount obtained from a product and the amount of factor that has been used for its production

Global productivity.-It’s the relationship between the monetary value of the production of a period and the monetary value of the amount of resources used to achieve it.

Productivity improvement.- It’s obtained by innovating in:

Technology (for example, the Internet)

Organization (for example the assembly line)

Human resources (through training)

Labor relations (improvement of labor legislation)

Labor conditions (for example, labor health)

Other

INTERDEPENDENCE.-

Globalization.- All countries (nation-states) are dependent to different degrees, in each of the following areas: trade, technology, communications, finance and migration, among others. All this, in the context of globalization, forces countries to be in constant interdependence because they’re connected in different areas, such as those mentioned above.

Specialization.- Economic interdependence is a result of the specialization of production systems (for example, Spain has specialized in tourism and construction)

Variation.- Interdependence isn’t inflexible, because organizations, individuals and countries can change their production from one group of products to another.

Mutual dependence.- On the other hand, the relations between the imperialist nations and their colonies aren’t unilateral, that is, not only do the colonies need foreign powers for their development, but powerful countries also need the colonies to obtain raw materials. and as markets to sell their goods and/or export their capital.

DEFINITION OF THE COMPANY.- The company is the basic economic unit that is responsible for satisfying the needs of the market using material and human resources. It’s responsible, therefore, for organizing the production factors, capital and labor.

FUNCTIONAL AREAS OF THE COMPANY (a possible division) .-

Production and Logistics.- Business logistics manages and plans the activities of purchase, production, transport, storage, maintenance and distribution

Management and Human Resources.- Select, hire, train, employ and maintain the organization's collaborators. A person or a department (the professionals of the Human Resources and the directors of the organization) can do these tasks.

Marketing.- Design the products, assign the prices and choose the most appropriate distribution channels and communication techniques to launch a product that will really satisfy the needs of the clients. These tools are also known as the Grundy’s Four Ps: product, price, distribution or place and advertising or promotion.

Finance and administration.- Study how the company can obtain and manage the money it needs to achieve its objectives and how it organizes its assets.

Sales.- It’s in charge of the sales of the company's products and customer service.

CLASSIFICATION OF COMPANIES.-

According to their economic activity.-

The primary sector.- They’re mainly extractive and create utility of the goods when they obtain the resources of nature (agriculture, livestock, fishing, mining, etc.)

The secondary sector. - Physically they convert some goods into more useful ones. Industrial companies and construction companies are in this group.

The tertiary sector.- (Services and commerce), with activities such as transportation, tourism, consulting, etc.

According to the legal form.-

Companies that only belong to one person.-This person has unlimited liability (with everything he owns). It’s the simplest way to start a business. They’re usually small and family businesses.

Companies that belong to a group of people.-

Societies.- Such as public limited company, the partnership company, the limited partnership and the limited liability company

Social economy.- Cooperatives, labor companies and others.

According to the size.- There is no unanimity among economists in defining small and large companies because there is no established criterion to measure them. The main criteria are: sales volume, equity capital, number of workers, profits, etc. The most used is the number of workers:

Microenterprise.- From one to five workers

Small business.- From six to fifty workers

Medium-sized company.- From fifty-one to five hundred

Large company.- More than five hundred

According to the area of activities.-

Local

Regional

National

Multinational

According to who is the owner.-

Private-owned company.- The owners are individuals

Public-owned company.- The owner is the State

Mixed company.- The owners are individuals and the State

Self-management company.- The owners are the workers

According to the market share (the relationship between the sales of the company and the total sales of the sector) .-

Aspiring company.- Wants to have more market share

Specialist company.- Focuses on a market segment (set of clients with similar characteristics). This segment must be large enough to be profitable, but not large enough to attract leader companies.

Leader company.- It’s the most important company and is imitated by the others.

Follower company.- It doesn’t have a significant market share and it isn’t a problem for the leader company.

OBTAINING AND ANALYSIS OF THE COST OF PRODUCTION AND PROFIT.-

Total costs.- Are those that a company has in a production process or activity. They are the sum of the fixed costs and the variable costs: TC = FC + VC

Fixed costs.- They’re invariable if the quantity produced has small changes. Fixed costs are connected with the production structure and that is why they are called structural costs, and they are used to make reports on the degree of use of that structure. Example: If we make more bread, we won’t pay more rent for our industrial unit.

Variable costs.- They change if the activity level changes. That is, if the level of activity decreases, these costs decrease, and if the level of activity increases, these costs increase. Example: If we make more bread we need more flour. Except when there are structural changes, in the economic units - or productive units - the variable costs have a linear behavior, because the average value per unit tends to be constant. In Microeconomic Theory, variable costs aren’t linear, at first they grow at a more than proportional rate but after the inflection point they grow at a less than proportional rate.

Profit.- It’s the wealth that a person obtains from an economic process. Profit equals total revenue minus production and distribution costs. It’s the value of the outputs minus the value of the inputs. Economic profit indicates wealth creation. The negative profit is called a loss. In a free market, the more profit a company has, the more successful it is.

IDENTIFICATION OF THE MAIN ECONOMIC SECTORS IN ANDALUSIA.-

Primary Sector.- It has the lowest percentage of total production but it has a great relative importance with the other productive sectors. This importance is greater if we compare it with the primary sector of other Western economies, where it has been reduced to a minimum. The primary sector produces 8.26% of the total and employs 8.19% of the working population. It’s an uncompetitive sector since other economies with a much smaller working population produce much more. To this relative importance of the Andalusian primary sector must be added its long tradition in Andalusia, where it’s deeply rooted. The primary sector can be divided into a series of subsectors: agriculture, fishing, livestock, hunting, forest resources, mining and energy.

Agriculture.- Traditionally the main products have been wheat, olive trees and vine. In recent decades, as a consequence of the Common Agricultural Policy, traditional crops have decreased and the cultivation of wheat, rice, beet, cotton and sunflower has increased, however, the continuous reforms of the CAP have led to successive changes in agricultural productions. Greenhouses, mainly in Almería, have also increased, a striking case is El Ejido that can be seen from the International Space Station (ISS).

Fishing.- It’s a traditional activity in Andalusia and its importance is seen in the Andalusian diet. The Andalusian fishing fleet is the second largest in Spain, with a large fishing area that includes waters that don’t belong to Andalusia. Overexploitation problems exist today due to new fishing techniques and new fishing ships with heavy dredging and powerful freezers that can fish for several weeks. This modern fishing is associated with deep-sea fishing, while coastal fishing, except for the motorization of boats, continues to be a very traditional activity. All of the previously mentioned problems have led to rapid improvement in aquaculture, both on the coasts and in inland fish farms. For example, the Riofrío fish farm in Granada exports 40% of its caviar production, and competes in international markets with Russian and Iranian caviar.

Livestock.- Andalusian livestock is 10% of national livestock, while Andalusian agriculture is 30% of national agriculture, therefore, only 70% of Andalusian needs for meat and milk are supplied by Andalusian livestock. This situation is due to the water but also to historical reasons.

Hunting.- The most important in big game hunt are deer, wild boar, but also mountain goat, mouflon, fallow deer, roe deer, etc. The most important in small game hunt are the partridge, rabbit, hare, quail, thrush, pigeon, etc.

Forest resources.- Forest resources are very important due to their extension and diversification: pastures, fruits, wood, etc. and due to other aspects such as soil fixation, water regulation and maintenance of flora and fauna. In total, the forest area is 50% of the Andalusian surface, and half of this area is forests (more than ten trees per ha) the rest of the area without trees is pastures, bushes and rocky areas. The production value of forest areas is only 2% of agricultural production. Hunting, wood, fruits (pine nuts), cork and the use of pastures are the most important subsectors.

Mining and energy.- The exploitation of mining resources was done without taking into account that this is an exhaustible resource. Consequently, most of the mining areas (Linares-La Carolina, Riotinto and the Guadiato Basin) are now in decline due to the high cost of extraction and the lower calorific value in the case of coal. Despite this low profitability and the general crisis in the sector, it still has some importance. If we compare the value of extractions with the rest of Spain, we can see that Andalusia has 59% of metal extractions, especially pyrite and iron, Andalusia has 98% of the gold and silver extraction and 100% of the strontium.

Secondary sector.-

Industry.- The development, in the 19th century, of the industries linked to mining extraction (Garrucha and Carboneras, Riotinto, El Pedroso, Peñarroya and Linares - La Carolina) failed. At the beginning of the 21st century, although there is a greater integration between mining extraction and industrial transformation, this is still insufficient and incomplete. The shortage of energy products causes a strong dependence on imported petroleum, although Andalusia has great potential for the development of renewable energy, especially solar energy and wind energy. There are other less important industries such as automotive, aeronautics, etc.

Building.- At the beginning of 2008 the international financial crisis got much worse, banks had a fall in their profits, and the stock market had sharp falls. In this context, the construction industry begins to show obvious signs of crisis: a sharp drop in sales, a drop in housing prices, a rise in non-performing loans or an increase in unemployment in the sector (for example, the half of real estate agencies close). In February 2008, the Spanish economy showed obvious symptoms of an economic crisis, because unemployment had the highest growth in the last 25 years.

Tertiary sector. - This sector has had a very important growth in the last decades. It was a minority and is now a majority in Western economies. This process has been called outsourcing of the economy and has been very important in the Andalusian economy. In 1975 the tertiary sector produced 51.1 of Andalusian gross added value (GVA) and employed 40.8%, while in 2007 it produced 67.9% of GVA and 66.42% of jobs. However, this growth in the tertiary sector was earlier than in other developed economies and was independent of the industrial sector.

Commerce.- It’s focused on the export of agri-food products and the import of energy products. The three main countries that buy Andalusian products are Germany, France and Italy with 33% of total exports. The economies of these countries buy the majority of Andalusian agri-food products. On the other hand, Algeria, Nigeria and Russia mainly sell petroleum to Andalusia with 24.2% of imports. The challenge for Andalusia in the future is to diversify its exports to other more elaborate products with greater added value and to reduce its dependence on exports of energy products.

Tourism.- Andalusia is the first Spanish community in tourism with almost 30 million visitors a year. The main sites are the Costa del Sol and Sierra Nevada. The Andalusian situation, in the South of the Iberian Peninsula, makes it one of the warmest places in Europe. The Mediterranean climate predominates throughout the territory, which gives a large number of hours of sunshine, and together with the existence of a large number of large beaches, it’s ideal for developing sun and beach tourism.

TOPIC 2.- EXCHANGE AND MARKET. NATIONAL MAGNITUDES AND INDICATORS OF AN ECONOMY

PART A.- EXCHANGE AND MARKET

DEMAND.-

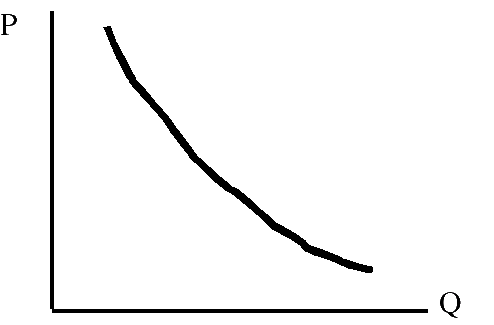

Definition.-It’s the amount of goods and services that buyers are willing and able to buy at different prices and conditions given at a given time.

D

eterminants

of individual demand.-

The price of the good.- The higher the price, the lower the demand

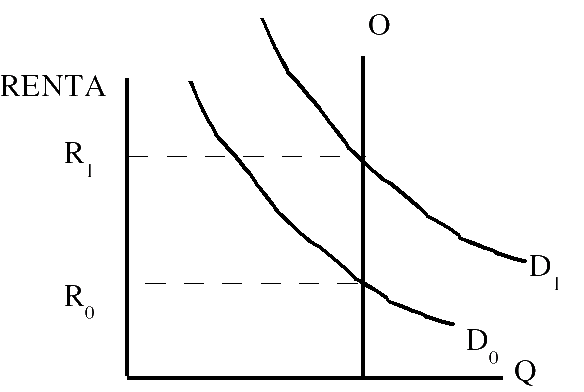

The level of income.- The higher the level of income, the higher the demand (for normal goods and on the contrary if the goods are inferior-chicory, or services such as that of the shoemaker-)

Personal tastes.- If a product is fashionable, its demand increases

Government policies.- The government can cause the demand for a product to increase (for example, certain regulations may force to increase the demand for a certain good)

The price of substitute goods and the price of complementary goods.-

Substitute goods (goods that aren’t consumed at the same time and satisfy the same need).- If the products are substitutes, the higher the price of one of them, the greater the demand for the other (if the rest of the circumstances are kept constant). For example, butter and margarine.

Complementary goods (goods that are consumed at the same time and satisfy the same need).- If the products are complementary, the higher the price of one of them, the lower the demand for the other (if the rest of the circumstances are kept constant). For example, the car and fuel.

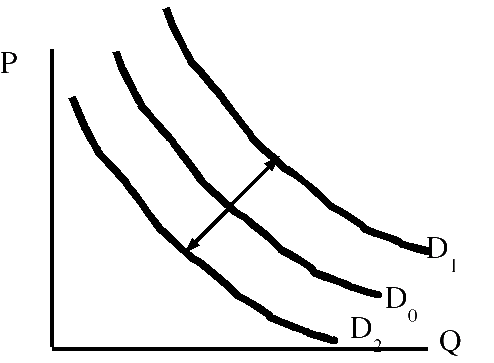

Movement along the demand curve.- There is movement along the demand curve when a change in price causes the quantity demanded to change. It’s important to distinguish between movement along the demand curve and a shift in the demand curve.

Shift on the demand curve.- The shift of the demand curve takes place when there is a change in the relationship between quantity and price that is brought about by a change in any of the factors that influence demand except price. A shift in demand results in a new demand curve. When income increases, the demand curve for normal goods shifts to the right.

Shape of the Demand Curve.- The demand curve usually slopes downward from left to right; that is, it has a negative slope (with two theoretical exceptions: the Veblen goods and the Giffen goods).

Veblen goods.- It’s stated that some types of high-end goods, such as diamonds, or luxurious cars, are Veblen goods, decreasing their prices decreases the preference of people to buy them because they are no longer perceived as exclusive or high standing products. Similarly, an increase in the price can increase that high standing and the perception of exclusivity, therefore it is the most preferable good.

Giffen goods.- A Giffen good, for example rice (or bread), is one that people consume more if the price rises, violating the law of demand. In normal situations, when the price of a good rises, the substitution effect causes people to buy less of it and more of substitute goods. In the Giffen good situation, there are no cheaper and closer substitutes available. Due to the lack of substitutes, the income effect dominates, guiding people to buy more of the good, even if its price rises. Consumers get poorer so they concentrate their spending on these goods

SUPPLY.-

Definition.- It’s the quantity of goods and services that producers are willing and able to offer at different prices and conditions given at a given moment.

Shape of the curve.- In a Cartesian diagram of ordered price and abscissa quantity, the supply curve usually slopes upward from left to right; that is, it has a positive association. The positive bias is often referred to as the "law of supply" which means that producers will offer more of the goods and services if their price increases.

Determinants of individual supply.-

The price of the product.- The higher the price, the higher the supply

The cost of the production factors.- The higher the cost, the lower the supply

The availability of the production factors.- The greater the availability, the greater the supply.

The quantity of goods produced.- The greater the quantity, the greater the supply.

The expectations or objectives of the companies.- The strategy of the company also conditions the quantity offered

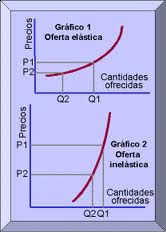

Elasticity.-

Definition.- It’s the measure of the way in which the quantity supplied reacts to a change in price.

Formula.- Elasticity of supply is the percentage of change in the quantity supplied over the percentage of change in the price

Example.- If, in response to a 10% increase in the price of a good, the quantity supplied increases by 20%, the elasticity of supply would be 20%: 10% = 2

Inelastic-elastic.- The elasticity of supply is always positive because when the price changes, the quantity also changes in the same direction. By agreement it was established that when its value is between zero and one it is said to be inelastic and when it exceeds this value it is said to be elastic. Supply is normally more elastic in the long term than in the short term because in the latter case we can only vary the amount of labor and raw materials in the production process, while capital remains fixed. In the event that there is production capacity without also using the elasticity would be greater since it could be used to increase production.

Stocks.- The quantity of goods offered may, in the short term, be different from the quantity produced, and producers will have stocks that they can increase or spend.

Determinants of the price elasticity of supply.-

The existence of raw materials available for the production process.- The case of petroleum is a good example. If this raw material isn’t available, the production process isn’t possible.

The duration of the production process.- A long production process limits the possibility of increasing the quantity supplied. For example, the supply of new housing is very inelastic.

Underutilized capacity.- The greater the spare capacity in an industry, the easier it would be to increase production if prices rise

The ease of resources to move within the industry.-

The storage capacity of companies.- If they have more goods in stock, they will be able to respond to a change in price more quickly)

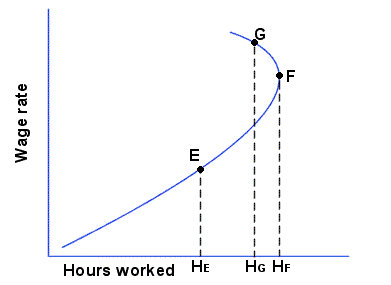

Supply curves that change its slope.- The labor supply curve will slope upwards and to the right (positive slope), as it does up to point E, for example. This individual will continue to increase his labor supply services as the salary increases to point F where he is working HF hours (each time period). Beyond this point you will begin to reduce the amount of work hours you offer (for example, at point G you have reduced your work hours to HG). Where the supply curve has a positive slope (positive elasticity of labor supply versus wages), the substitution effect is greater than the income effect, that is, it substitutes leisure for wages. Where it slopes upwards and to the left (negative elasticity), the income effect, that is, wages is substituted for leisure, is greater than the substitution effect. The direction of the incline may change more than once for some individuals, and the labor supply curve is likely to be different for different individuals. The job supply curve must start at the Minimum wage/hour (MW/hour).

ECONOMIC BALANCE.-

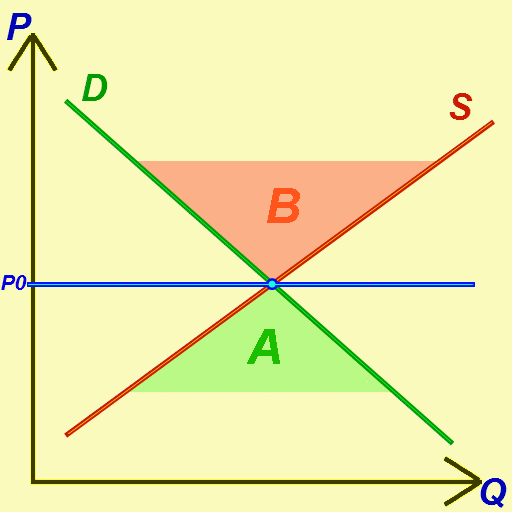

Definition.- An economic equilibrium is simply a state of the world where economic forces are balanced and in the absence of external influences the equilibrium of economic variables will not change. It’s the point at which the quantity demanded and the quantity supplied are equal. Market equilibrium, for example, refers to a condition where a market price is established through competition such that the quantity of goods or services sought by buyers is equal to the quantity of goods or services produced by sellers. This price is often called the equilibrium price and will tend not to change unless demand or supply changes.

Interpretations.- In most interpretations, classical economists such as Adam Smith held that the free market would tend toward economic equilibrium through the price mechanism. That is, any excess supply (zone B) for a price higher than the equilibrium price (market excess or glut) would lead to price cuts (for example 2x1), which decrease the quantity supplied (reducing the incentive to produce and sell the product) an increase in the quantity demanded (offering consumers bargains), automatically disappearing the glut. Similarly, in an unconstrained market, any excess demand (or shortage) (zone A) would lead to the price increasing, reducing the quantity demanded and increasing the quantity supplied (since the incentive to produce and sell increases). As before, the imbalance (here, the scarcity) disappears. This automatic disappearance of non-equilibrium price situations distinguishes markets from centrally planned economies, which often have difficult times to achieve equilibrium prices and suffer from persistent shortages of goods and services.

INDUCED DEMAND.-

Definition.- Induced demand is the phenomenon that occurs when supply increases and more than one good is consumed, that is, supply pulls consumption. This is entirely consistent with the economic theory of supply and demand; however, this idea has become important in the debate on the expansion of transport systems, and is often used as an argument against the expansion of highways (the more lanes there are, the more cars circulate), such as main roads to get to work. This is considered by some as a factor that contributes to urban expansion.

Road trip price.- A road trip can be considered to have an associated cost or price (the general cost -monetary and non-monetary-) that includes miscellaneous expenses (for example, fuel and tolls) and the opportunity cost of the time spent traveling, which is usually calculated as the product of the travel time and the value of the travelers' time. When road capacity increases, initially there is more space on the road per vehicle than there was before, so congestion is reduced, and consequently the time spent traveling is reduced - reducing the overall cost of each trip (affecting at the second cost mentioned in the previous paragraph). In fact, this is one of the keys to building new capacity on the highway (the reduction in travel time). A change in the cost (or price) of the trip results in a change in the amount consumed.

PERFECT COMPETITION.-

Definition.-

In neoclassical economics and microeconomics, perfect competition describes the perfect form of a market in which there are many small firms, all producing homogeneous goods and many consumers.

In general, a perfectly competitive market is characterized by the fact that no single company has an influence on the price of the product it sells. Because the conditions for perfect competition are very strict, there are few perfectly competitive markets.

In the short term.

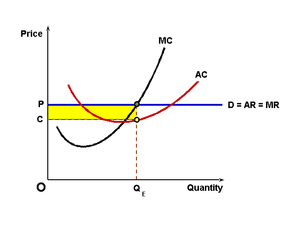

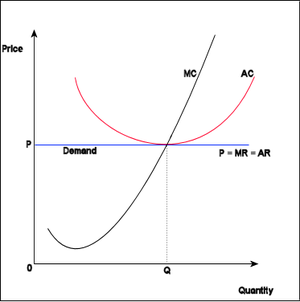

In perfect competition, in the short term, inefficient situations can arise (we could manufacture the given production at a lower cost or we could manufacture more production at the given cost) since production doesn’t have to occur when the marginal cost (the cost added by the last unit produced -mc-) is equal to the average cost (ac), although the distribution may be efficient (the distribution of resources among alternatives coincides with the consumer's taste).

Production under perfect competition will always tend to have marginal costs (mc) equal to marginal revenue (mr). However, in the long run, such markets are both: productively efficient and efficient in the allocation of scarce productive resources.

Extraordinary profit.- In the short term, it’s possible for an isolated company to obtain extraordinary profit. This situation is shown in the graph. If the average price or income, indicated by P, is above the average cost indicated by C, we would obtain an extraordinary profit P - C per unit sold. The opposite situation could also occur.

In the long term.- However, in the long term, the positive benefit can’t be maintained. The arrival of new companies or the expansion of existing ones in the market causes the (horizontal) demand curve of each company to shift downwards, bringing down at the same time the price, the average income curve, and the marginal income curve. The bottom line is that, in the long run, the company will only make a normal profit (zero extra profit). Its horizontal demand curve will touch its average total cost curve at its lowest point.

Features.-

Many buyers/many sellers.- Many consumers with the willingness and ability to buy the product at a certain price. Many producers with the willingness and ability to offer the product at a certain price. And in no case with the ability to individually influence the price

Low entry/exit barriers.- It’s relatively easy to enter or exit the market as a company. There are no limitations on the number of companies that can participate, and no administrative authorization or licenses are required.

Perfect information.- For both consumers and producers knowing the price and the quantity offered

The objective of companies is to maximize profits.- The objective of companies is to sell when marginal cost meets marginal revenue, where they generate the maximum profit

Homogeneous products.- The characteristics of any given market good or service don’t vary across the suppliers (there are no brands, no designations of origin or other elements that distinguish the products)

Perfect mobility of factors.- Companies can allocate their resources to produce the goods and services that provide them with greater profitability, without any limitation

MONOPOLY.-

Definition.- A monopoly (from the Greek “monos”, only + “polein”, to sell) exists when an individual or a specific company has sufficient control over a particular product or service to significantly determine the terms in which other individuals will have access to it. Monopolies are characterized, therefore, by a lack of economic competition for the good or service they provide and a lack of viable substitute goods.

Competition Laws.- In many jurisdictions, competition laws place specific restrictions on monopolies. The maintenance of a dominant position or a monopoly in the market isn’t illegal in itself, however certain categories of behavior can, when a company is dominant, be considered abusive and therefore be met with legal sanctions.

Legal Monopoly.- A government-granted monopoly or legal monopoly, by contrast, is approved by the State, often to provide an incentive to invest in risky ventures.

Government monopoly.- The government can also reserve the company for itself, thus forming a government monopoly.

Monopoly Revolution Theory.- If one company raises prices too high, then others can enter the market if they can provide the same good, or a substitute, at a lower price. The idea that monopolies in markets with easy entry don’t need to be regulated is known as the "theory of monopoly revolution."

Altering the market.- A monopolist can - unlike a competing company - alter the market price for his own convenience; a decrease in the level of production results in a higher price. Pure monopolies are said to "face downward sloping demand." An important consequence of such behavior is clear: a monopoly selects a higher price and a smaller quantity of production than a price-accepting company; that is, less is available at a higher price.

Monopoly and efficiency.- It’s often argued that monopolies tend to become less efficient and innovative over time, becoming “satisfied giants”, because they don’t have to be efficient or innovative to compete in the market. Sometimes this loss of efficiency can increase the ability of a potential competitor to overcome barriers to entry, or provide incentives for research and investment in new alternatives. This theory holds that, in some circumstances, (private) monopolies are forced to behave as if they were competitive at the risk of losing their monopoly to new entrants. This is likely to occur when the barriers to entering a market are low.

Short term.- In the short term it may be good to allow a company to try to monopolize a market. When monopolies aren’t broken through the open market, sometimes a government will intervene, either regulating the monopoly, or transforming it into a publicly regulated monopoly environment or even including the division of the monopoly (see antitrust law). Public utility companies are often efficient with a single operator and therefore less susceptible to efficient division, but are often heavily regulated (example: Spain's deregulation of telecommunications)

Forms for the emergence of a monopoly.-

Trust.-

United States.- A special trust or business trust is a business entity formed to try to monopolize business, dominate trade, or set prices. Trusts gained economic power in the United States in the late 19th and early 20th centuries. Some, but not all, were organized as trusts in the legal sense. They were often created when company bosses convinced (or forced) shareholders of all companies in an industry to bring their shares to a Board of Directors, in exchange for dividends. The Board would then manage all the companies in "trust" by the shareholders (and minimizes competition in the production process).

Vertical integration.- A trust is a vertical integration of companies so that an entire production process is under the control of a single company

Cartel.- Through this figure, oligopolies can become monopolies when several suppliers from the same sector act together to coordinate services, prices or sale of goods. It would be a horizontal integration of companies located in the same sector of activity.

Mergers and acquisitions.-

Merger.- A merger is a combination of two companies into a larger one. Such actions are commonly voluntary and involve an exchange of shares. The stock exchange is often used because it allows the shareholders of the two companies to share the risk involved in the deal. A merger may look like a takeover but, in the former case, it results in a new name for the company (often combining the names of the original companies) and a new brand; in some cases, qualifying the combination as a merger rather than an acquisition is done purely for political or marketing reasons.

Acquisition or absorption.- In this case, it means the disappearance of the acquired company. An acquisition can be friendly or hostile (public offer). In the first case, the companies cooperate in the negotiations; in the second case, the target company to be absorbed isn’t willing to be bought or the Board of Directors of the company to be absorbed has no prior knowledge of the offer. Acquisition usually refers to the purchase of a smaller company by a larger one. It’s known as reverse takeover when a smaller company will acquire management control of a larger or older company and retain its name for the combined entity. Reverse takeover also occurs when a private company has strong propects and its eager grow financially buys a company listed on a stock market. Achieving successful acquisition has proven to be very difficult, statistics show that 50% of acquisitions were unsuccessful.

TYPES OF MONOPOLY.-

Pure monopoly.- If there is a single seller in a certain industry and there are no close substitutes for the good that is produced by it, then the market structure is that of a pure monopoly.

Artificial monopoly.- It’s a monopoly created by the government through artificial barriers to entry such as patents, (for example, the pharmaceutical industry) and copyrights, (for example, the audiovisual industry).

Natural monopoly.- A natural monopoly occurs when, due to economies of scale of a particular industry, maximum efficiency of production and distribution is carried ouy through a single supplier. Traditional examples include water and electricity services. In recent years, technological advances have allowed productive sectors that traditionally have functioned as natural monopolies, now no longer justified. It may also depend on the control of a natural resource

Monopolistic competition.- It’s a very common market structure where many competitive producers sell very similar products that are differentiated from each other by some variable (that is, the products are close substitutes, but not exactly the same). Common examples include markets for restaurants, cereal, clothing, shoes, and service companies in large cities.

Monopsony.- A monopsony (from ancient Greek (monos) "only" + (opsonia) "buy") is a form of market in which only one buyer faces many sellers.

Bilateral monopoly.- In a bilateral monopoly there are both a monopoly (a single seller) and a monopsony (a single buyer) in the same market. In such a market price and output will be determined by non-economic forces such as the bargaining power of both buyer and seller.

OLIGOPOLIO.-

Definition.- It’s a form of market in which a market or industry is dominated by a small number of sellers (oligopolists). The word derives from the Greek "oligo" (few) and "opoly" (sale). Because there are few participants in this type of market, each oligopolist knows the actions of the others. The decisions of a company influence, and are influenced by the decisions of other companies. Oligopolists' strategic planning always involves taking into account the likely responses of other market participants. This causes oligopolistic markets and industries to be at high risk of collusion.

Collusion.- Oligopolistic competition can lead to a wide range of different outcomes. In some situations, companies may employ restrictive trade practices (market division, pricing, etc.) to restrict or limit competition, raise prices and restrict production mainly in the same way as a monopoly. When there is a formal collusion agreement, it is known as a cartel. A good example of a cartel can be OPEC, which has a profound influence on the international price of petroleum.

Price Leadership.- Companies sometimes operate in secret in an attempt to stabilize unstable markets, to reduce the inherent risks (economic losses) in these markets to make investments and even significant outlays for product development. There are legal restrictions for such collusions in most countries. There doesn’t have to be a formal agreement for collusion to take place (although for the act to be illegal there would have to be actual communication between the companies) - for example, in some industries, there might be a known market leader who informally sets prices for the other producers to respond, known as price leadership.

Approaching Perfect Competition - In other situations, competition between sellers in an oligopoly can be fierce, with relatively low prices and high production. This could lead to an efficient result approaching perfect competition. Competition in an oligopoly may be greater than when there are more companies in an industry but they are regionally located and don’t compete directly against each other.

MARKET FOR GOODS AND SERVICES IN PERFECT COMPETITION.-

Functioning.- The supply and demand of a product determine an equilibrium price, and at this price the companies freely decide the quantity they’re going to produce. Consequently, the market determines the price and each company accepts this price as a fixed data and can’t influence it (accepting price)

Production of each company.- Each company will produce the quantity that its supply curve indicates for this price. The supply curve of each company is conditioned by its production costs.

Minimization of costs and equalization of profits.- Inefficient companies won’t be able to leave the sector in the short term. But in the long term they will sell their facilities, or make the necessary adjustments, therefore, there is a tendency to minimize costs and to equalize profits in perfect competition.

LAND MARKET.-

Perfectly inelastic supply curve.- Land was sometimes defined in classical and neoclassical economics as the "original and indestructible power of the soil." Georgists maintain that this implies a perfectly inelastic supply curve (ie, zero elasticity). This means that the availability of this resource is very limited in the short term, for example, the fishing grounds where boats can go to fish are what they are, the development of new fishing areas implies investment and planning by fishermen and administration.

Shifts in the demand curve.- As can be seen in the following graph, the price of land will depend on demand. For a given period of time the price will be set in this way.

LABOR MARKET.-

Suppliers and demanders for work.- Labor markets function through the interaction of workers and employers. Labor economics looks at the suppliers of labor services (the workers), the demanders of labor services (the employers), and tries to understand the resulting patterns of wages, employment and income.

Labor demand and salary determination.- The labor demand is a derived demand. If the marginal revenue is greater than the marginal cost of a company, (what hiring brings me is greater than what it costs me) then the company will employ the worker.

Wages differences.- Wage differences exist, particularly in mixed and fully/partially flexible labor markets. For example, the wage of a doctor and that of a cleaning employee, both employed by Social Security, differ greatly. But why? There are many factors concerning this issue. This includes the worker's Marginal Income MRP (see above). The marginal income of a doctor is much higher than that of a cleaning employee. Also, the barriers to becoming a doctor are much greater than to becoming a cleaning employee. For example, to become a doctor you need a lot of education and training that is expensive, and only those who are socially and intellectually advantaged can succeed in such a demanding profession. The cleaning employee, however, requires minimal training. The supply of doctors, therefore, would be much more inelastic than the supply of cleaners. The demand would also be inelastic if there is a high demand for doctors, so Social Security will pay higher wages to attract professionals.

Labor supply curve.- (See point "Supply curves that change their slope" of this same topic).

FINANCIAL CAPITAL MARKET.-

Capital Market.- The capital market is the market for securities, where companies and governments can raise long-term funds. It’s a market in which money is borrowed for periods longer than one year. The capital market includes the stock market and the bond market.

Money Market.- The money market is a global financial market for short-term loans. Provides short-term liquidity for the global financial system. The money market is where short-term obligations such as Treasury bills, commercial paper and bank acceptances are bought and sold.

Main determinants of the capital market.- They’re the income and the interest rate

LIMITS OF THE MARKET MECHANISM AND ITS REPERCUSSION ON CONSUMERS.-

Development process.- A number of Third World countries were former colonies and with the end of imperialism, many of these countries, especially the smaller ones, faced the challenges of building a nation and institutions on their own for the first time. Due to this common origin, many of these nations were, throughout the 20th century, and are still developing in economic terms today. This term when used today generally denotes countries that haven’t developed to the same levels as the countries of the Organization for Economic Cooperation and Development (OECD), and that are, therefore, in the process of development.

Third World Status.- In the 1980s, the economist Peter Bauer offered a competent definition for the term Third World. He argued that attaching Third World status to a particular country wasn’t based on any stable economic or political criteria, and was primarily an arbitrary process. The great diversity of countries that were considered Third World, from Indonesia to Afghanistan, which ranges widely from the economically primitive to the economically advanced and from the politically not aligned with the Soviet Union. The only characteristic that Bauer found common in all Third World countries was that their governments demand and receive Western aid (the donation of which he strongly opposes). Therefore, the term Third Word was flawed and misleading even during the Cold War period.

Processed products-raw materials.- Third World countries sell raw materials and buy processed products that are more expensive; to put an end to this, the countries of East and South-West Asia have substituted imports and developed export industries.

PART B.- NATIONAL MAGNITUDES AND INDICATORS OF AN ECONOMY

INTERPRETATION OF NATIONAL AND INDIVIDUAL WEALTH.-

Wealth-income.- From an individual perspective, wealth is the amount of property or assets owned by someone. Instead, income is the sum of all wages, profit, interest payments, and other ways of earning money in a given period of time. If I save part of my income I’m generating wealth.

National wealth.- From a national perspective, national wealth will be the amount of properties owned by a nation, this definition could include the country's infrastructure, cultural heritage, etc.

CIRCULAR FLOW OF INCOME.-

Relationship between families and companies.-

Real flow - monetary flow.-

The real flow that goes from companies to families are goods and services and, as a counterpart, the monetary flow that goes from families to companies is consumer spending

The real flow that goes from families to companies are the production factors and, as a counterpart, the monetary flow that goes from companies to families are wages, income, dividends, etc.

Relationship between families and businesses and the government.-

Real flow-monetary flow.-

The real flow that goes from the State to families and companies are goods and services and, as a counterpart, the monetary flow that goes from families and companies to the State are taxes.

The real flow that goes from families and companies to the State is work and, as a counterpart, the monetary flow that goes from the State to families and companies are wages.

OBTAINING THE INTERNAL PRODUCT AND CALCULATION AND INTERPRETATION OF THE MAIN RELATED QUANTITIES.-

Gross domestic product (GDP) .-

Definition.- The Gross Domestic Product (GDP) or Gross Domestic Income, a basic measure of the economic performance of an economy, is the market value of all final goods and services made within the borders of a nation in a year.

Gross Domestic Product can be defined in two ways:

Gross Domestic Product at market prices.- It’s equal to the total expenses for all final goods and services produced within a country in a stipulated period of time (usually a 365-day year). GDPmp = Consumption + Gross investment + Government expenditures + (Exports - Imports), or, GDPmp = C + I + G + (X - M)

Gross Domestic Product at factor cost.- It’s equal to the sum of the added value of each stage of production (intermediate stages) by all industries within a country, in the period. GDPfc = Added Value of the Primary Sector + Added Value of the Secondary Sector + Added Value of the Tertiary Sector

RELATIONSHIP BETWEEN GDPfc AND GDPmp.- GDPfc = GDPmp - Indirect taxes (mainly VAT) + Subsidies in production and imports. GDPfc = GDPmp – Ti - Su

Net Domestic Product at factor cost.- The Net Domestic Product at factor cost (NDPfc) is equal to the Gross Domestic Product at factor cost (GDPfc) minus depreciation (loss of value of industrial equipment, etc.) in the capital goods of a country. NDPfc = GDPfc - Dep

Net National Product at factor cost.- The Net National Product at factor cost (NNPfc) is the Net Domestic Product at factor cost (NDPfc) plus the income earned by citizens abroad, minus the income earned by foreigners in the country. NNPfc = NDPfc + IEC - IEF

Net National Product at market prices.- The Net National Product at market prices is the Net National Product at factor cost plus indirect taxes minus subsidies in production and imports. NNPmp = NNPfc + Ti - Su

Example.- Calculate the NDPfc with this information: C = 500; I = 100; G = 200; X = 20; M = 30; Ti = 70; Su = 15; Dep = 25; IEC = 33, IEF = 27

NDPfc = C + I + G + (X - M) - Ti + Su - Dep = 500 + 100 + 200 + (20 - 30) - 70 + 15 - 25 = 710

INCOME DISTRIBUTION.-

Definition of income distribution.- The distribution of income is how the total economy of a nation is distributed among its population

Analysis.-

Geographic.- This analysis measures the differences between the inhabitants of the regions

Functional.- This analysis measures the differences between the factors: land, labor and capital

Personal.- This analysis measures the differences in the distribution of income between families

Measurement of personal income distribution.-

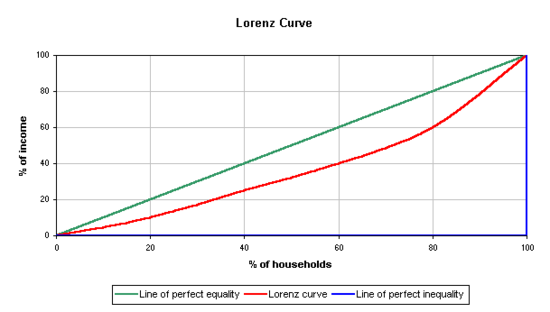

Lorenz curve.- The Lorenz curve is often used to represent the distribution of income where it shows at the bottom the percentage of families and the percentage of total income they have. The percentage of families is plotted on the X axis, the percentage of income on the Y axis.

Perfect equality.- Each point of the Lorenz curve represents a state such as “20% of all families have 10% of total income”. A perfectly equal income distribution would be one in which each person has the same income. In this case, "n% of the company would have n% of the income". This can be represented by a straight line y = x, called the line of perfect equality or equidistribution.

Perfect inequality.- On the contrary, a perfectly unequal distribution would be one in which one person has all the income and the others nothing. In that case, the curve would be y = 0 for x <100% and y = 100% when x = 100%. This curve is called the line of perfect inequality

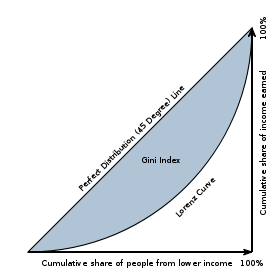

Gini coefficient.- The Gini coefficient is the area between the line of perfect equality and the observed Lorenz curve. The larger this area, the greater the inequality. It’s defined as a proportion and can vary from 0 to 1 (0% to 100%): A low Gini coefficient indicates more distribution of income or wealth, with 0 corresponding to perfect equality (all having exactly the same income), while higher Gini coefficients indicate a more unequal distribution, with 1 corresponding to perfect inequality (eg a situation with more than one individual, where one person has all the income)

Social impact.- In the neoliberal system there is a struggle over whether the market can regulate itself and distribute the wealth of a country in a balanced way or whether the government should intervene. Radical neoliberalism thinks that the government shouldn’t intervene in the economy just to guarantee stability. The updated socialism and the center sectors are part of a softer neoliberalism and promote a government more concerned about social issues, but without abandoning the ideology of contemporary liberalism.

LIMITATIONS OF MACROMAGNITUDES TO JUDGE THE HEALTH OF AN ECONOMY. HUMAN DEVELOPMENT INDICATORS.-

Limitations of the Gross Domestic Product to judge the health of an economy.-

Distribution of wealth.- GDP doesn’t take into account the disparity in income between the rich and the poor.

Transactions outside the market.- GDP excludes activities that aren’t maintained through the market, such as family production and voluntary or unpaid services.

Underground economy.- The official GDP estimates but doesn’t take into account the shadow economy, in which transactions contribute to production, such as illegal trade and activities that avoid taxes, aren’t reported, causing GDP to be underestimated.

Non-monetary economy.- GDP bypasses economies where no money comes into play at all, resulting in inaccurate and abnormally low GDP statistics. For example, in countries with very large informal business transactions, parts of the local economy aren’t easily recorded. Barter may be more prominent than the use of money, even extending to services

Quality of the goods.- People may buy cheap, short-lived goods over and over again, or they may buy long-lasting goods less often. It’s possible that the monetary value of the items sold in the first case is higher than in the second case, in which case a higher GDP is simply the result of greater inefficiency and waste.

Quality improvements and inclusion of new products.- By not adjusting to quality improvements and new products, GDP underestimates true economic growth. For example, although computers today are less expensive and more powerful than computers of the past, GDP treats them as the same products, accounting for them only by monetary value.

What is being produced.- GDP counts the work it produces, not the net change or that resulting from repairing the damage. For example, rebuilding after a natural disaster or war can produce a considerable amount of economic activity and consequently boost GDP. The economic value of health care is another classic example - it can increase GDP if many people are sick and are receiving expensive treatment, but it isn’t a desirable situation. Alternative economic measures, such as the standard of living or per capita income, better measure the human utility of economic activity.

Externalities.- GDP ignores externalities or "evils" (the opposite of goods) such as damage to the environment. By counting the goods that increase utility but not deducting the "evils" or accounting for the negative effects of increased production, such as pollution, GDP overstates economic wellfare. The Genuine Indicator of Progress is therefore proposed by ecological economists and "green" economists as a substitute for GDP. In countries highly dependent on resource extraction or with a high ecological footprint, the disparities between GDP and the Genuine Indicator of Progress (GIP) can be very large, indicating ecological excess. Some environmental costs, such as cleaning up petroleum spills, are included in GDP.

Sustainability of growth.- GDP doesn’t measure the sustainability of growth. A country can temporarily achieve high GDP by overexploiting natural resources.

Basket of goods.- GDP growth can vary greatly depending on the basket of goods used in the economy and the relative proportions used to deflate GDP statistics.

Comparable basket of goods.- International comparisons of GDP can be inaccurate if they don’t take into account local differences in the quality of goods, even when adjusted for purchasing power parity. This type of adjustment to an exchange rate is controversial because of the difficulties of finding comparable baskets of goods to compare purchasing power across countries. This is especially true for goods that aren’t globally traded, such as houses.

Alternatives to GDP.-

Human Development Index (HDI) .- The HDI uses GDP as part of its calculation and then indicators of life expectancy and education levels

Genuine Indicator of Progress (GIP) or Sustainability Index of Economic Well-being (SIEW).- The GIP and the similar SIEW try to address many of the criticisms seen above by taking the same raw information offered by GDP and then adjusting for income distribution , adds the value of family and volunteer work, and subtracts crime and pollution.

Wealth estimator.- The World Bank has developed a system to combine monetary wealth with intangible wealth (institutions and human capital) and environmental capital. Some people have seen beyond the standard of living a broader sense of quality of life or well-being. This also establishes that GDP is a crucial statistic for the success of a specific country.

Remaining Private Product.- Murray Newton Rothbard and other Austrian economists argue that, since government spending is financed by productive sectors, and produces goods that consumers don’t want, it is a burden on the economy and, therefore, should be deducted. Rothbard argues that even government tax surpluses should be deducted to create an estimate of the PPR.

Study on the European quality of life.- This study, whose first edition was published in 2005, assesses the quality of life across European countries through a series of questions on global and subjective life satisfaction, satisfaction with different aspects of life life, and a group of questions used to calculate deficits of time, love, being and having.

Gini coefficient.- It considers the income disparity within a nation, qualifying the GDP results that can lead us to erroneous conclusions

Gross National Happiness.- The Bhutan Center for Studies is currently working on a complex set of subjective and objective indicators to measure “national happiness” in various areas (standards of living, health, education, cultural vitality and diversity, use of time and balance, good governance, community vitality, and psychological well-being). This set of indicators would be used to assess progress towards Gross National Happiness, which they have already indicated as the nation's priority, above GDP.

Planet Happiness Index.- The Planet Happiness Index (PHI) is an index of human well-being and environmental impact, introduced by the New Economic Foundation (NEF), in July 2006. It measures the environmental efficiency with which human well-being is achieved within a given country or group. Human well-being is defined in terms of subjective life satisfaction and life expectancy.

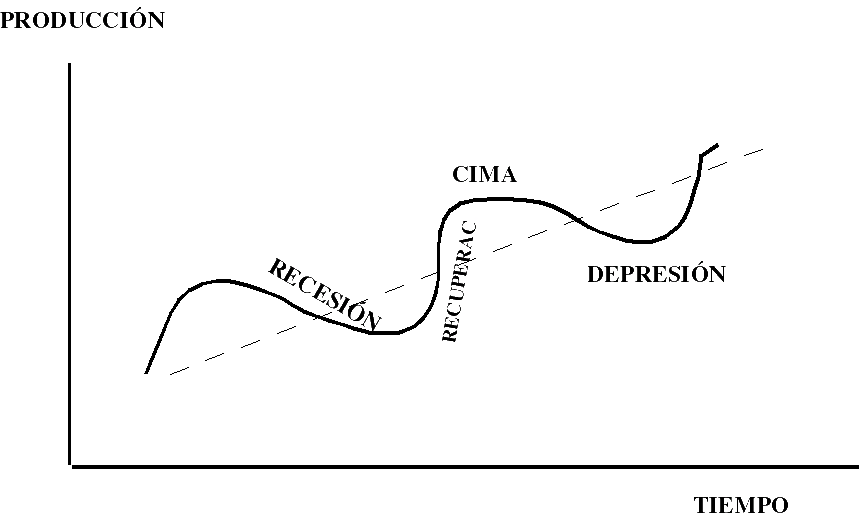

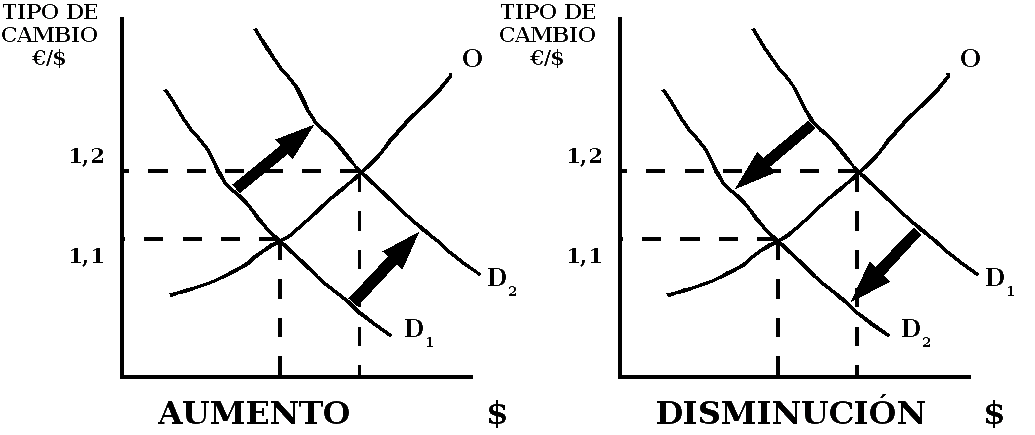

ECONOMIC GROWTH, DEVELOPMENT AND SUSTAINABILITY.-